Weekly Report (21st October, 2023) : Israel-Hamas war, 'higher for longer' Fed narrative keep risk sentiment subdued.

21 October 2023 | By IFA Global | Category - Market

Global Developments

Uncertainty around how the Israel-Hamas war would unfold continues. There hasn't been any major de-escalation despite president Biden's visit to Israel this week. There have been widespread protests in the Arab world on concerns around civilian casualties and a deepening humanitarian crisis as Israel prepares for ground invasion to obliterate Hamas from Gaza. Risk aversion continues as a result and is reflected across asset classes. Brent ended at USD 92 per barrel and Gold has risen to USD 1994 per ounce. It had even topped the USD 2000 per ounce mark intraday for the first time

since early August. S&P500 and Nasdaq ended 2.7% and 3.5% lower this week.

Bond markets however are behaving differently than how one would expect in a typical risk off scenario. Concerns over inflation spiking again due to higher energy prices and a narrative of higher for longer from central banks seems to be outweighing safe haven demand. US 10y bond yield has risen to almost 5%, its highest level since 2007. Fed Chair Powell in his speech this week said that records suggest a period of below trend growth and softening of labor market conditions is needed for inflation to reach 2% target. He added that any evidence of persistently above trend growth or of tightness in labor market not easing could put further progress on inflation at risk and could warrant further tightening of monetary policy. Market is expecting the Fed to stay on hold in the upcoming policy. It has in fact trimmed its expectations of a rate hike in the December policy as well.

China sold most US securities in 4 years in August, likely to generate Dollars to intervene if needed in order to defend a weakening Yuan. China has reduced its holdings of US treasuries to USD 805bn, the lowest level since 2009.

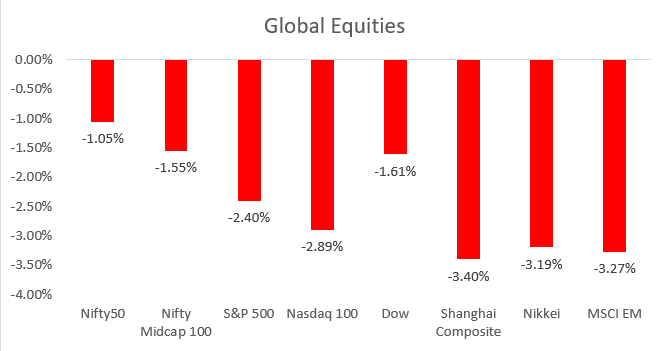

Equities

Nifty ended 1% lower this week at 19542. Broader markets too saw some profit booking with Midcap index ending 1.5% lower. Nifty trailing 12 months P/E stands at 21.7. Stronger than expected Q2 earnings of a few companies have helped limit losses in an overall risk off environment. FPIs have sold close to USD 1.5bn in domestic equities so far in October.

IFA Global Quant based investment model is indicating a moderately bullish bias towards equities. Compared to its benchmark having 60-30-10 composition of equities(domestic plus usa), debt and gold, the model is indicating being overweight equities with a portfolio weight of 70%. (Based on the model's quant variables, equity allocation would vary between 40% and 90%.)

Bonds and Rates

Yield on the benchmark 10y has risen to 7.36% again on higher crude prices and higher US treasury yields. Liquidity in the banking system is almost neutral. Overnight rates have been fixing above MSF. 1y and 5y OIS ended at 7% and 6.77% respectively. We believe current levels are attractive to add duration to the portfolio. 1y t-bill is yielding around 7.13% and 1y CDs around 7.65%. Minutes of the October RBI policy suggested MPC was concerned about inflationary pressures stemming from elevated fuel and food prices.

USD/INR

Rupee continues to trade in extremely narrow ranges. It strengthened a bit on likely Nationalized bank offers to end the week at 83.12 onshore. However it weakened in offshore to an implied spot level of 83.24. 3m ATMF implied vols at 3.28% are extremely compressed on low realized vols.

We expect the Rupee to continue trading in the 82.90-83.50 range in the coming week. Exporters are advised to add RRs to their hedge portfolios to benefit in case Rupee depreciates. Carry enhancing structures involving barriers can also be considered. Importers are advised to buy some OTM calls to hedge medium term exposures considering how low vols are currently and given the lurking geopolitical risks.

Forwards, especially near term came under pressure this week on account of maturity of buy leg of Sell-Buy swaps done by RBI last year. Cash spot at one point had traded at par. 1y forward yield ended at 1.69%.

IFA Global hedging barometer unchanged at 123 is indicating a moderately bearish outlook on Rupee over the medium term (Range 36-180 with 36 indicating extreme bullishness)

Key Data and Events to track next week

UK September jobs report on Tuesday

German IFO business sentiment on Wednesday

ECB monetary policy and US Q3 GDP preliminary estimate on Thursday

US September PCE on Friday

Expected Ranges and Bias

EUR/USD 1.0510-1.0640 with downside bias

GBP/USD 1.2110-1.2310 with down side bias

USD/JPY 148.50-150.50 with sideways price action

USD/INR 82.90-83.50 with sideways price action.