Weekly Report (19th February, 2023): Markets re-price Fed terminal rate higher on surprisingly strong US data

19 February 2023 | By IFA Global | Category - Market

If one thought the US January NFP print was a one off, data which has followed has dispelled all doubts. January core CPI momentum was higher than expected. January Retail sales beat expectations, indicating that consumption is still healthy. Prices at the producers' level too rose by more than expected.

With such data, it was not surprising that Fed members were hawkish and said the Fed needed to do more. While prior to the NFP, there were talks about the Fed pausing or even pivoting, now there is an outside possibility of even an upshift to a 50bps hike.

Market is now pricing in a terminal Fed's fund rate of 5.28% (up from 5.18% last week) and expects the Fed to get there by July. A 25bps hike in March and May are completely priced in.

The US labor market is simply too tight and core services inflation momentum is just too strong for the Fed to let down it's guard.

Price action across assets

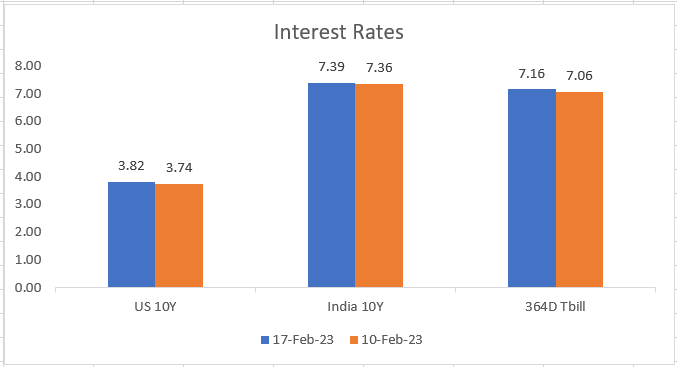

US 2y yield rose 10bps to 4.61% and 10y yield rose 8bps to 3.81%

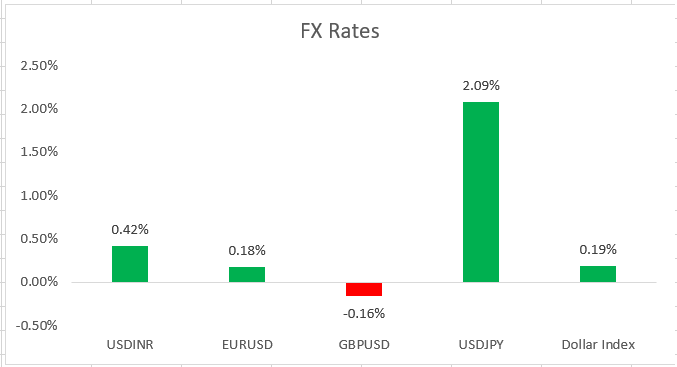

Dollar strengthened against most G10 currencies (except EUR, DKK and SEK). Commodity currencies underperformed. Dollar strengthened against all Asian currencies with KRW (-2.7%) and THB (-2.3%) being the worst performers.

Equities though were quite resilient despite terminal rate expectations being repriced higher. S&P500 ended 0.3% lower while Nasdaq in fact ended 0.6% higher. European equities too did well with STOXX600 rising 1.4%.

Brent ended the week at USD 83 per barrel compared to USD 86.3 per barrel last week. Gold declined 1.25% to USD 1842 per ounce. Copper gained 2.3% this week.

Domestic Developments

Domestic January trade deficit surprised on the downside, coming in at only USD 17.75bn against expectations of USD 23bn. There has been a drop in imports across gold, oil and non-oil non-gold categories. If this trend continues, it would imply a meaningfully lower CAD in FY'24 and could result in BoP being positive. However we will have to wait and see if this print was just an aberration.

FX Reserves dipped USD 8.3bn to USD 566.9bn as on week ended 10th Feb

Equities

Nifty ended the week 0.5% higher at 17944. It gave up some gains towards the end of week and could not manage to close above 18000 mark. Midcaps and Smallcaps underperformed this week. Though Adani group stocks fell this week, the panic seems to have subsided. It does not seem it poses wider systemic concerns. We expect the Nifty to trade a 17700-18200 range in the coming week with a slight up side bias.

Bonds and Rates

Yield on the benchmark 10y ended 1bp higher at 7.37%. The benchmark 10y got devolved on PDs in the Friday's auction which resulted in a sell off post the auction result. The yield curve is now the flattest since 2017 with difference between 10y and 1y yield a mere 21bps. 1y OIS rose 14bps to 6.97% this week. We continue to believe it's a good time to keep adding duration in a calibrated manner to the portfolio.

FX Strategy

Rupee was the best performing Asian currency this week as one would expect during phases of Dollar strength. Rupee weakened 0.4% to end the week at 82.83. RBI likely intervened in both onshore as well as offshore to defend the 82.90 mark.

We expect the RBI to continue offering Dollars to temper Rupee depreciation if broad Dollar strength continues.

3m ATMF implied vols ended at 5.17% while 1y forward yield ended 10bps lower at 2.05%.

We expect the Rupee to trade a 82.40-83.40 range next week with a slight depreciation bias.

Key Data/Events next week

US, Eurozone, UK PMIs on Tuesday

Fed meeting minutes late Wednesday evening.

US Q4 GDP second estimate on Thursday

US Jan personal income and spending on Friday

Expected Ranges and Bias

USD/INR: 82.40-83.40 with slight up side bias

EUR/USD: 1.0650-1.08 with sideways price action

GBP/USD: 1.1920-1.2150 with sideways price action

USD/JPY: 133.40-135 with up side bias