Weekly Report (29th July, 2023) : BoJ tweaks YCC, China announces further stimulus measures.

29 July 2023 | Category - Market

Global Developments

It was a week of central bank rate decisions and while the Fed and the ECB both hiked by 25bps in line with expectations, it was the BoJ that sprung a surprise.

Fed Chair Powell's speech was dovish. He said the Fed would decide to hike or hold in September on the basis of their assessment of two more CPI prints and two more jobs reports that would come out by then. He also said that while the job market was still tight, supply and demand were coming into better balance. Powell further added that the Fed had come a long way and had taken real rates to significantly restrictive levels. It could therefore afford to be a bit patient to allow the effect of past tightening to fully play out. The market is not pricing in more hikes by the Fed. Markets would react significantly to next CPI prints and NFP data as Fed has predicated its September action on these data points.

The ECB followed in Fed's footsteps and significantly toned down its hawkishness. President Lagarde said the ECB was open minded about September and would decide on the basis of incoming data. Growth in the Euro area has been a concern. PMIs and Sentiment indicators have been painting a gloomy outlook.

The BoJ decided to allow more flexibility in its YCC program. It said it would offer to buy 10y JGBs at 1% through fixed rate operations. This allows for 10y JGB yield to rise above 0.5%, what had been the upper cap under BoJ's YCC so far. This move is seen as a step towards gradually normalizing the ultra loose policy as the Japanese economy is finally seeing some sticky core inflation.

US Q2 GDP surprised on the up side, coming in at 2.4% yoy. PCE, Feds preferred inflation gauge at 4.1% was the lowest since Sep'21. Employment Cost Index, another key gauge followed by the Fed rose 1% in Q2, slight lower than expected

Price action across assets

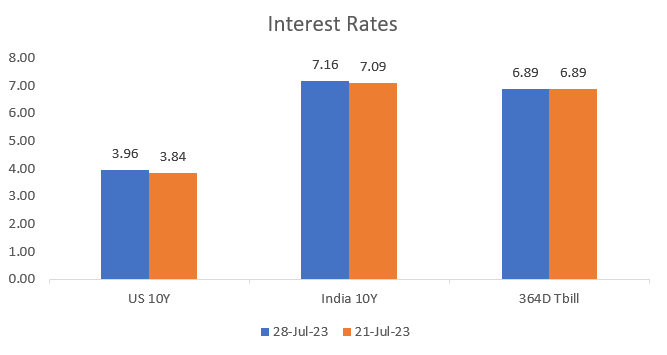

US 2y ended the week 4bps higher at 4.89% while 10y ended 12bps higher at 3.96%

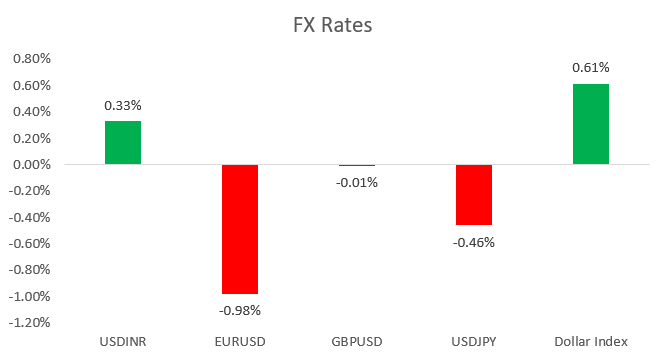

Among G10 currencies, Yen strengthened 1% this week on BoJ's policy tweak. Euro fell 1% on a dovish ECB and weak Eurozone growth outlook. Pound was little unchanged.

Among Asian currencies THB, KRW and CNH strengthened 0.4-1.1% against the Dollar while INR, IDR and PHP underperformed and weakened between 0.3-0.5%

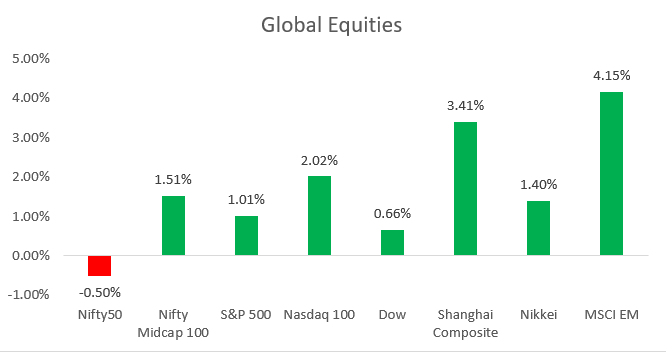

S&P500 rose 0.9% while Nasdaq rose 1.7% this week. European equities did well on a dovish ECB with DAX gaining 2% this week. The outperformer though was the Shanghai composite which rallied 3.8% this week as China introduced a slew of measures to revive consumption and investment in the economy.

Commodities edged higher this week on China stimulus measures. Brent rose 3.8% to USD 84.2 per barrel. Copper rose 2.6% to 3.90 per Pound. Gold was steady at USD 1955 per ounce.

Domestic Developments

FX Reserves dropped USD 2bn to USD 607bn in the week ended 23rd September

Equities

Nifty ended the week 0.5% lower at 19646. While the benchmark index is seeing a bit of consolidation, broader indices continue to do well. Midcap index gained 1.5% this week. Metals and Energy stocks outperformed this week as commodities rallied on China stimulus measures. FPIs have so far invested USD 5.5bn in equities in July so far.

We believe there is a room for 4-5% further upside in the current rally. 18900 would be an extremely crucial support

IFA Global Quant based investment model is indicating a moderately bullish bias towards equities. Compared to its benchmark having 60-30-10 composition of equities(domestic plus usa), debt and gold, the model is indicating being overweight equities with a portfolio weight of 70%. (Based on the model's quant variables, equity allocation would vary between 40% and 90%.)

Bonds and Rates

Bonds and Rates sold off this week as commodities rallied and US treasuries came under pressure. Yield on the benchmark 10y ended 7bps higher at 7.15%. There was a tail in Friday's auction in benchmark security, with cutoff coming in at 7.18%. FPIs have invested USD 400mn in Indian debt in July so far. Banks parked Rs 94000crs with RBI in 14 day VRRR auction.

We revise our expected trading band on the 10y higher to 7-7.25%

USD/INR

Those positioned for a downside break in USD/INR were disappointed yet again as RBI continues to keep a firm floor around 81.60. We saw stops get triggered on break of 82.05. Rupee eventually ended the week at 82.26, weakening 0.4% compared to last week.

1y forward yield continues to remain suppressed at 1.68% while 3M ATMF implied vols rose to 3.83%

We expect the Rupee to trade a 81.90-82.60 range in the coming week with sideways price action.

IFA Global hedging barometer unchanged at 94 continues to indicate a moderately bullish outlook on Rupee over the medium term (Range 36-180 with 36 indicating extreme bullishness)

Exporters can consider doing forward extra or RRs with Knock In barrier on Sell Call leg. Importers can consider buying 'out of the money' calls with strikes of 82.75 or 83.00 to hedge their 2-3 month exposures.

Key Data/Events to track in coming week:

Eurozone CPI on Monday

US July ISM manufacturing PMI and June JOLTS opening on Tuesday

US July ADP on Wednesday

BoE rate decision and US ISM services PMI on Thursday

US July Jobs report on Friday

Expected Ranges and Bias

EUR/USD: 1.0960-1.1230 with up side bias

GBP/USD: 1.2750-1.3050 with up side bias

USD/JPY: 138.50-141 with downside bias

USD/INR: 81.90-82.60 with sideways price action