Multi-Asset Weekly Newsletter

9 February 2025 | By IFA Global | Category - Market

Weekly Newsletter

Global Developments & Global Equities

TRUMP'S COMMENTS ON RECIPROCAL TARIFFS DAMPEN SENTIMENT INTO THE WEEKEND

The US January jobs report was solid. Though the headline NFP print missed expectations, the previous print was revised even higher, and wage growth surprised the upside. This caused the Dollar to strengthen. Next week's key data will be the US January CPI print, which is due on Wednesday. President Trump's comment that he intends to impose reciprocal tariffs on countries next week soured risk sentiment heading into the weekend. The market is expecting 1.4 cuts (35bps) by the Fed until the end of 2025.

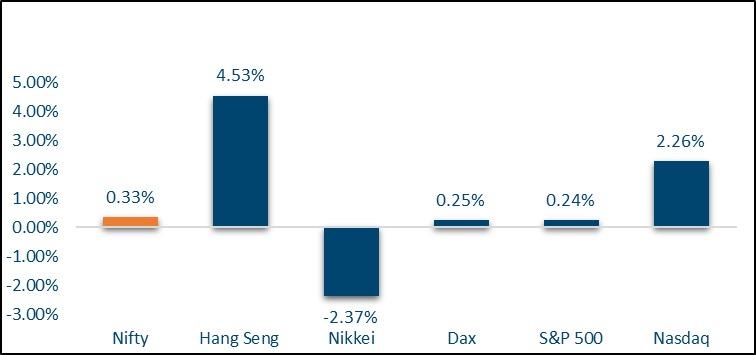

NIFTY V/S GLOBAL MARKETS

The S&P500 ended the week 0.24% lower. CAC,DAX and FTSE were all up 0.3%. Chinese Equities opened after the Lunar New Year and caught up with global equities. Hang Seng ended 4.5% higher, and CSI300 ended 2.3% higher. Nikkei lost 2% this week.

FIXED INCOME:

The yield on the US 10y treasury dropped 6bps to 4.49% and that on the 2y rose 4bps to 4.29% this week. Yields across the UK and the Eurozone were almost flat week over week. Yields on JGBs rose 5-7bps across the curve. RBI cut the repo rate by 25bps to 6.25% as expected through a unanimous 6-0 vote. This was the first policy under new RBI governor Mr Sanjay Malhotra. RBI expects the GDP to grow 6.7% and projected CPI inflation at 4.2% for FY26. Yield on the India 10y ended had dropped to 6.645% just before the RBI policy but rose thereafter to end the week almost flat at 6.70%. RBI maintaining the stance as neutral did not go down well with traders. 1y and 5y OIS ended 1bps and 3bps higher on the week at 6.08% and 6.11% respectively.

FX and Commodities

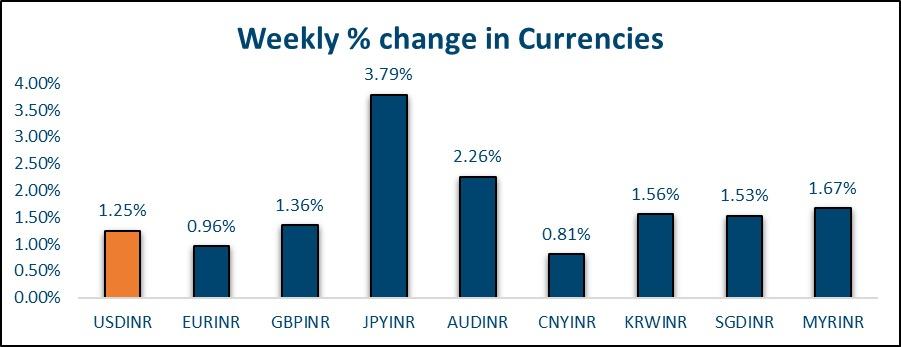

FOREIGN EXCHANGE:

Indian Rupee (-0.9%) was the worst-performing Asian currency this week. Most other Asian currencies strengthened against the Dollar with PHP (0.6%) being the outperformed. Among G10 currencies, the Euro (-0.3%) was the worst performer, while JPY (+2.5%) was the best performer. The Euro gapped down on Monday and recovered through the week but gave up gains on Friday on Trump's comments over reciprocal tariffs. The market expects the ECB to cut another 85 bps by the end of 2025. JPY strengthened on expectations that the BoJ would hike rates at a faster clip. Rupee slid on expectations of a rate cut by the RBI which it did deliver on Friday. RBIs short position in forwards increased to USD 68bn as on December end from USD 59bn as on Nov end. This is surprising given the drawdown in Reserves as well, as one would have expected the reason for the drawdown to be the delivery of Dollars under maturing forward contracts. Also, given the elevated offshore points, one would have expected the RBI to not have rolled over its short positions in NDF RBI Governor in his speech said that RBI's foreign exchange policy has remained consistent and aims to maintain stability without compromising on market efficiency. FX Reserves rose USD 1bn to USD 630.6 bn in the week ending 31st Jan. The rupee is also the worst-performing Asian currency. While the Rupee had ended at 87.43 onshore, it weakened to 87.80 offshore post Trump's comments.

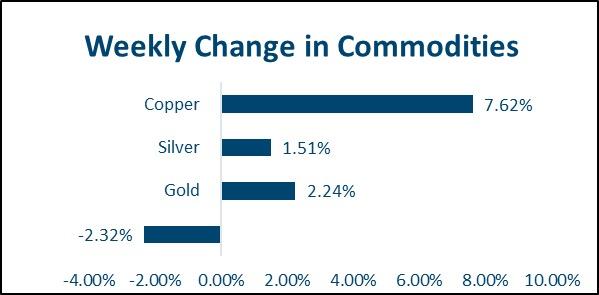

COMMODITIES

Brent ended the week 2.8% lower at USD 74.6 per barrel. The EIA report indicated a larger-than-expected inventory build-up. US natural gas prices rose 8.7% this week Base metals did well this week. LME Aluminum and Copper were up 1.3% and 4% respectively. Dalian Iron ore was up 2.1% Precious metals gained this week. Gold and Silver were up 2.2% and 1.6% respectively.

WHAT WE LIKE:

FX:

We expect the broad Dollar to be range-bound with a strengthening bias over the medium term. The phase of Rupee underperformance should be behind us and we expect the Rupee movement to be aligned with the Asian basket, especially Yuan. Importers are advised to tread with caution and hedge on dips to 87-87.20. Exporters can add hedges on upticks to 87.90-88.20.

Fixed Income:

One can look to exit long-duration positions on dips to 6.60-6.65% on 10y and look for levels around 6.85% to reenter. 5.90% on 5y OIS can be targeted to concert floating rate exposures to fixed.