How can quant approach help in constructing an optimal FX hedge portfolio?

17 March 2023 | By IFA Global | Category - Market

17 March, 2023

We are used to adjusting our equity portfolios dynamically based on market conditions but we seldom do the same for the FX hedging portfolio and even if we do, we do so based on our gut, instead of following a robust quantitative approach.

For instance, based on market conditions we adjust our allocation to cash, large-caps, mid-caps, and small-caps. The objective is to maximize the return per unit of risk taken. In other words, to pursue the allocation with the best Sharpe ratio or technically, to be on the efficient frontier.

In a similar way, we can adjust the composition of our hedging portfolio to optimize the hedging performance. It is always optimal to have a mix of hedging instruments in our portfolio such as Forwards, Risk Reversals (RRs), Plain Vanilla Options, or even Exotics (in the case of non-retail users as per RBI classification). How much to hedge through which instrument depends on the prevailing market conditions (such as Forward points and volatility) and the outlook.

In the case of exporters, it is prudent to increase the allocation to plain puts when USD/INR is at the bottom of the range, increase the allocation to RRs when in the middle of the range and increase the allocation to forwards when at the top of the range.

In the case of importers, it is prudent to increase allocation to forwards at the bottom of the range, increase allocation to RRs when in the middle of the range and Plain Vanilla calls at the top of the range.

While the above is quite intuitive, it can be complicated to implement as what is the bottom, middle, or top of the range is quite subjective. It, therefore, helps to eliminate the human bias and rely on what rigorously back-tested data suggests to determine the optimal hedge portfolio composition at any point in time. Moreover, while making hedging decisions, we tend to put an outsized weightage on spot. We do not give forward points (carry) and volatility due consideration. The interplay between spot, forwards, and vols can be difficult to assess if not done quantitatively. Generally, it is seen that when the spot is depressed, vols are subdued and forward points are elevated and when the spot is elevated, vols are elevated and forward points are compressed.

To illustrate the point, we ran a back-test on optimal hedging strategy for importers to cover 6-month exposures. We found that volatility was an important factor that helped improve the choice of the hedging instrument. This is because volatility by nature tends to be mean reverting and in the case of USD/INR, the spot-vol correlation has historically been positive.

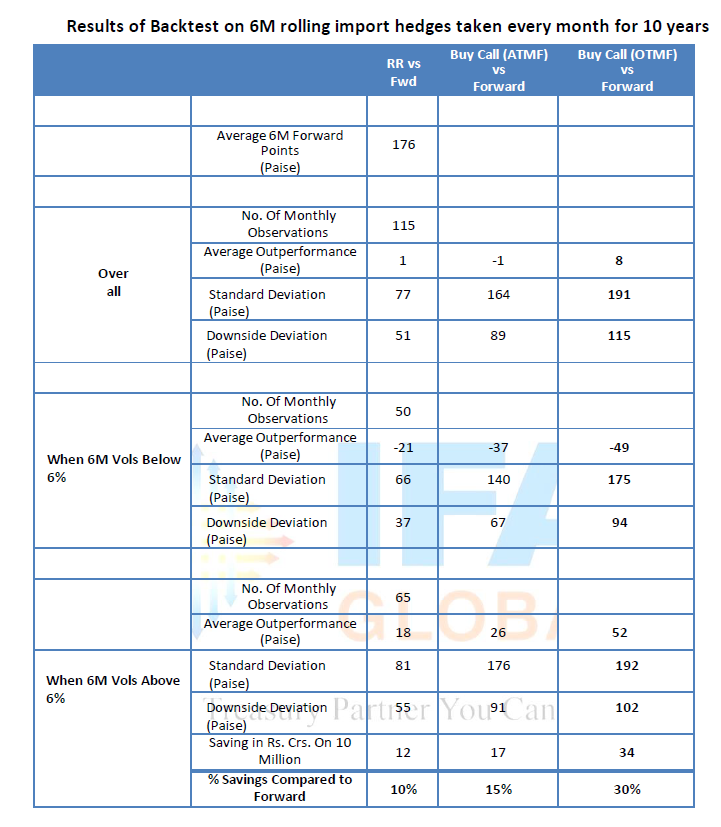

We observed that forwards outperformed RRs (Buy Call ATMF and Sell Put ATMS) and Plain Vanilla ATMF buy calls when the 6-month ATMF implied vols were below 6%. However, when the 6m ATMF implied vols were above 6%, RRs outperformed forwards and plain Vanilla calls on a risk-adjusted basis. Plain Vanilla calls underperformed even during times when the spot was elevated as vols were also elevated at that time, thereby making the plain Vanilla ATMF call very expensive. The average 6-month forward points during the period were 175p. Executing a RR instead of a forward would have resulted in an average saving of 18 paise. This is a saving of 10.3% on such instances. There were 65 instances out of a total of 115 when the RR outperformed forwards. The strategy of hedging through RRs when ATMF vols were above 6% and hedging through Forwards when Vols were below 6% would have helped the importer save a cumulative sum of Rs 11.7 crs for a 10-year period on USD 10 million on rolling 6-month maturity hedges undertaken every month.

If the importer were able and willing to take slightly more risk, by having a 50-50% combination of RRs and Out-of-the-Money Forward (say 40 delta) call options, he would have been able to save on an average 35 paise compared to forwards when the 6-month vols were above 6%. This would have translated into a cumulative saving of Rs 22.7 crs for 10-year period on USD 10 million bookings done every month on a rolling 6-month maturity basis (~20% compared to forwards during times when 6-month vols were above 6%) over 10 years while hedging 6-month exposures every month on a rolling basis. While ATMF options are expensive, Out-of- the-money forward options are cheaper due to lower moneyness. As the spot tends to peak out once the vols have diverged significantly from the mean, there is a lesser probability that the Out-of-the-money call option would be exercised. By entering into this option, one is able to buy protection at a cheaper rate compared to ATMF and is able to participate in the case of Rupee appreciation. However, if the Rupee is above the ATMF level at maturity, instead of being hedged at the forward rate, the importer would be hedged at a higher rate as the strike price is higher. This is the risk. If we skew the allocation further towards Out-of-the-Money Forward Vanilla calls when the 6-month vols are greater than 6%, potential savings would be even higher, albeit with higher risk.

The case study above is a rather simplistic illustration of how a hedging strategy can be refined using quant and back-testing.

Whenever we engage with clients, we encourage them to assess their ability and willingness to take risks and after that is established, we advise them on what the optimal composition of their hedge portfolio should be. Such an approach to hedging we believe is systematic and can help outperform ad hoc, discretionary hedging decisions on a more consistent basis.

The results of our backtest are attached in the table below: