Weekly Report (18th November, 2023) : Lower US CPI print triggers risk rally

18 November 2023 | By IFA Global | Category - Market

- US treasuries rally

- Tech stocks outperform

- Dollar weakens across the board

- Crude drops on China concerns but recovers on OPEC+ supply cut fears

Global Developments

Key data that moved asset classes this week was the US October CPI print which came in below expectations. US Oct PPI too came in lower than expected. Progress on the inflation front has caused markets to revise lower its expectations of Fed's rate trajectory despite Fed chair Powell's recent hawkish comments. US Retail sales were slightly better than expected while jobless claims were a tad higher than expected.

As of now, growth is holding up and labor market is resilient while inflation is coming off, which bodes well for risk assets.

Market is now pricing in a 100% chance of Fed maintaining status quo in December (which was 90% last week with 10% chance of 25bps hike). Market is now pricing in a 48% chance of a 25bps cut in May, up from 30% a week ago.

Price action across assets

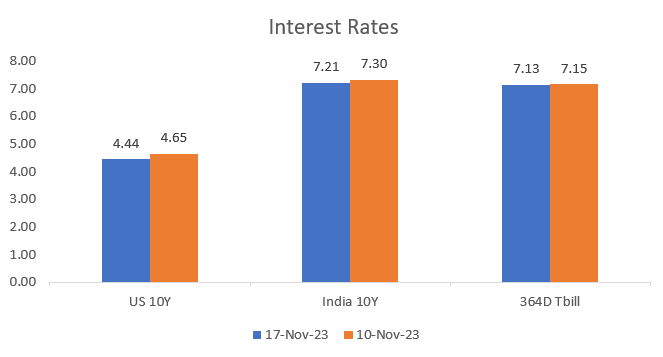

US 2y yield ended the week 13bps lower at 4.89% while 10y yield ended 20bps lower at 4.43%

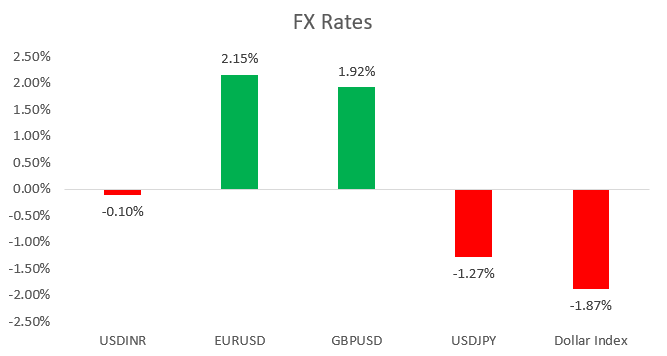

Dollar weakened across the board this week.

EUR: Euro strengthened 2% this week on lower than expected US CPI print.

GBP: Sterling too strengthened 2.5% this week, tracking broad Dollar weakness. UK CPI too came in lower than expected at 4.6% yoy (exp 4.8%)

JPY: Yen appreciated to 149.63 against the Dollar after almost testing 152 earlier in the week. Weak growth data from Japan has caused the yield on 10y JGBs to drop to 0.74% from 0.85% last week. However, US yields have fallen more and that caused the Yen to appreciate.

Brent had dropped to USD 77 per barrel on China growth concerns but recovered to end at USD 80.5 per barrel on reports that OPEC+ may cut production further to provide additional support to the market. Gold inched higher to USD 1980 per ounce from USD 1940 levels last week.

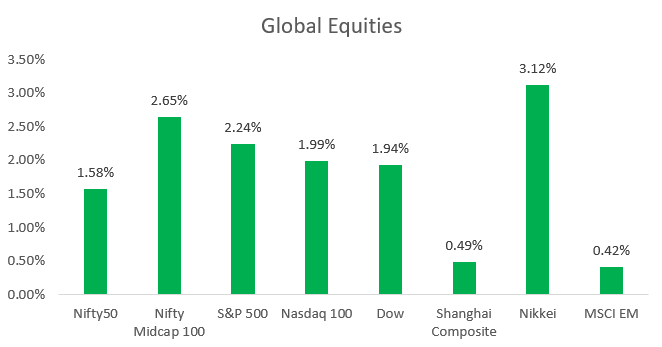

US equities did well this week with S&P500 and Nasdaq both ending 2.3% higher.

Domestic Developments

RBI increased the risk weight for unsecured loans extended by banks and NBFCs and also on commercial bank lending to NBFCs (excluding loans to HFCs and those classified as priority sector) by 25 percentage points. This is a prudent step intended to slowdown the pace of unsecured lending in the economy.

October trade deficit surprised on the up side, coming in at USD 31.4bn on a sharp rise in gold and silver imports ahead of festive season.

Equities

Nifty ended the week 1.6% higher at 19731. Bank Nifty however underperformed as RBI increased risk weights for unsecured loans, which would increase the cost of capital for banks. IT stocks outperformed on announcement of buyback by TCS and also as US tech stocks outperformed on a drop in long term yields. Nifty IT index rose 5% this week. Broader markets outperformed with Midcap index gaining 2.7% this week. Net FPI flows have turned positive for November (+USD 172mn). Nifty TTM P/E Ratio stands at 21.1. We prefer trading equities from the long side as long as support at 18900 holds on the Nifty.

IFA Global Quant based investment model is indicating a moderately bullish bias towards equities. Compared to its benchmark having 60-30-10 composition of equities(domestic plus usa), debt and gold, the model is indicating being overweight equities with a portfolio weight of 70%. (Based on the model's quant variables, equity allocation would vary between 40% and 90%.)

Bonds and Rates

Yield on the benchmark 10y ended 8bps lower at 7.22% this week on lower crude prices and lower US treasury yields. 1y and 5y OIS ended at 6.84% and 6.45% respectively. Spreads on NBFC papers inched higher as RBI increased risk weights for Bank lending to NBFCs. FPIs have invested net USD 1.4bn in domestic bonds in November so far.

We believe any uptick in 10y yield to 7.30-7.35% is an opportunity to add duration to portfolio.

USD/INR

Rupee continues to remain extremely range bound, ending the week at 83.27.

Cross/INR has seen a massive upmove as crosses strengthened against the Dollar but Rupee remain flat against the Dollar this week

1y forward yield ended at 1.59% while 3m ATMF implied vols sank further to 3.05%

We expect the Rupee to underperform amid broad Dollar weakness as RBI would look to recoup Reserves and correct Rupee overvaluation. We expect a 83.00-83.50 range for the Rupee in the coming week.

IFA Global hedging barometer lower at 108 is indicating a neutral outlook on Rupee over the medium term of 3-6 months (Range 36-180 with 36 indicating extreme bullishness)

Key Data and Events to track in coming week

Tuesday: FOMC meeting minutes

Wednesday: US Durable goods

Thursday: Europe and UK Nov PMIs and Japan Oct CPI

Friday: US November PMI

Expected Ranges and Bias

EUR/USD 1.0800-1.1050 with up side bias

GBP/USD: 1.2350-1.2550 with up side bias

USD/JPY: 147-150 with downside bias

USD/INR: 83.00-83.50 with sideways price action