Weekly Report 2nd April, 2023): No bad news is good news!

2 April 2023 | By IFA Global | Category - Market

Global Developments

Risk sentiment held up extremely well in the week gone by as there were no further accidents following SVB, Signature, First Republic and Credit Suisse. There is a feeling among market participants that due to the recent banking crisis, financial conditions will tighten enough automatically and this will help the Fed dis-inflate without having to lift rates much further. White House is pushing for stricter capital and liquidity related regulations for mid-sized banks.

Also, the central Banks' commitment to lifelines in the form of liquidity backstops, should anything break, is comforting for the markets.

US Feb PCE (5% against expected 5.1% yoy) and core PCE 4.6% against expected 4.7% yoy) came in lower than expected. PCE is the Fed's preferred inflation. gauge. Market is pricing in a 58% chance of a 25bps hike in the May Fed meeting. Market expects this hike to be the final one.

On the other hand, while Eurozone headline CPI came in lower (6.9% against expected 7.1% yoy), core inflation came in line with estimates (5.7% yoy). Market is pricing in a 86% chance of a 25bps hike by the ECB in the May meeting. Market is expecting a terminal rate of close to 3.50%.

Market at this point feels ECB would be able to hold rates higher for longer compared to the Fed.

Price action across assets this week

US 2y yield rose 26bps to 4.02% while 10y rose 9bps to 3.47%. German 10y rose 17bps while UK 10y rose 20bps

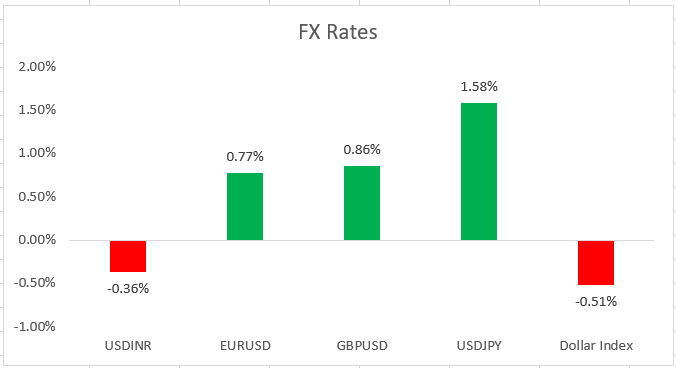

Dollar weakened against all G10 currencies except the Yen (-1.6%). Canadian Dollar (+1.7% was the best performer on bounce back in crude prices). Among Asian currencies the IDR (+1.1%) and INR (+0.4%) were the top performers against the Dollar while KRW (-0.6%) was the laggard

Equities globally did well in a risk on environment. S&P500 and Nasdaq gained 3.5% and 3.4% respectively. European STOXX600 was up 4% while Nikkei gained 2.4%. Markets seemed comfortable holding risky bets into the weekend unlike last week.

Crude rose 6.4% to USD 79.9 per barrel while Gold dipped 1% to USD 1969 per ounce. Copper was flat on the week at USD 410 per pound.

Domestic Developments

FX Reserves rose USD 6bn to USD 578.8bn as on week ended 24th March

RBI's long forward book stood at USD 20.5bn as on February end.

Central government Apr-Feb fiscal deficit stood at Rs 14.5 lakh crs (83% of annual estimates)

CAD narrowed to USD 18.2bn (2.2% of GDP) in Q3'FY23 compared to USD 30.9bn (3.7% of GDP) in Q2'FY23

Equities

Nifty rose 2.5% this week on the back of a massive rally on Friday to end at 17359. Broader markets however underperformed. Bank stocks led the rally. IT stocks too rebounded smartly. If seems a short term bottom is in place around 16800 and the Nifty seems poised to move higher towards to 17800.

Bonds and Rates

Yield on the benchmark 10y ended flat at 7.31%. 1y OIS rose 15bps to 6.83% and 5y OIS rose 10bps to 6.30%. Call rate fixed at 7.79% on Friday and was even dealt above 8% mark, due to tight year end liquidity. 91d T-bill was cancelled this week as participation would have been tepid due to tight liquidity. 25bps hike seems to be the most likely outcome on Thursday. We expect the 10y to continue trading a 7.20-7.40% range.

USD/INR

Rupee appreciated 0.4% this week to 82.18 on month end exporter selling and year end USD conversions.

Now that the financial year end is behind us, it will be interesting to see whether the RBI continues to accumulate Reserves as aggressively. We believe it could become a bit more tolerant of Rupee appreciation and step in at lower levels.

1y forward yield ended at 2.40% while 3m ATMF implied vols ended at 5.10%

We expect the Rupee to trade a 81.80-82.70 range in the coming week with sideways price action.

Key Data/Events to follow in coming week

US March ISM manufacturing on Monday

US March ADP and ISM services on Wednesday

US March jobs report on Friday

RBI monetary policy on Thursday

Expected Ranges and Bias

USD/INR 81.80-82.70 with sideways price action

EUR/USD: 1.0770-1.0950 with up side bias

GBP/USD: 1.2210-1.2430 with up side bias

USD/JPY: 131.50-134.50 with up side bias.