Weekly Report (19th March, 2023): Markets fear 'higher for longer' could result in more accidents

19 March 2023 | By IFA Global | Category - Market

Nightmare week for a Rates trader as US Rates volatility rose to highest since 2008

Global Developments

It was a week of intense drama and volatility in terms of news flow and market reaction. US CPI and Retail sales which would otherwise have been the most important data points that the markets would have looked forward to, were overshadowed by newsflow around the banking crisis in US and Europe.

The Fed, US treasury and FDIC rushed to put in place measures to prevent a systemic fallout from the SVB and First Republic Bank crisis. President Biden in his address to the nation said the US banking system was absolutely safe and that all SVB depositors would have access to entire funds as early as Monday itself. The Fed put in place a Liquidity backdrop i.e. the Bank Term Funding Program (BTFP) under which banks can borrow from the Fed against US treasuries. This would take care of the liquidity woes in case of deposit flight and the bank would not have to resort to a distress sale of securities. This would ensure that the kind of crisis that happened at SVB is not repeated. In order to reinstate confidence among small depositors, big US banks would place deposits in First Republic Bank.

We also had a scare in Europe with fears of Credit Suisse going under. However with the Swiss National Bank (SNB) extending a CHF 50bn lifeline, failure of Credit Suisse seems to have been averted as of now.

Given the systemic stability concerns, there was anticipation that the Fed and the ECB would slow down the pace of tightening. The ECB however hiked by 50bps, saying there was no trade off between systemic stability concerns and price stability and that inflation was still extremely elevated. If the Fed follows a similar playbook, it would hike by 25bps as well in its policy on 22nd March. It seems therefore that central banks would continue to pursue their inflation mandates and if something breaks in the process, they would invoke their 'lender of last resort' function and throw liquidity lifelines.

Despite all the resolution measures, the banking crisis in US and Europe seems to have left behind a sour taste and a feeling among market participants that 'higher for longer' is not sustainable. This is reflected in the unprecedented moves we saw in US rates market.

Price action across asset classes

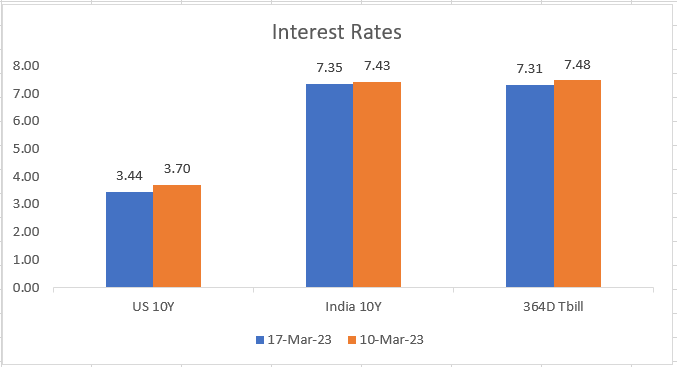

There was absolute pandemonium in US rates. Yield on the 2y treasury ended 75bps lower on the week at 3.83% and 10y ended 27bps lower at 3.43%. Markets are pricing in only a 60% chance of a 25bps hike in the March policy and is expecting a terminal rate of just 4.80% compared to 5.60% before the SVB crisis. In fact, markets are pricing in 100bps of cuts by Jan'24!

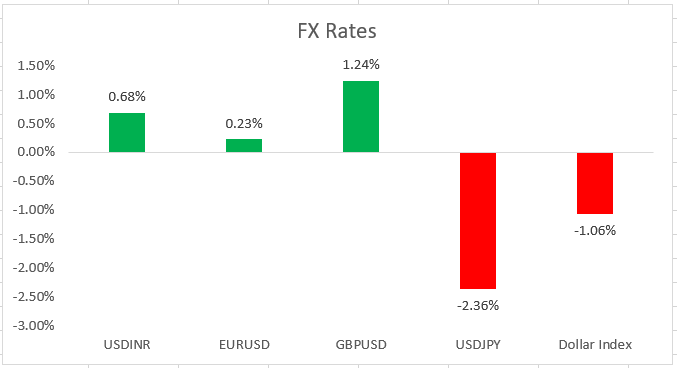

Dollar weakened against all G10 currencies this week except the CHF and NOK which underperformed due to developments around Credit Suisse. Yen was the best performer (+2.4%) followed by the NZD (+2.3%). Dollar weakened against All Asian currencies expect the Rupee. Thai Baht (+2.5%) was the best performer followed by KRW (1.7%)

Brent tumbled 12% to USD 73 per barrel, its lowest level since Dec'21. Gold rose 6.5% on safe haven demand and drop in US yields. Copper dropped by 3.3%

Nasdaq outperformed in a drop in US yields, gaining 4.4% this week while S&P500 gained 1.4%. It was up almost 3% from lows hit on Monday.

Domestic Developments

Domestic Feb goods trade deficit came in lower for the second successive month at USD 17.4bn. Service exports too were robust at USD 14.6bn. With these prints, there is a possibility we may have a current account surplus in the current quarter.

FX Reserves dipped USD 2.4bn to USD 560bn as on week ended 10th March

Equities

Despite a bounce back on Friday, Nifty ended the week 1.8% lower at 17100. Banks, Auto and IT stocks underperformed. Midcaps and Smallcaps underperformed the benchmark. We expect a 16800-17300 range for the Nifty over the next few sessions.

Bonds and Rates

Yield on the benchmark 10y ended 8bps lower at 7.34%. 1y OIS ended 24bps lower at 6.78%, tracking the move in US rates. Overnight Call fixings inched higher on liquidity tightness post the advance tax outflow. We expect the 10y benchmark to trade a 7.25-7.40% range over the next few sessions.

USD/INR

Rupee was the worst performing Asian currency this week depreciating 0.6% (50p) against the Dollar to 82.55. Mid month defence related outflows, equity related outflows and a M&A related outflows kept the Rupee under pressure. Lower crude prices also seemed to have triggered greater demand from oil importers.

RBI however likely intervened in offshore and onshore around 82.80 to contain Rupee weakness.

We expect the Rupee to trade a 81.90-82.90 range in the coming week.

1y forward yield rose 16bps to 2.42%. 3m ATMF implied vols ended at 5.17%

IFA Global hedging barometer at 108 is indicating a neutral outlook on the Rupee in the medium term.

Key data and Events in coming week

Fed rate decision on Wednesday

Protests in France over retirement age

Poland deciding to supplies fighter jets to Ukraine has brought about yet another twist in Russia-Ukraine war. Developments on that front need to be tracked.

Germany March ZEW on Tuesday.

Expected Ranges and Bias

USD/INR: 81.90-82.90 with down side bias

EUR/USD: 1.0520-1.0720 with up side bias

GBP/USD: 1.2050-1.23 with up side bias

USD/JPY: 130-133.50 with down side bias