Weekly Report (30th April, 2023): Risk sentiment holds as Earnings beat prevails over renewed concerns around Small Banks in US

30 April 2023 | By IFA Global | Category - Market

Global Developments

Concerns around small banks in US resurfaced this week as First Republic Bank share price tumbled 75%. It's earnings report showed that deposits had fallen a lot more than analysts had expected and there were reports that it was looking at asset sales of around USD 100bn to bridge the asset liability gap. Despite the renewed concerns around small banks in US, risk sentiment held up well as Q1 earnings of big tech companies such as Alphabet, Microsoft and Facebook parent Meta beat estimates.

US Q1 GDP came in below expectations at 1.1% QoQ annualized (est 1.9%) on weaker personal consumption. Fed's preferred inflation gauge the PCE and core PCE came in line with estimates at 0.1% MoM and 0.3% MoM respectively. Core inflation in the US continues to remain very sticky.

Market is pricing in a 84% chance of a 25bps hike by the Fed in the monetary policy on Wednesday (3rd May). This would take the Fed funds rate range to 5-5.25%. Market is still pricing in over 2 cuts by the Fed in 2023. It will be interesting to see if the Fed can get the markets to price these out through its hawkish commentary.

ECB monetary policy is due on Thursday. Market is pricing in a 88% probability of a 25bps hike and a 12% probability of a 50bps hike.

New BoJ Governor's first policy was seen as dovish. Markets were expecting cues on changes to be made to the ultra dovish monetary policy framework. While the policy would be reviewed over a longer time frame, there was nothing concrete and nothing immediate and therefore the Yen weakened on Friday.

Price action across assets

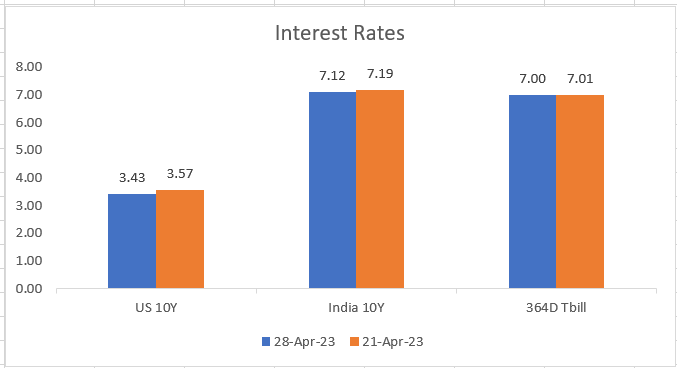

US 2y yield dropped 20bps to 4% and 10y dropped 15bps to 3.42% this week.

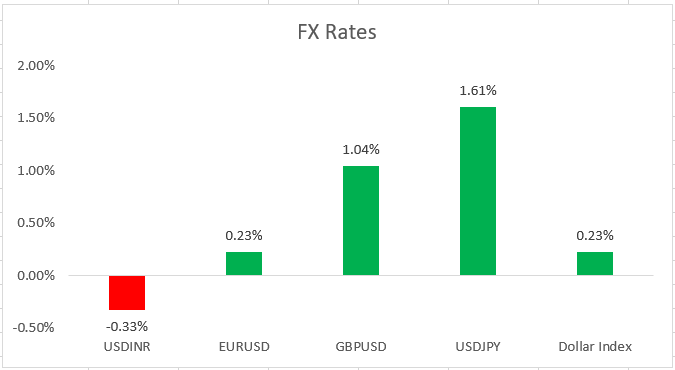

In the G10 space, Pound (+1.1%) was the best performer while Yen (-1.6%) and Australian Dollar (-1.2%) were the worst performers. Among Asian currencies, IDR (+1.2%) and PHP (1.2%) were the best performers. CNH (-0.3%), MYR (-0.6%) and KRW (-0.8%) underperformed.

S&P500 and Nasdaq gained 0.9% and 1.3% respectively this week. European equities underperformed with STOXX 600 dropping 0.5%. MSCI EM index too fell 0.4%

Brent fell 2.6% this week to end just above the USD 80 per barrel mark. Gold was almost flat at USD 1990 per ounce. Copper and Iron ore prices fell 2.8% and 2.6% respectively this week.

Domestic Developments

FX Reserves fell USD 2.2bn to USD 584.2bn as on week ended 21st April.

Equities

Domestic equities had a great week with Nifty gaining 2.5% to end above the 18000 mark. Gains were broad based across sectors with auto, IT, Banks, metals, energy indices all rallying anywhere between 2-3%. Broader markets too did well. We expect the Nifty to trade a 17800-18400 range with an up side bias in the coming week.

Bonds and Rates

Yield on the benchmark 10y ended 4bps lower at 7.12% this week. 1y OIS ended absolutely flat at 6.60% while 5y OIS ended 3bps lower at 6.06%. Overnight call rates have been fixing above the MSF rate as banking system liquidity has tightened. We expect the yield on the 10y to trade a 7.00-7.20% range over the next couple of weeks with sideways price action.

USD/INR

Rupee gained 0.3% against the Dollar to end at 81.83. Rupee traded a 81.61-82.10 range this week. While IPO related flows and month end exporter selling pushed USD/INR lower, firm Dollar bids from agent banks kept the floor under the pair. Rupee strengthened in offshore in NY session to end at 81.75 implied spot.

1y forward yield rose 6bps to 2.29% while 3m ATMF implied vols continue to remain extremely suppressed at 4.54%

IFA Global hedging barometer has moved lower to 94 and is indicating a bullish view on Rupee over the medium term (Range 36-180 with 36 indicating extreme bullishness and 180 indicating extreme bearishness)

Key Data and Events to track in the coming week

US Apr ISM Manufacturing PMI on Monday

US Mar JOLTS data, Eurozone April CPI on Tuesday

US Mar ADP, Apr ISM services PMI and Fed Rate decision on Wednesday

ECB rate decision on Thursday

US April Jobs report on Friday.

Expected Ranges and Bias

EUR/USD: 1.0960-1.1150 with up side bias

GBP/USD: 1.2450-1.2650 with up side bias

USD/JPY: 135-138 with sideways price action

USD/INR: 81.40-82.20 with sideways price action.