Investing in AT1 Bonds

28 March 2023 | By IFA Global | Category - Market

28 March, 2023

Investing in AT1 Bonds

Additional Tier 1 Bonds (AT1 Bonds) are considered standard corporate bonds by many and are often sold as ‘Super FDs’ to investors due to the information asymmetry in these financial instruments. In this brief write-up, we dig deeper into AT1 Bonds to determine whether investing in such securities is the best course of action.

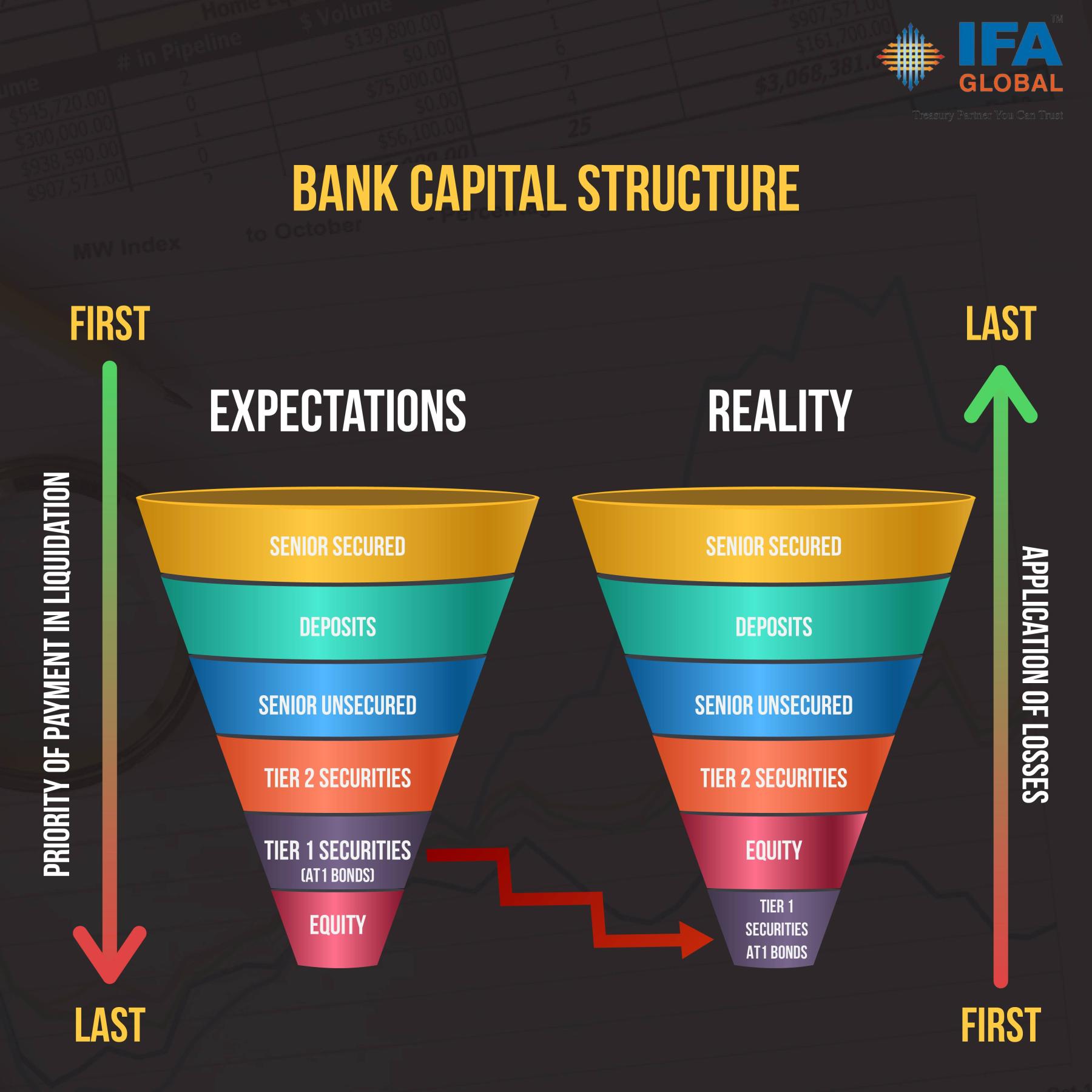

AT1 Bonds are fixed-income securities issued by banks in the form of perpetual unsecured bonds to fulfill RBI’s common minimum standards of capital adequacy. As the bonds have no set maturity date and a call option that allows banks to redeem them every five or ten years, they are often compared to equity rather than debt. It's also the reason why these bonds have a seniority ranking that is lower than that of conventional bonds but yet higher than that of equity.

Such unsecured fixed-income securities carry a significant risk to the invested capital because, in the event of an economic or existential crisis, the issuer may decide to write off all outstanding AT1 Bonds, rendering the entire investment worthless. The AT1 Bond investors at Credit Suisse are today experiencing exactly what happened with Yes Bank AT1 Bond investors in India. Their AT1 Bonds were written off and their investment was completely wiped out. The current practices revolving around AT1 Bonds have altered the seniority ranking of these bonds and given preference to equity. As a result, the AT1 Bonds were written off before equity. But the U.K. and European Union regulators bolstered the confidence of AT1 Bond investors and assured them that equity shareholders will bear losses before bondholders in any future bank failures. Additionally, these banking institutions have free discretion to postpone the call option and forgo interest payments to investors, which ups the risk even further.

However, the common practice still remains that the call option is exercised after 5 years ensuring that the capital is preserved. But the major problem arises when the banks postpone or fail to exercise this call option which indeed increases the overall risk of your portfolio, negating the benefits of diversification and risk mitigation which are the primary purpose of fixed-income investments. Hence, to even consider investing in AT1 bonds, they should be able to provide similar returns to equity which will certainly not be the case in the long run.

It is crucial to assess your portfolio's risk exposures and make sure that the return on equity and AT1 bonds are compared to their respective risks in order to generate the best risk-adjusted returns.