Weekly Report (28th May, 2023): Debt ceiling drama about to reach climax

28 May 2023 | By IFA Global | Category - Market

Global Development

After week of negotiations, Republicans and Democrats are closing in on locking in a two year agreement that would restrain federal spending and lift the debt ceiling past next year's US presidential election. It is expected that they would reach an agreement over this weekend.

If they fail to do so, US government could default by 5th June. That is the date which Treasury secretary Yellen has said, by which the US treasury would have exhausted all it's extra ordinary measures and would have no cash left to meet it's obligations.

If the US defaults, it would be ominous for the world economy. It would result in a deep recession and several thousands of job losses in the US. It's still however a low probability event as of now. An agreement is likely to eventually be reached at the eleventh hour.

Meanwhile, most of the US data that came out this week beat expectations. US Q1 GDP was revised higher in the second estimate. Personal consumption and PCE price index too were revised higher. April headline PCE and core PCE came in above estimates as well.

More recently there has been a clear divergence in economic surprises between the US and Europe. US high frequency data has been coming in better whereas Eurozone data has disappointed.

Market is pricing in a 69% probability of a 25bps hike in the June meeting by the Fed. Market was pricing in 2.5 cuts in 2023 not long ago but has now largely priced them out post the Fed minutes and hawkish commentary from Fed members this week.

25bps hike by the ECB in June is almost completely priced in. There is also a 83% chance of a 25bps hike in July and 48% chance of another 25bps hike in September.

UK April CPI print this week came in way above expectations (8.7% yoy vs 8.2% yoy exp). Core CPI in UK is the highest since 1992. Market is fully pricing in a 25bps hike each in June, August and September. Terminal rate is likely to be around 5.5%

Price action across assets

This week saw a repricing of the central bank rate trajectories, especially in US and UK. As a result, there was a massive sell off in bond markets

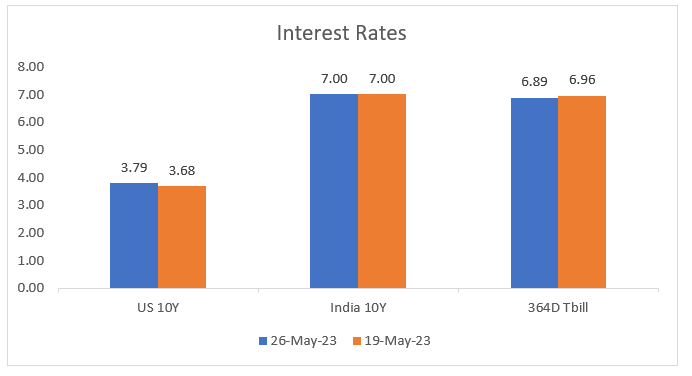

This week US, German and UK 2y yields rose 30bps, 19bps and 54bps respectively. UK 2y yield is now within striking distance of the 4.66% peak seen in Sep'22. US 10y yield ended 13bps higher at 3.80%

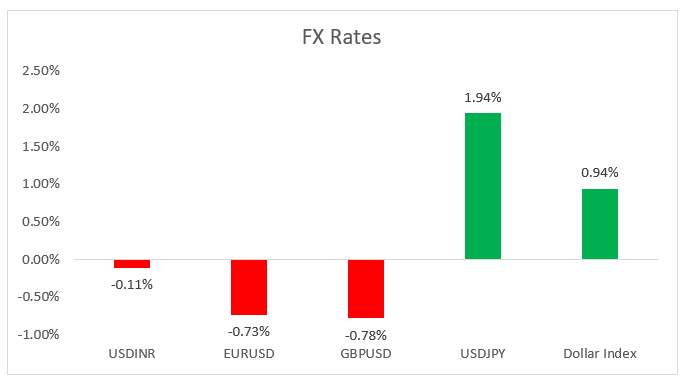

Dollar strengthened against all G10 currencies. NZD (-3.7%) was the worst performer while CHF (-0.7%) was the best performer. Among Asian currencies, MYR (-1.4%) was the worst performer while KRW (+0.15%) and Rupee (0.11%) were the top performers.

