Weekly Report (23 Sep, 2023) : All major central banks maintain status quo

23 September 2023 | By IFA Global | Category - Market

Global Developments

It was a week of four major central bank rate decisions, the Fed, the BoE, BoJ and SNB and all of them maintained status quo.

US Fed kept rates unchanged to allow the lagged effect of previous rate hikes to play out. Inflation cooling off and labor market tightness gradually dissipating gives Fed the leeway to pause. Dot plot indicated thay Median expectation was for the Fed funds rate to be at 5.1% by end of 2024 compared to median expectation of 4.6% in June and this spooked risk assets. The narrative from the Fed is therefore that the rates would remain higher for longer. It also expects the economy to be resilient for the next couple of years as it has revised its unemployment rate expectation lower and GDP growth expectation slightly higher.

The Bank of England too kept rates unchanged. While a 25bps hike seemed imminent, Wednesday's lower than expected CPI print may have tilted the scales in favor of a hold. Governor Bailey though stressed that BoE would monitor inflation closely to see if further hikes are needed. Just like the Fed, BoE too said that rates would have to be next high enough for long enough to ensure that inflation reaches target.

BoJ too kept rates and 10y yield target unchanged citing extremely high uncertainties on the growth outlook, both domestically and globally

China too kept 1y and 5y Loan Prime Rates (LPR) unchanged this week.

One major risk lurking around is that of a US government shutdown if the Republicans fail to pass a short term extension by 30th September. Right wing Republicans are holding up the bill as they want deep spending cuts. Such cuts would not be accepted by a Democrat controlled senate. If the government shuts down, several government employees will be furloughed without pay. Non critical government functions would be suspended.

Price action across assets

US 2y yield is up 8bps and 10y is up 10bps compared to last week on expectations of rates remaining higher for longer.

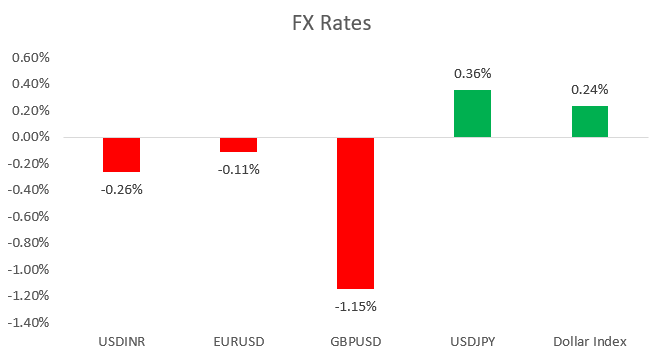

Dollar strengthened for the tenth straight week. GBP weakened 1% this week as BoE kept rates on hold. Euro and Yen are set to end the week almost flat. Offshore Yuan traded a 7.24-7.37 range this week and ended at 7.30

S&P500 and Nasdaq are set to end the week 2% and 2.4% lower respectively.

Brent is about 1% lower for the week. Gold was range bound between USD 1910 and USD 1950 per ounce this week, ending at USD 1926.

Domestic Developments

Biggest development this week was the announcement of inclusion of IGBs in the JP Morgan EM bond index with effect from 28th June 2024. India will get a weightage of 10% in increments of 1% over 10 months and that would result in inflows to the extent of USD 30bn (active and passive put together). USD 230bn of funds are currently benchmarked to the JP Morgan EM bond index. We may see even greater inflows if Indian bonds get included in FTSE and Bloomberg-Barclays EM bond indices as well. JP Morgan said that 23 IGBs with a combined notional value of USD 330bn are eligible for inclusion.

FX Reserves fell USD 867mn in the week ended 15th September to USD 593bn

Equities

Nifty ended the week 2.6% this week at 19674. It was the fourth consecutive week of losses. Broader indices too continued to remain under pressure with Midcap 100 index ending 1.7% lower. Below is how various sectors performed:

Bank Nifty -3.5%

Nifty IT -1.4%

Nifty Auto -1.2%

Nifty Energy -0.9%

Nifty FMCG -0.6%

Nifty Metal -3.9%

Nifty Pharma -3.3%

The Nifty TTM P/E Ratio stands at 22.2. We continue to remain optimistic on Indian equities and prefer to enter from the long side on dips.

IFA Global Quant based investment model is indicating a moderately bullish bias towards equities. Compared to its benchmark having 60-30-10 composition of equities(domestic plus usa), debt and gold, the model is indicating being overweight equities with a portfolio weight of 70%. (Based on the model's quant variables, equity allocation would vary between 40% and 90%.)

Bonds and Rates

Yield on the benchmark 10y had dropped to 7.08% on euphoria following news of IGBs getting included in JP Morgan EM bond index. The rally was short lived as 10y bond gave up all gains and ended at 7.18%. Liquidity deficit in the banking system is the highest in about 4 years at close to Rs 125000crs. Higher US yields and crude prices too are weighing on domestic bonds.

USD/INR

Rupee was under pressure throughout the week and was precariously close to all time lows. However, news of index inclusion caused the Rupee to strengthen to 82.80. From there on, it gave up some gains to end the week at 82.93. Rupee outperformed amid broad Dollar strength.

We expect the Rupee to trade a 82.70-83.30 range over the coming week with sideways price action.

IFA Global hedging barometer unchanged at 123 is indicating a moderately bearish outlook on Rupee over the medium term (Range 36-180 with 36 indicating extreme bullishness)

Exporters are advised to tread cautiously until Yuan and crude relent. Importers are advised to consider increasing their hedge ratios through RRs

Key Data and Events to track next week

Thursday: US Q2 GDP estimate

Friday: UK Q2 GDP, German Retail sales, Eurozone Sep CPI, US August PCE

Developments around the possibility of US government shutdown will have to be closely followed

Expected Ranges and bias

USD/INR 82.70-83.30 with sideways price action

EUR/USD: 1.0620-1.0780 with sideways price action

GBP/USD: 1.2210-1.2410 with sideways price action

USD/JPY: 146.50-149 with sideways price action