Weekly Report (25th June, 2023) : Hawkish Fed commentary, BoE surprise 50bps hike and Weak Eurozone Services PMIs weigh on risk sentiment.

25 June 2023 | By IFA Global | Category - Market

Global Developments

Risk sentiment this week was marred by hawkish comments from Fed Chair Powell in his testimony before the Congress. He reiterated that lowering inflation to 2% had a long way to go and that Fed officials saw rates being somewhat higher by year end. Market is currently pricing in a 72% chance of a 25bps hike in July. It thereafter expects the Fed to pause until January, before beginning to cut rates

Bank of England this week surprised by a delivering a 50bps hike instead of 25bps as inflation in UK, especially core inflation continues to remain stubbornly high. Core CPI print for May came in at a 31 year high of 7.1% against expected 6.8%. Market now expects a terminal rate of over 6%, compared to 5.75% a week ago

Eurozone services PMI too was disappointing, barely managing to hold in expansion territory. Manufacturing PPI slipped further lower in contraction territory. In what was a big negative surprise, France Services PMI slipped into contraction zone in June. Until now, though the manufacturing sector was subdued, services sector was doing well. Weakening service sector outlook has dampened sentiment.

Price action across asset classes

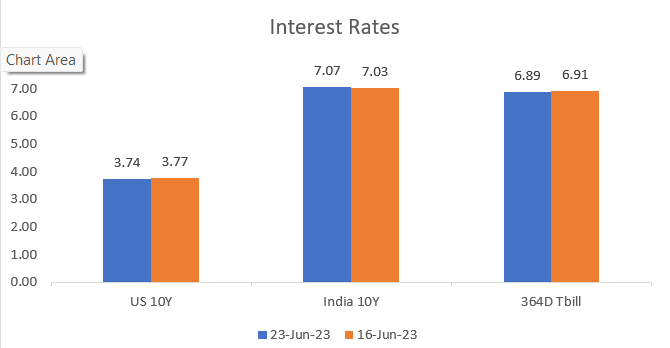

US treasuries had sold off on hawkish Fed commentary but managed to recover on Friday. US 2y yield ended the week 3bps higher at 4.74% while 10y yield ended 3bps lower at 3.73%.

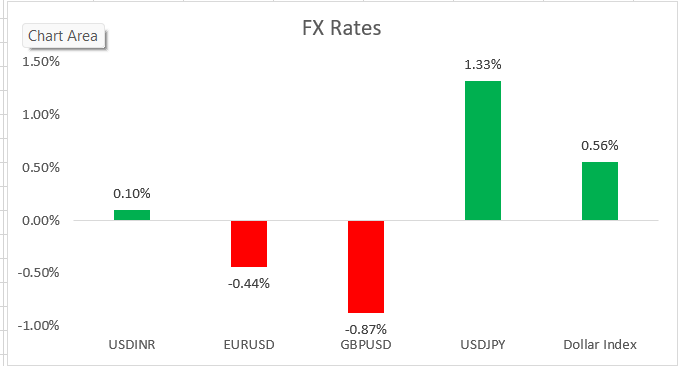

Dollar strengthened against all G10 currencies except the Canadian Dollar. AUD (-2.9%) and NOK (-2.4%) were the worst performers. All Asian currencies except PHP (+0.2%) weakened against the Dollar. KRW (-2.5%) and THB (-1.6%) were the worst performers. Offshore Yuan CNH weakened 1.2% against the Dollar.

Brent dropped 2.5% this week to USD 73.9 per barrel given the overall risk off tone. Gold dropped 1.9% on prospects of US Fed keeping rates higher for longer. Copper fell 1.9% this week to USD 380 per pound.

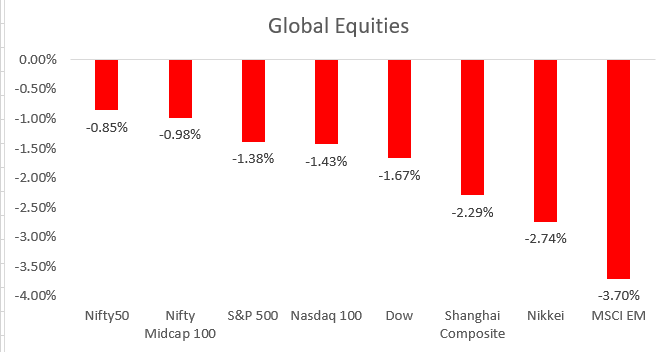

Global equities had a rough week. S&P 500 and Nasdaq both ended 1.4% lower on the week. European STOXX 600 ended 2.9% lower. MSCI EM index ended 3.7% lower.

Domestic Development

FX Reserves rose USD 2.3bn to USD 596.1bn in week ended 16th June.

Equities

After coming ever so close to printing an all time high of 18887, Nifty saw some profit taking and ended the week 0.9% lower at 18665. Metal stocks underperformed. Midcaps and Small caps which have seen a tremendous rally off late also ran into some profit taking. 18550 is expected to act as a strong support for Nifty.

IFA Global Quant based investment model is indicating a moderately bullish bias towards equities. Compared to its benchmark having 60-30-10 composition of equities(domestic plus USA), debt and gold, the model is indicating being overweight equities with a portfolio weight of 70%. (Based on the model's quant variables, equity allocation would vary between 40% and 90%.)

Bonds and Rates

Yield on the benchmark 10y ended 4bps higher at 7.07%. Rates sold off as RBI minutes were hawkish. 1y OIS ended 4bps higher at 6.70% while 5y OIS ended 12bps higher at 6.27%. We continue to expect the 10y to trade in a 6.90-7.15% band over the coming few weeks.

FX Strategy

Rupee weakened 10p to 82.03 this week. Given the recent weakness in Yuan, CNHINR has dropped to 11.36, which is the lower end of the range in which RBI has been likely maintaining it. As a result, we believe RBI has been less tolerant of Rupee appreciation and has been intervening in spot around 81.90. It has been sterilizing it's FX intervention by swapping the spot Dollar purchases forward. This has supported the forward curve. 1y forward yield rose 6bps to 1.88% this week.

Vols continue to remain subdued with 3m ATMF implied vols dropping 25bps to 3.57%

We expect the USD/INR pair to remain under pressure in the coming week. Corporates are likely to avail ECBs before the scheduled withholding tax increase from July. Combined with month end exporter selling, we could see USD/INR spot drift lower. However we expect the RBI to continue supporting the pair as along as there is no meaningful reversal in USD/CNH

We expect a 81.60-82.25 range for the Rupee for the coming week.

IFA Global hedging barometer at 94 continues to indicate moderately bullish outlook on Rupee over the medium term.

Key Events/Data in coming week

US Q1 GDP Third estimate on Thursday

Eurozone June CPI on Friday

Expected Ranges:

USD/INR: 81.60-82.25 with downside bias

EUR/USD: 1.0830-1.11 with upside bias

GBP/USD: 1.2650-1.29 with up side bias

USD/JPY: 142-145 with sideways price action.

India May core sector data and April-May fiscal deficit data on Friday