Weekly Report (26th March, 2023): Markets jittery as central banks push ahead with rate hikes

26 March 2023 | By IFA Global | Category - Market

Global Developments

All major global central banks have adopted the same playbook recently i.e. separate the price stability mandate from financial stability mandate. This means that central banks will continue to tighten if needed, to rein in inflation and if anything breaks in the process, they would invoke the lender of last resort function and dole out liquidity lifelines.

After the ECB hiked by 50bps last week, the Fed this week hiked by 25bps, BoE by 25bps and SNB by 50bps

Despite the Fed saying that rate cuts in 2023 were not part of their baseline scenario, markets are pricing in 120bps of cuts by year end. Markets are clearly not convinced that 'higher for longer' is sustainable.

Heading into the weekend, there was a bout of risk aversion with Deutsche Bank stock plunging 9%. It was down almost 15% at one point. The cost of insuring against Deutsche Bank defaulting (i.e. spreads of Credit Default Swaps) rose to the highest since 2019, crossing the 2% mark. However, rather than any specific concerns it just seemed markets were not comfortable carrying risky positions into the weekend.

Price action across assets

Market participants dumped risky assets into the weekend and moved towards safe havens.

US 2y had dipped to 3.54% at one point on Friday but recovered to end at 3.77%, down 7bps on the week. US 10y ended the week 5bps lower on the week at 3.38%

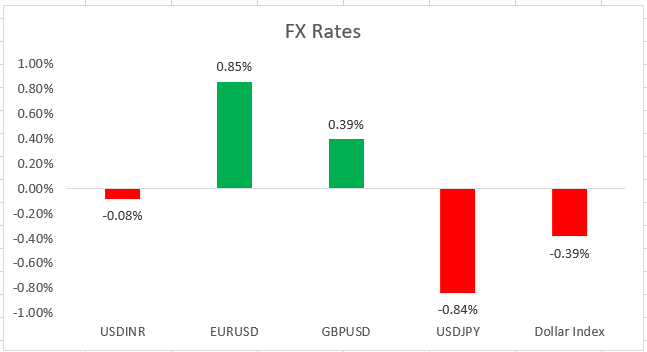

Dollar weakened against EUR (0.8%), GBP (0.5%) and JPY (0.9%) and strengthened against commodity currencies AUD (-0.8%), NZD (-1%) and CAD (-0.1%). All Asian currencies except the HKD strengthened against the Dollar this week. MYR (+1.3%) and IDR (+1.3) were the best performers

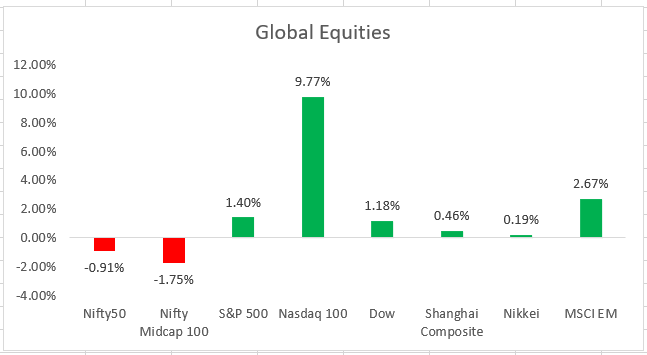

US equities had a resilient week with S&P500 and Nasdaq gaining 1.4% and 1.7% respectively. KBW bank index though ended 1.4% lower.

Brent rose 2.8% on the week to USD 75 per barrel while Gold dipped 0.5% to USD 1978 per ounce. Copper ended the week 4.8% higher. It was up 6.7% at one point but gave up gains on risk aversion heading into weekend.

Domestic Developments

The key highlight of the week was the passage of the finance bill.

The indexation benefit applicable in case of investments in Debt Mutual funds has been revoked. This is a major set back for such funds as indexation benefit was one of the major reasons which made these funds attractive.

FX Reserves rose USD 12.8bn to USD 572.8bn as on week ended 17th March, confirming that RBI has accumulated Reserves on dips to 81.75

Equities

Nifty ended the week 0.9% lower at 16945, most of the move lower happening on Friday. Metal and IT stocks underperformed. We expect the Nifty to trade a 16800-17300 range for now. Given the global uncertainties, the possibility of a retest and break of 16800 cannot be ruled out.

Bonds and Rates

Yield on the benchmark 10y ended 4bps lower at 7.31% this week. 1y and 5y OIS ended 10bps and 14bps lower respectively at 6.68% and 6.19%. Despite the move lower in OIS on Friday, corporate bonds of 3-5y maturities were under pressure with yields rising about 5bps due to cessation of indexation benefit. Banking system liquidity improved on account of government spending and with RBI doing a 5 day Rs 75000crs variable rate repo. We expect the yield on the 10y to continue trading a 7.20-7.40% range. T-bill and CD rates have moved lower, tracking the OIS.

USD/INR

Rupee was the worst performing Asian currency this week, behind the HKD, amid broad Dollar weakness, ending the week almost flat at 82.48. Rupee had strengthened to 82.07 intraday on Thursday but gave up gains thereafter.

We have been seeing strong bids from Oil importers and agent banks on dips. 1y forward yield had risen to 2.52% but ended at 2.45% as cash-tom points eased on improving system liquidity. Long term forwards have been rising as market is expecting US rates to come sharply lower in 2024. MIFOR ended 14bps lower across the curve this week with 2y ending at 6.62% and 5y at 6.82%. 3m ATMF vols ended the week flat at 5.15%

We expect the Rupee to trade a 82.10-82.90 range in the coming week. We may see year end inflows (Dollar conversions) but we expect these to be absorbed by the central bank and oilers. There could be some volatility in last day March over First day April points but we expect the RBI to keep a close eye on the liquidity situation.

Key data/events to look forward to next week

US Q4 GDP third estimate on Thursday

US Feb PCE on Friday.

Eurozone March CPI on Friday.

Domestic Feb core sector data, Apr-Feb central government fiscal deficit on Friday.

Expected Ranges and Bias

EUR/USD: 1.0680-1.0930 with up side bias

GBP/USD: 1.2130-1.2430 with up side bias

USD/JPY: 130-133 with down side bias

USD/INR: 82.10-82.90 with down side bias