TARFs Increasingly Popular Amid Low Carry Environment.

26 June 2023 | By IFA Global

26 June, 2023

TARFs Increasingly Popular Amid Low Carry Environment

Target Accrual Range Forwards (TARFs) for currencies are financial instruments that provide investors with exposure to foreign exchange rates while limiting potential losses within a predetermined range. TARFs are commonly used by corporations, financial institutions, and investors to hedge against currency risk or speculate on currency movements.

In the context of currencies, an investor agrees to exchange one currency for another at a predetermined exchange rate, known as the target rate, for a specified period. However, the actual exchange rate received by the investor depends on the movement of a reference rate, such as the spot rate or a benchmark exchange rate, within a predetermined range.

The range of exchange rates in a currency TARF is divided into two parts: the target range and the accrual range. The target range represents the desired range of exchange rates within which the investor wants to exchange currencies at the target rate. If the reference rate remains within the target range throughout the specified period, the investor exchanges currencies at the agreed-upon target rate.

However, if the reference rate moves outside the target range, the exchange rate becomes variable, and the investor exchanges currencies at a rate that accrues based on the difference between the reference rate and the target range. This accrual range allows the investor to participate in favourable currency movements but limits losses if the exchange rate moves unfavourably.

Currency TARFs provide a balance between stability and potential gains in foreign exchange transactions. They allow investors to manage currency risk by locking in exchange rates within a desired range while still benefiting from favourable currency movements. This makes TARFs useful for companies engaged in international trade, investors with currency exposure, or speculators seeking to profit from currency fluctuations.

It's important to note that TARFs for currencies are complex financial instruments and their suitability depends on an investor's risk appetite, currency outlook, and understanding of market dynamics. Engaging in currency TARFs requires careful consideration of the specific terms and conditions associated with each contract and should be done with the assistance of financial professionals ensuring that such instruments are hedge compliant with the auditor.

To understand this complex instrument better we have taken an example and shown how the instrument would perform under three hypothetical scenarios (INR appreciation, INR depreciation, and range-bound price action). This would help explain TARFs and how they compare with regular forward bookings and leave your exposures open from an exporter’s point of view.

Let us say an exporter is looking to book a strip of 12 forward contracts of notional USD 1 million each with month-end expiries from July-23 to June-24. Consider the spot rate for USDINR to be 82, the 1-year forward rate to be 83.5, and the par forward rate to be 82.75. Let the target rate (also known as the big figure cap) be Rs. 15. This means that the company will be able to accumulate only a maximum of Rs. 15 before this structure is knocked out (ceases to exist).

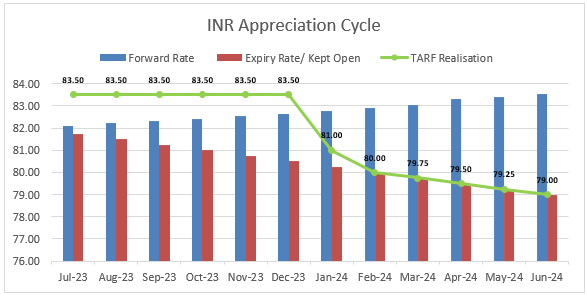

In the case of INR appreciation, we can notice that the company will constantly realize a rate of 83.50 and accumulates a net TARF gain of over Rs. 1.5 until the target of Rs. 15 is met in Jan-24. After this period, this structure is knocked off and the company’s position is again open. While the exporter would have considered that he would be hedged for 12 months, he was effectively hedged for just 6 months

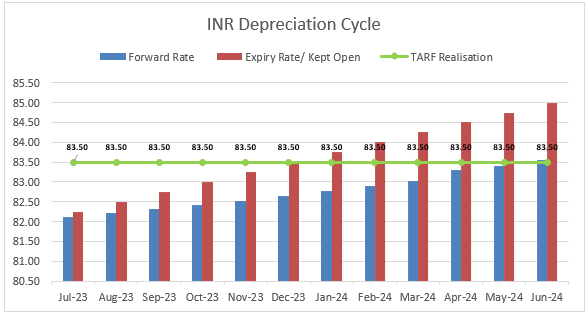

In the case where INR weakens, the TARF gains are accumulated only in the initial few months up until the INR starts trading above 83.50. Due to this reason the accumulated gain does not reach the target of Rs. 15 and the company realizes a rate of 83.50 until Jun-24. In an environment of low carry and compressed forward premiums, the losses incurred by the company that books forward will be 6.8 times more than a company that hedges through TARFs.

