Weekly Report (22nd January, 2023): BoJ chooses not to shock markets; maintains status quo

22 January 2023 | By IFA Global | Category - Market

Weak US Data, tough Fed talk cause hard landing concerns to resurface

Global Developments

BoJ rate decision and US Retail sales were the two major highlights of the week gone by.

There was much anticipation around what the BoJ would do after it had said it would assess the side effects of its ultra loose monetary policy. BoJ however refrained from raising the cap further on the 10y yield and kept it at 0.5%. It chose not to abandon YCC (yield curve control) and continued to maintain its policy rate in negative territory at -0.1%. Considering that interest expense is the second biggest expense for the Japanese Government and that the Japanese Government debt is widely held by a lot of Domestic pension funds and insurance companies, the BoJ would have been apprehensive about shocking the market. A sudden big up move in yields could have made pension funds and insurance companies vulnerable and stoked systemic concerns. We had witnessed a similar episode in UK not too long ago. Also, it was the weak Yen which was bothering the BoJ as it was fueling inflationary pressures. The fact that they have managed to bring the Yen under control by lifting the 10y yield cap to 0.5% (after several attempts through verbal intervention and FX intervention had had little impact), meant that there was no immediate need to take any drastic measures.

US December Retail sales were disappointing. Retail sales ex auto (-1.1% MoM against expected -0.5% MoM) saw the biggest fall since Feb'21.

The dilemma for the Fed however is that labor market is still strong (as was highlighted again this week by jobless claims which came in below the 200k mark) and that could keep core inflation elevated. Fed can therefore not be seen as lowering it's guard in the fight against inflation. All Fed members who spoke this week were hawkish and of the view that Fed needed to do more. Weak retail sales coupled with still hawkish comments from Fed members caused concerns around hard landing to resurface. Market is expecting a 25bps hike in the Feb policy and terminal Fed funds rate to be around 4.90% (4.75-5% Fed funds rate range)

Another development this week was the US debt ceiling getting hit. While the government would be able to keep going till June without defaulting, the Congress would eventually need to raise the ceiling. This could be tricky as Republicans are in control of the House and they are demanding commitments to cut spending in lieu of raising the ceiling. Democrats on the other hand want the ceiling to be raised unconditionally. Government would be compelled to cut or defer expenses and that would weigh on growth and risk sentiment.

Price action across assets

US yields fell by about 5bps across the curve this week. They were however a lot lower at one point. 2y saw a low of 4.03% but ended at 4.17%. 10y has fallen to 3.32% but ended the week at 3.48%

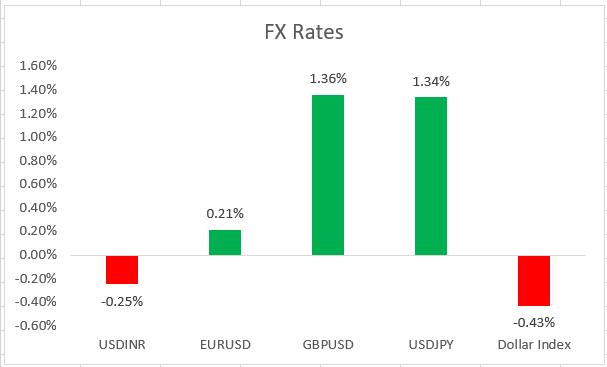

Dollar weakened against most major currencies. Sterling (+1.4%) was the best performing G10 currency while JPY (-0.1%) was the worst performer

Among Asian currencies, MYR (+1.2%) and CNH (-1.2%) were the best and worst performers respectively.

S&P500 ended 0.7% lower while Nasdaq ended the week 0.6% higher.

Brent ended the week 2.6% higher at USD 87.6 per barrel on optimism around rebound in Chinese demand. Gold ended the week 0.3% higher at USD 1926 per ounce. Copper prices rose by another 1.4% this week and are up 32% from July lows.

Domestic Developments

FX Reserves rose USD 10.4bn in the week ended 13th Jan to USD 572bn, highest since August'22. Our estimate of the revaluation impact is close to USD 6bn (As other currencies and Gold had strengthened against the Dollar that week)

Equities

Nifty traded a 17850-18183 range this week and ultimately ended 0.4% higher at 18027. 17800 is a crucial support for the Nifty. FPIs have sold net USD 1.8bn of domestic equities so far in January. Midcap and Smallcap stocks underperformed. IT stocks bounced back strongly this week. We expect the next week to be range bound as well heading into the budget.

Bonds and Rates

Yield on the benchmark 10y rose 4bps this week to end at 7.34%. 1y OIS ended 5bps higher at 6.65%. Maiden sovereign green bond auction for Rs 8000crs is on 25th Jan. Response to that and the premium it gets issued at over other Gsecs of similar maturity will be interesting to see. We otherwise expect the bonds and rates to be steady in the coming week as we head into the budget.

USD/INR

Rupee appreciated 0.3% to end at 81.12 this week. On several instances it seemed 81 would get broken on spot. However there were persistent Dollar bids that kept coming in at every dip.

NDF related selling alongside Adani FPO and sovereign green bond related flows were head going through.

1y forward yield had risen to 2.42% but ended the week at 2.32%. 3m forward yield however ended 15bps higher at 2.57%. Agent banks were heard paying in April.

3m ATMF implied vols continue to remain suppressed at 5%

We expect the Rupee to trade a 80.50-81.40 range next week with strengthening bias.

Key data and Events in the coming week

US Q4 GDP advance estimate and December Durable goods, New Home Sales data on Thursday.

Expected Ranges and Bias

EUR/USD 1.0810-1.0930 with up side bias

GBP/USD 1.2280-1.2480 with up side bias

USD/JPY 127.50-130.50 with Sideways price action

USD/INR 80.50-81.40 with down side bias