Is Silver a good contra bet?

13 January 2024 | By IFA Global | Category - Market

13 January, 2024

In 2023, amid a backdrop of escalating inflationary pressures and increasing geopolitical tensions on a global scale, there was a growing demand for safer asset classes in India, notably Gold, Silver, and the Dollar. Gold and Silver, recognized for their historical role as reliable hedges against inflation and uncertainty, experienced heightened interest from investors.

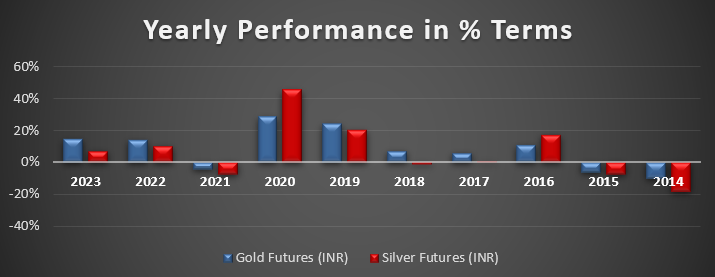

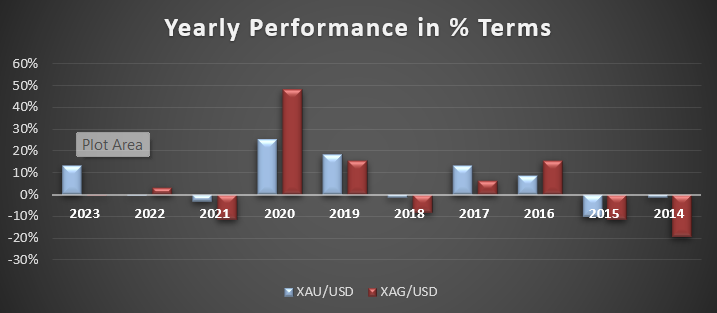

Gold, in particular, has been the preferred choice for investors and central banks worldwide as a safe-haven investment. Central banks acquired approximately 800 tonnes of gold in the first three quarters of 2023, reflecting a 14% increase compared to the same period in 2022. The annual demand reached its highest point since 1950, and gold outperformed silver in 8 out of the last 10 years when denominated in INR. However, when comparing the two precious metals in USD terms, silver outperformed gold in only 3 of the last 10 years.

The notable underperformance of silver in recent times presents an intriguing investment opportunity for those adopting a contrarian view, seeking a relatively safer asset class compared to equities. Furthermore, several fundamental factors also contribute to silver's attractiveness:

• Supply Constraint: Lagging mine supply growth suggests a scarcity of silver, which could drive prices higher.

• Strong Industrial Demand: The increasing demand for silver in green technologies, such as solar panels, is expected to boost overall demand and, consequently, prices.

These considerations pose a choice for investors – whether to embrace the stability of gold or the potential growth perspective offered by silver, driven by the increasing demand for sustainable and green technology. Both precious metals contribute to portfolio diversification, but it's crucial to align your decision with your financial goals and risk tolerance. Keep in mind that investing in precious metals is a long-term strategy, requiring patience and vigilance.