Weekly Report (28 October, 2023) : Risk aversion continues as war uncertainty looms

28 October 2023 | By IFA Global | Category - Market

● US data still resilient, US treasury yield curve flat, Dollar holds on to its strength

● War uncertainty looms; gold and crude remain elevated

● ECB holds rates after hiking in 10 successive meetings

● Fed and BoJ in the coming week

Global Developments

ECB kept rates on hold in its policy this week. This was the first hold after 10 successive hikes. However, this was expected after a dovish hike last time and therefore we did not see much of a reaction in the Euro. The ECB said that rates if maintained at current levels for a sufficiently long duration should help bring inflation down to target.

We have the Fed and BoJ policies in the coming week. The Fed is likely to maintain status quo as far as target Fed funds rate range is concerned. However in the press conference, we expect the Fed to be probed on reasons why it feels the yield curve is flat despite short term rates being as high as they are at present. There could be questions around when would it be appropriate to stop QT. The way the Dollar reacts would depend on how the long term yields move through the policy and even thereafter. Most US data released this week was better than expected. Growth related measures i.e. Q3 GDP, Durable goods and personal spending all surprised on the upside while inflation measures mostly printed in line.

The BoJ on the other hand may be compelled to raise the 1% cap on 10y JGBs further higher to support the currency.

Price action across assets

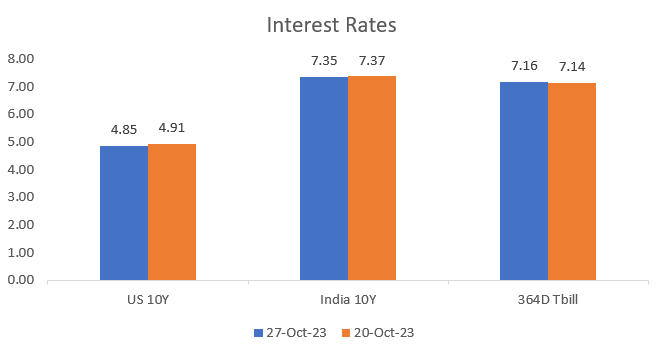

US 10y yield had spiked to highest levels since 2007, around 5% but has retraced to 4.85%. US 2y yield ended at 5.02%

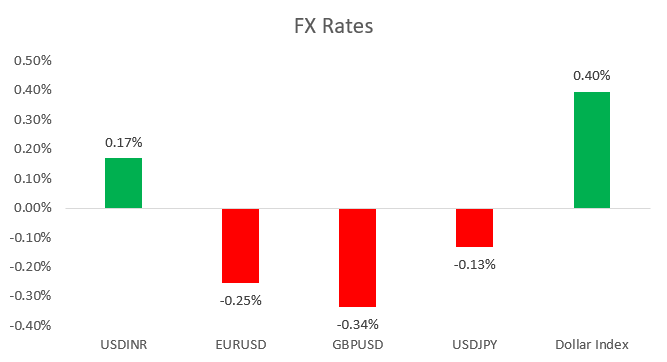

Dollar has been mostly stable through the week if we compare the week on week close. Euro is getting supported around 1.05 and Pound in the 1.20-1.2050 range. Yen broke past 150 this week but retraced yesterday to end at 149.65. Asian currencies such as IDR and PHP weakened a bit this week.

Gold and crude continue to remain elevated as Middle East geopolitics remains on the boil given Israel's impending invasion of Gaza and Iran's warning against the same. Brent ended rhe week at USD 90.5 per barrel and Gold almost at USD 2000 per ounce

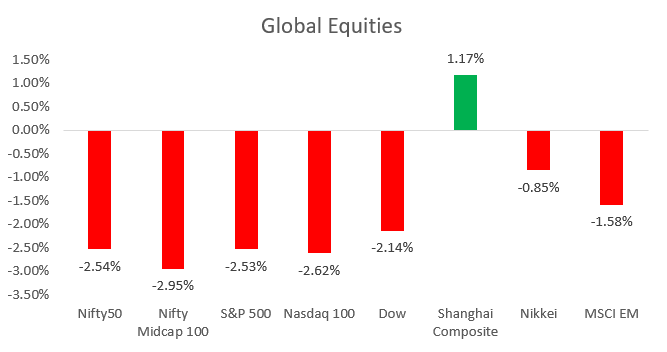

S&P500 lost another 2.2% this week and is now down more than 10% from its peak in July. Nasdaq too ended the week 2.2% lower and is down almost 12% from its high in July

Equities

Despite Friday's 1% up move (which followed 6 straight sessions of losses), Nifty ended the week 2.7% lower at 19047. Nifty Midcap index too ended 3% lower this week. Major sectoral indices were all under pressure. FMCG was the best performer (-0.9%) and Metal index the worst performer (-3.9%). Nifty TTM P/E now stands at 20.8. FPIs have pulled out USD 2.5bn from domestic equities in October so far. We continue to be constructive on Nifty as long as crucial support at 18900 holds.

IFA Global Quant based investment model is indicating a moderately bullish bias towards equities. Compared to its benchmark having 60-30-10 composition of equities(domestic plus usa), debt and gold, the model is indicating being overweight equities with a portfolio weight of 70%. (Based on the model's quant variables, equity allocation would vary between 40% and 90%.)

Bonds and Rates

Yield on the benchmark 10y ended at 7.36%. 1y and 5y OIS ended at 6.97% and 6.71% respectively. Banking system liquidity continues to remain tight. Call rates are consistently fixing above MSF. 1y t-bill cut off this week came in at 7.16%. 1y bank CDs are trading around 7.65%. We continue to believe 7.35-7.45% zone on 10y is a good range to add duration to bond portfolios.

USD/INR

Rupee continues to remain stuck in a range of 83.10-83.30. Rupee has been under pressure as FPI outflows from domestic equities continue. Net FDI in India in April-August too was a mere USD 3bn compared to USD 18bn in same period last year.

We expect the Rupee to continue to remain under pressure and trade a 83.00-83.60 range in the coming week.

1y forward yield ended at 1.73% while 3m ATMF implied vols ended at 3.38%

IFA Global hedging barometer unchanged at 123 is indicating a moderately bearish outlook on Rupee over the medium term (Range 36-180 with 36 indicating extreme bullishness)

Key Data and Events to look forward to next week

Germany CPI on Monday

BoJ rate decision and Eurozone October CPI on Tuesday

China Oct Manufacturing PMI, Fed policy, US ADP, US ISM manufacturing, JOLTS job openings on Wednesday

BoE rate decision on Thursday

US ISM services and Oct jobs report on Friday

Expected Ranges and Bias

EUR/USD 1.0490-1.0690 with down side bias

GBP/USD 1.2010-1.2210 with down side bias

USD/JPY 148.50-150.50 with down side bias

USD/INR 83-83.60 with up side bias