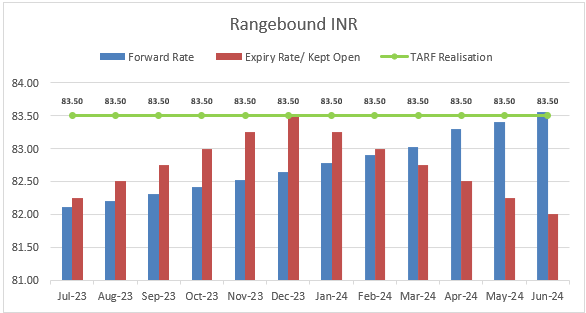

The scenario where the domestic currency remains range-bound between 82 to 83.5, the accumulated gains will remain in the range of 0-1.5 and will most probably not achieve the target rate of Rs. 15. This translates into a higher realization rate of 83.5 as compared to the forward rates for 11 out of the 12 months.

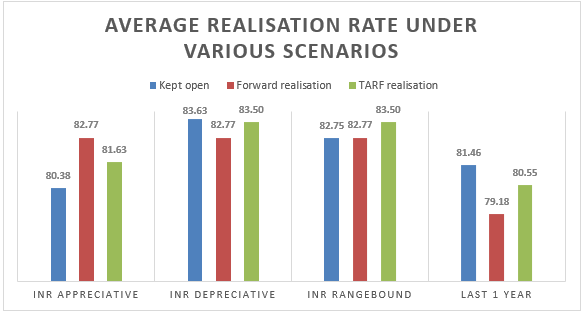

Comparing all three scenarios and the last 1-year back-tested data in the below graph suggests that TARFs would have provided a better net realization rate in 2 of the 3 scenarios (INR depreciative cycle and range-bound) when compared to a company that books plain back-to-back forwards. The back-tested data also showcases that TARFs would have provided a better rate than forwards due to the extremely low carry environment. The market expectations of elevated interest rates in the U.S. till the end of 2023 shall prolong this period of low carry and therefore provides a good opportunity for exporters to hedge their positions via a mix of TARFs and regular forward contracts depending upon their flows and working cycle.

IFA’s take on TARFs:

The suitability and appropriateness of this product would vary from client to client and case to case basis. Our intent is to neither encourage nor discourage this product through this blog but just to help people contemplating it understand associated risks better.

This structure involves an element of selling optionality to enhance carry. It is somewhat similar to a range forward i.e. BP and SC with a Knock Out option on the Buy Put leg. The protection in this structure is therefore NOT unconditional. There is a risk of losing protection if Rupee appreciates significantly. The biggest risk therefore associated with this structure is the uncertainty around the notional amount hedged as it depends on the trajectory of USD/INR fixings at each month’s end.

Below are some pros and cons of this structure:

Pros:

1) It helps to enhance carry. One is able to capture a rate higher than the par forward rate.

2) Such a structure can be used to hedge anticipated exposures or part of exposure deliberately/knowingly kept open.

Cons:

1) If Rupee appreciates significantly, the big figure cap would be reached earlier, resulting in the structure getting knocked out i.e. ceasing to exist (contraction risk). One will therefore have to sell the remaining notional at the lower market rate

2) The structure is path dependent and therefore difficult to price. It requires the use of Monte Carlo simulations. While the price to enter the structure may still be competitive, if one wishes to exit the structure, the quote may not be that competitive. It would entail a significant spread.

3) It is important to know and manage the delta at any point in time to manage the hedge ratio. This is more difficult compared to a structure involving plain Vanilla options.