Weekly Report (23 July, 2023) : Wheat prices soar as Russia withdraws from Black Sea Grain Deal

23 July 2023 | Category - Market

Global Developments

One of the key Developments this week was Russia withdrawing from the grain deal which ensured safe passage for Ukranian agricultural exports to rest of the world amid the ongoing war. Russia has demanded better global access for its own exports and Russian Agricultural Bank to be reconnected to SWIFT in order to revive the deal. Withdrawal from grain deal has resulted in a spike in Wheat and fertilizer prices, of which Ukraine is a major exporter. It also increases the risk of Russia and Ukraine targeting each other's civilian vessels in the Black sea.

On the data front, US June Headline Retail sales came in lower but Retail sales control group beat estimates. Jobless claims came in lower than expected. UK June CPI surprised on the downside and came in at a 15 month low at 7.9% (exp 8.2% yoy)

Next week is a week of central bank rate decisions. We have the Fed rate decision on Wednesday, ECB on Thursday and BoJ on Friday. Both ECB and Fed are expected to hike Rates by 25bps. The Fed will likely tone down its hawkishness given that inflation is gradually mkderating and may choose to opt for a more data dependent, policy to policy approach. Nevertheless, we expect it to reiterate its commitment of bringing inflation back down to 2% and signal adopting a more aggressive stance if progress on inflation front stalls. July hike is fully priced in by the markets while market implied probability of a 25bps hike in September currently stands at 15%

Price action across assets

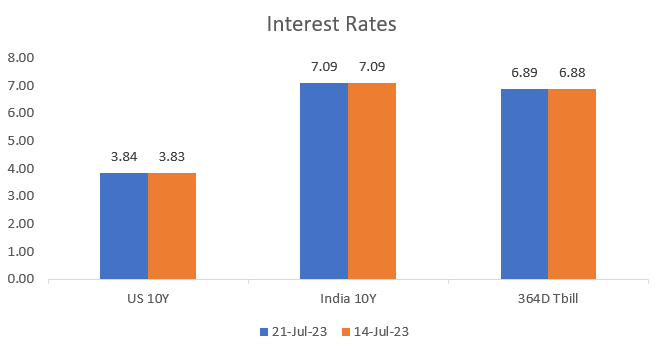

US 2y yield rose 18bps this week on better than expected US housing and retail sales control group data to 4.85%. 10y yield also rose 5bps to 3.84%

The Dollar made a bit of a comeback this week. Dollar index strengthened 1.2%. EUR, GBP and JPY weakened 0.9%, 1.8% and 2.1% respectively against the Dollar this week. Pound weakened on a lower than expected UK CPI print which caused the market to lower expectations of the terminal BoE cash rate in this hike cycle. Offshore Yuan too weakened 0.4% against the Dollar this week

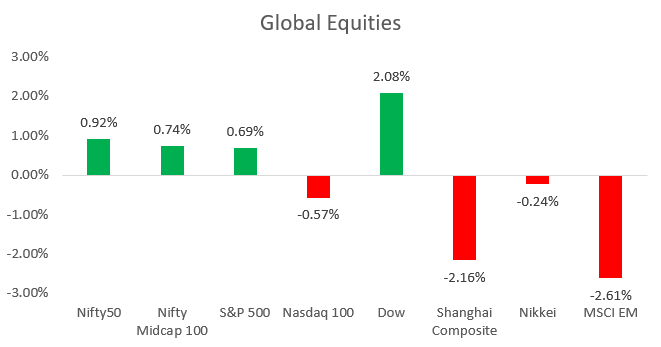

The rally in equities stalled globally as investors took stock of developments on the geopolitical front and chose to remain cautious ahead of key corporate earnings' releases and central bank rate decisions. S&P500 ended the week 0.7% higher while Nasdaq ended 0.8% lower. FTSE was the outperformer this week, rising 3.4%

Brent rose 1.3% to USD 80.9 per barrel. Gold rose 0.3% to USD 1961 per ounce. Copper retraced 2.7% this week to USD 3.82 per Pound. Wheat and corn prices rallied this week as Russia pulled out of the grain deal and attacked Ukranian grain stores and port infrastructure.

Domestic Developments

FX Reserves rose USD 12.7bn in the week ended 14th July to USD 609bn. Even after adjusting for the valuation effect (which would be significant considering the rally in crosses against the Dollar in that week), the RBI is likely to have mopped up close to USD 5bn of inflows

The centre imposed a ban on Non-basmati rice this week with immediate effect in an effort to contain food inflation

Equities

Nifty was within touching distance of the 20000 mark but retraced on Friday on disappointing results from IT major Infosys and general profit taking, heading into weekend. It nevertheless ended the week 0.9% higher at 19745. We expect the uptrend to remain intact and believe dips like the one we saw on Friday present good opportunities to enter from the long side. We believe there is another 4-5% potential upside in this swing as long as the support at 18900 holds. Fed rate decision and domestic Q1 corporate earnings will be key drivers for the market in the coming week.

FPIs have so far invested USD 5.3bn in equities in July and close to USD 18bn in the fiscal so far.

IFA Global Quant based investment model is indicating a moderately bullish bias towards equities. Compared to its benchmark having 60-30-10 composition of equities(domestic plus usa), debt and gold, the model is indicating being overweight equities with a portfolio weight of 70%. (Based on the model's quant variables, equity allocation would vary between 40% and 90%.)

Bonds and Rates

Bonds were steady this week with yield on 10y ending at 7.08%. The Gsec auction on Friday went through smoothly. 1y and 5y OIS ended at 6.79% and 6.30% respectively. We expect the 10y yield to continue trading in the 6.90-7.15% band in the foreseeable future.

USD/INR

Rupee was stable during the week and expectedly outperformed its peers amid broad Dollar strength. Cross/INR therefore saw some retracement after a tremendous rally in the previous couple of weeks. The central bank continues to keep a firm floor under the USD/INR pair.

We expect the Rupee to trade a 81.60-82.40 range in the coming week with an appreciation bias. A crude price spike and overall risk sentiment taking a hit in case Russia-Ukraine war intensifies is the major risk lurking around for the Rupee.

1y forward yield has been steady around 1.75% and 3M ATMF implied vols have been hovering around 3.7%

IFA Global hedging barometer unchanged at 94 is indicating a moderately bullish outlook on Rupee over the medium term (Range 36-180 with 36 indicating extreme bullishness)

Exporters can consider doing forward extra or RRs with Knock In barrier on Sell Call leg. Importers can consider buying 'out of the money' calls with strikes of 82.75 or 83 to hedge their 2-3 month exposures.

Key Data and Events to Follow in coming week

US Fed rate decision on Wednesday

ECB rate decision and US Q2 GDP estimate on Thursday

BoJ rate decision and US June PCE data on Friday

Expected Ranges and Bias

EUR/USD 1.1050-1.1250 with up side bias

GBP/USD 1.2740-1.3020 with up side bias

USD/JPY 139-142.50 with downside bias

USD/INR 81.60-82.40 with downside bias.