Multi-Asset Weekly Newsletter

4 May 2025 | By IFA Global | Category - Market

Weekly Newsletter

Global Developments & Global Equities

RISK ASSETS RALLY AS TRUMP ADMINISTRATION STANCE SEEN MORE CONSTRUCTIVE THAN CONFRONTATIONAL ON TRADE

We have seen the risk sentiment turn on its head post the first week of April, i.e., after the week when reciprocal tariffs were announced by the Trump administration. The US Q1 GDP data was disappointing, indicating a contraction. However, the labor market continues to remain resilient, as indicated by the latest April jobs report. We saw risky assets such as equities and EM currencies do well, and safe havens such as US treasuries, JPY, and gold take a breather. It seems the market now feels that big bang reciprocal tariffs were just a way to get trade partners to the negotiation table. While earlier it seemed like the Trump administration's approach would be confrontational, it now seems that the approach would be constructive in dealing with trade partners. The extension of the timeline for when tariffs would come into effect has given room for negotiations to take place. The Trump administration, it seems, is also asking trade partners for the devaluation of the Dollar. However, this is not confirmed. It just seems so given the concerted way in which EM and Asian currencies have appreciated this week.

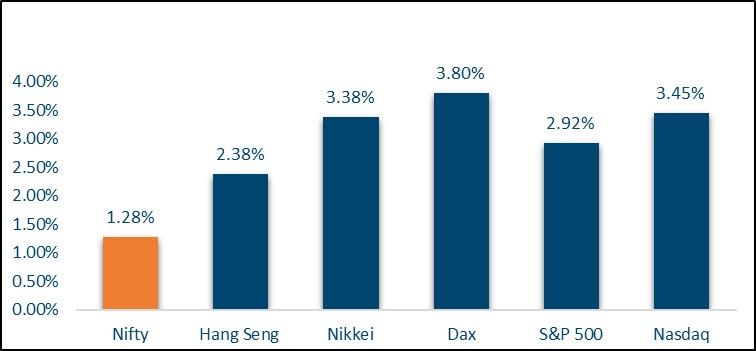

NIFTY V/S GLOBAL MARKETS

Equities globally did well this week. S&P 500 and Nasdaq rallied 2.8% and 3.4% respectively this week. Among Asian indices, Hang Seng was up 2% and Nikkei 4%.

FIXED INCOME:

US 2y yield rose 13bps to 3.82% while 10y yield rose 10bps to 4.31%. 10y Yields in the Eurozone and the UK were mostly steady. Yield on the old benchmark 10y ended 1bp lower at 6.35%. The cut-off on the new 10-year benchmark auctioned yesterday came in at 6.33%. 1y and 5y OIS fell 9bps each to 5.63% and 5.59% respectively.

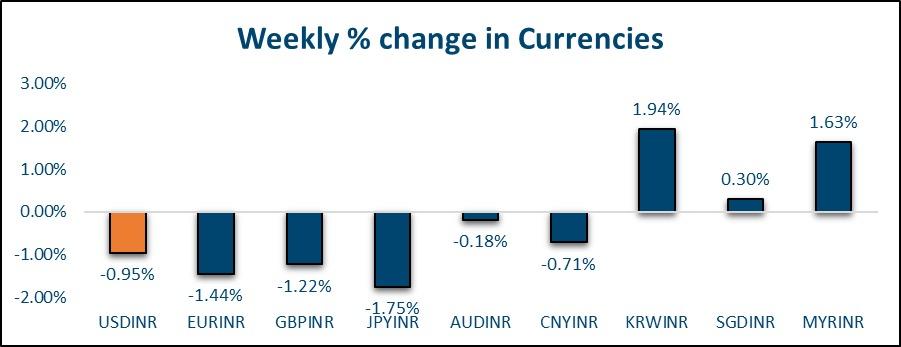

FOREIGN EXCHANGE:

Among G10 currencies, commodity currencies AUD (+0.6%) and CAD (+0.4%) were the best performers, while low JPY (-0.9%) and EUR (-0.6%) were the worst performers. Asian and EM currencies strengthened significantly against the Dollar this week. Rupee saw the biggest single-day gain in 29 months this week. While idiosyncratically, Rupee performed well this week, in relative terms, it has underperformed. It seems the RBI is willing to let the Rupee appreciate in line with the Yuan. 3m ATMF implied volatility surged 74 bps to 5.57%, highest since Nov'22. 1y and 5y forward yield rose 13bps each to 2.29% and 2.89% respectively.

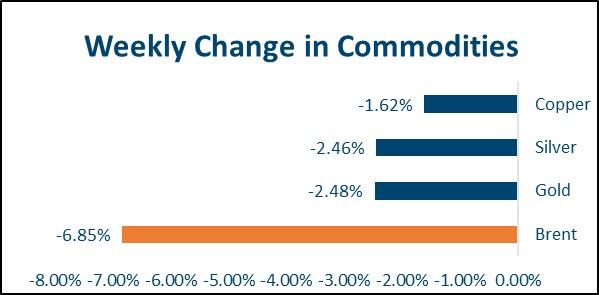

COMMODITIES:

There was a massive sell-off in Brent this week. It plunged 8.3% to USD 61.3 per barrel. It seems Saudi Arabia is continuing to pump crude at the same pace, despite such low levels, to get non-compliant OPEC members in line and increase market share. Precious metals lost a bit of shine this week, given the risk-on sentiment. Base metals were flat this week, with LME Copper and Aluminum ending at 9365 and 2431, respectively.