Weekly Report (9th July, 2023) : This week saw the Rupee depreciate 0.9% to 82.74. It was the worst performing Asian currency.

9 July 2023 | Category - Market

Domestic Developments

RBI had been putting a firm floor under the USD/INR pair as Rupee had strengthened in relative terms against the Yuan due to the latter's weakness. 11.25-11.30 is the lower end of the band in which RBI has been keeping CNHINR. Keeping Rupee competitive, especially against the Yuan is critical for competitiveness of domestic manufacturing and exports. Considering the overall positive domestic macros and FPI flows into equities, market was positioned for a break lower in USD/INR. As the move lower failed to materialize, speculative shorts were compelled to unwind their positions and take stops.

Long term forwards too have come under pressure with US data coming in better than expected. 1y forward yield has dropped to a mere 1.57%. US June ISM services print continues to point to a resilient service sector outlook and June ADP print and NFP prints continue to indicate a labor market that is still too tight for Fed's comfort. Even the Fed meeting minutes that came out this week indicated that most Fed members felt that further tightening was necessary. As a result, market now sees a 25bps hike in July as almost a done deal and moreover, is bracing itself for a high hold i.e. it is pushing expectations of a rate cut further out. Lower forward points make it less attractive to short the Dollar. We saw the 3m ATMF volatility spike about 30bps to 3.86% this week. However, it still continues to remain extremely low by historical standards. We see the volatility remaining subdued as long as the pair remains in the 81.60-82.90 range.

India June goods and services trade data will be in focus in coming week to see whether May was just an aberration. Trade deficit had spiked to over USD 22bn in May from 15-18bn in previous months. Current and capital account dynamics have been favorable in recent times. Crude has been below USD 80 per barrel and we have seen two back to back months in which FPIs have invested over USD 5bn in Indian equities. If current and capital account dynamics remain stable, we expect the Rupee to continue trading in the 81.60-82.90 range.

Key risks to our view of neutral to stronger Rupee are as follows:

1) Spike in crude prices due to geopolitical tensions flaring up

2) Global risk sentiment turning around as lagged impact of central bank tightening plays out in the real economy and ultimately creates financial sector stress

3) Deterioration in US-China ties denting risk sentiment. US treasury secretary is currently in China to attempt to ameliorate ties

4) RBI being compelled to tighten further to tame inflation, thereby hurting domestic growth sentiment.

Key Events/Data in coming week

China CPI data on Monday

India June CPI on Tuesday

US June CPI and India May IIP on Wednesday

US June PPI and ECB meeting minutes on Thursday

US July University of Michigan consumer sentiment on Friday

Expected Ranges:

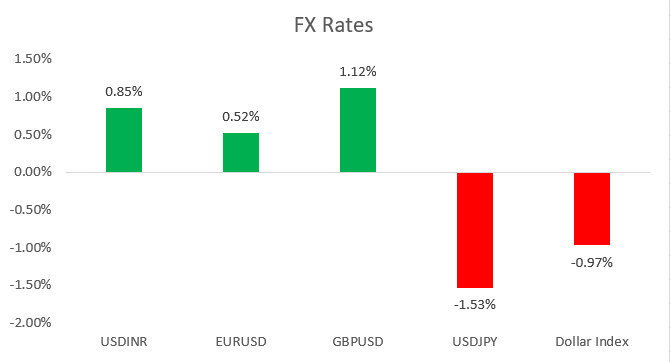

EUR/USD: 1.09-1.11 with up side bias

GBP/USD: 1.2730-1.2940 with up side bias

USD/JPY: 141-144 with sideways price action

USD/INR: 82.30-82.95 with sideways price action. IFA Global hedging barometer at 94 indicates a moderately bullish outlook on Rupee over the medium term (Range 36-180 with 36 indicating extreme bullishness)