Weekly Report (26August, 2023) : Powell, Lagarde strike a hawkish tone at Jackson Hole.

26 August 2023 | By IFA Global | Category - Market

Global Developments

The key event of the week was Fed Chair Powell's speech at the Jackson Hole symposium.

He struck a hawkish tone saying that though inflation had come off from its peak, it still was too high. He added that the Fed was prepared to raise rates further if appropriate and keep policy restrictive till it was confident of inflation sustainably coming down towards its objective.

While the probability of a 25bps hike in September continues to remain unchanged at 20% post Powell's speech, probability of a 25bps hike in November has risen to 48% from 42%. The probability of a 25bps hike in December has risen from 39% to 45%.

ECB president Christine Lagarde too said that interest rates would stay high for as long as needed to defeat inflation.

Another key event this was the BRICS summit. Six more nations would become members from 1st Jan'24 i.e. UAE, Saudi, Egypt, Ethiopia, Argentina and Brazil. This would certainly have ramifications for international trade.

China concerns continued to dominate headlines. The PBoC had cut the loan prime rate by less than expected at the start of the week. It has continued to indicate it's discomfort with a weaker Yuan by way of stronger fixings.

Price action across assets

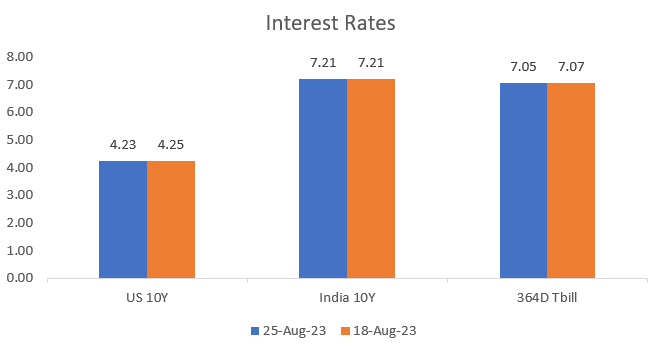

US 2y yield has risen 13bps this week to 5.06% while 10y yield is flat at 4.25%

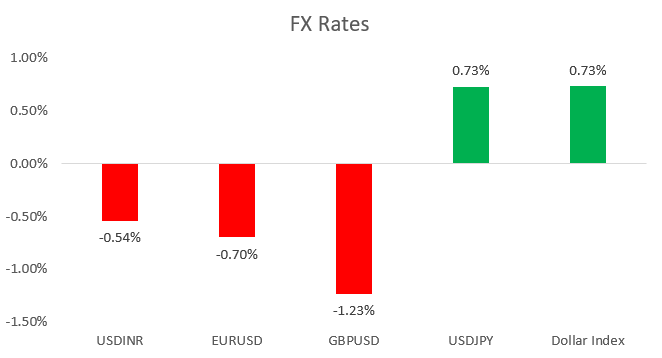

Dollar has strengthened against major currencies this week while it has weakened against Asian and EM currencies. Dollar had strengthened heading into Powell's speech but gave up some gains subsequently as his tone, though hawkish was along expected lines. Euro and Pound were the underperformers amongst G10 currencies as Services PMIs for Eurozone and UK for August came in contraction territory. There is clear divergence in ecomomic indicators between Eurozone and UK on one hand and US on the other.

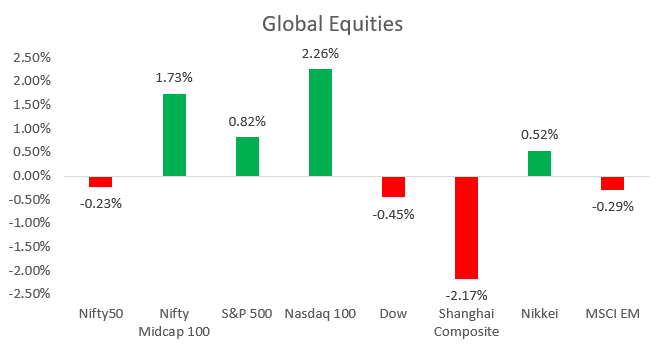

US equities at the time of writing this report were on course to end the week higher with S&P500 gaining 0.9% and Nasdaq close to 2%. Major European indices too ended the week 0.4-1% higher.

Gold gained 1.5% this week while Brent declined 1.5% Copper too recovered 1% this week. Silver rose 6% this week on account of a short squeeze as no major negative newsflow emerged from China.

Domestic Developments

RBI meeting minutes were hawkish. Governor Das said that though vegetable prices driven spike in inflation has proven to be transitory in the past, a combination of uneven rains, global surge in key agri commodities and El Nino conditions warranted close monitoring on inflation front.

FX Reserves dipped USD 7.3bn to USD 594.9bn in week ending 18th August as RBI intervened to support the Rupee.

Equities

Nifty ended the week 0.2% lower at 19265 mainly on account of profit taking on Friday, heading into Powell's Jackson Hole speech and weekend. Banks and IT stocks did well this week while energy stocks underperformed.

FPIs have invested net USD 1.3bn in domestic equities in August so far.

18900 is a crucial support for the Nifty and as long as that holds, we would prefer to enter equities from the long side.

Bonds and Rates

Yield on the benchmark 10y ended at 7.20%, 5bps lower compared to last week. 1y OIS almost ended flat at 7.01% while 5y OIS ended the week 4bps lower at 6.63%. Liquidity in the banking system is tight. Call rates consistently fixed above MSF this week. 1y T-bills are trading around 7.05% while 1y CDs are trading around 7.40%. FPIs have invested net ~USD 700mn in domestic debt in August thus far.

We expect the yield on the 10y to trade in a 7.05-7.30% range over the medium term. Any spike towards 7.30% would be a good opportunity to add to duration.

USD/INR

Rupee strengthened 0.55% this week to 82.65 as RBI asked banks to trim their arbitrage books. This was construed as RBI wanting to curb speculation. Stop losses got triggered on break below 82.90.

News of Qatar Investment Authority investing USD 1bn into Reliance Retail also boost sentiment. Moreover favorable global risk sentiment, USD/CNH and crude coming off too helped thr Rupee.

1y forward yield ended at 1.63% while 3m ATMF implied volatility dropped to 3.83%

Exporters are advised to hedge om upticks to 82.90 while importers can cover on dips to 82.40 and 82.10. Importers are advised to consider hedging through call spreads while exporters can hedge through forwards.

Key Data/Events to track in coming week

Tuesday: US JOLTS job openings data for July

Wednesday: US August ADP, Q2 GDP second estimate

Thursday: Eurozone August CPI, US July core PCE

Friday: China manufacturing PMI, US August jobs report, ISM manufacturing

Expected Ranges and Bias

USD/INR 82.10-82.90 with sideways price action

EUR/USD: 1.0740-1.0950 with up side bias

GBP/USD 1.2520-1.2780 with up side bias

USD/JPY: 144-147 with downside bias