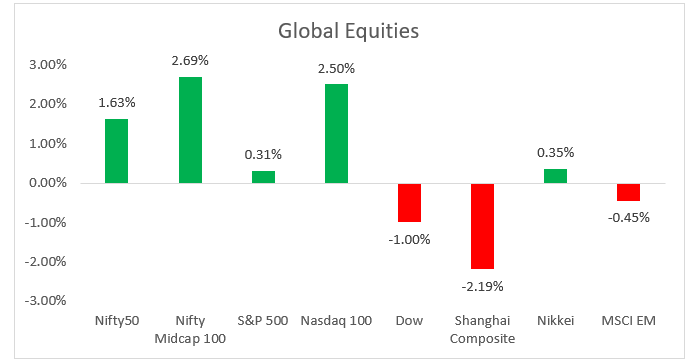

Global Equities were a mixed bag with Nasdaq rising 2.5% on strong earnings reported by Nvidia, on account of surging AI related demand. S&P500 rose a modest 0.3%. Shanghai composite was down 2.2% on disappointing China data and concerns around growth. MSCI EM index was down 0.5% and STOXX 600 was down 1.6%

Brent rose 1.8% this week to USD 77 or barrel. It had touched a high of USD 78.7 per barrel as Saudi warned short sellers to 'watch out'. Crude prices eased as Russian deputy PM downplayed possibility of OPEC+ production cut in the upcoming meeting on 4th June. Gold dropped 1.6% to 1946 per ounce amid a move higher in US rates and a stronger Dollar. Copper prices are at the lowest levels since December at USD 367 per Pound.

Domestic Developments

RBI's FX Reserves fell USD 6bn to USD 593.5bn as on week ended 19th May. 70% of the drop is likely on account of revaluation impact of currencies other than Dollar.

Equities

Nifty rose 1.6% this week to end at 18499, on the back of a strong rally on Friday. Midcaps outperformed the benchmark. Metal and IT stocks saw a sharp rebound. Bank stocks underperformed. We expect the positive momentum in equities to continue with an all time high on Nifty being a real possibility in June series.

FPIs have poured in USD 4.5bn in equities in May so far, the most since Aug'22

Bonds and Rates

Yield on the benchmark 10y ended the week flat at 7% despite the move higher in US rates and an uptick in crude prices. Yield on 5y bond had dropped to 6.85% on Monday in anticipation of increase in SLR demand due to rise in NDTL post the announcement of demonetization of Rs 2000 notes. It however ended the week at 6.93%. 5y OIS in fact ended the week 9bps higher at 6.07%. 1y OIS ended the week flat at 6.55%. Banks have been parking more than Rs 1 lakh crs with RBI in SDF, indicating that banking system liquidity is comfortable. Overnight call rates have been fixing in 6.4-6.45%

USD/INR

Rupee was one of the best performing currencies despite overall Dollar strength. Rupee strengthened 9p to 82.57.

RBI seemed to be defending 82.80-90 levels as was expected. Month end exporter selling saw the Rupee strengthen on Friday. Monday is the exchange trade currency derivatives' expiry. MSCI rebalancing related inflows to the tume of USD 2.8bn are likely to go through on 30th May and 1st June. Outflows of around USD 1.5bn are likely to hit on 2nd June.

1y forward yield ended 10bps lower at 1.89% this week. 3m ATMF implied vols dropped 31bps to 4.13%, lowest in 16 years!

We expect the Rupee to trade a 82.10-82.90 range in the coming week with a strengthening bias.

Key Data and Events to track in coming week

Developments around debt ceiling

India Jan-Mar Qtr GDP, April core sector data, April fiscal deficit, May GST collections on Wednesday

China May PMI on Wednesday

Eurozone May CPI estimate on Thursday

US May payroll data on Friday

Expected Ranges and Bias

EUR/USD: 1.0630-1.0850 with up side bias

GBP/USD 1.2290-1.2490 with upside bias

USD/JPY: 139-141.50 with sideways price action

USD/INR: 82.10-82.90 with downside bias.