Weekly Report (16th April, 2023): Global Risk sentiment stable as US inflation cools off, Retail sales hold up

16 April 2023 | By IFA Global | Category - Market

Global Developments

Global Risk sentiment was mostly stable this week. One widely tracked data point post the US banking crisis has been the utilization of credit lines with the Fed to avail liquidity. Utilization under Fed's discount window and Bank Term Funding Program (BTFP) by banks both declined for the week ended Wednesday. Foreign Repo utilization too saw a decline. These are encouraging signs.

Two major data points this week were the US March CPI and Retail sales. While the headline CPI print came in a tad lower than expected at 0.1% MoM (5% YoY), core CPI came in line with expectations and continued to remain elevated at 0.4% MoM (5.6% yoy). Super Core inflation however which is services inflation excluding shelter, healthcare and transportation was the lowest since H1'22. There are therefore signs of services inflation cooling off and this is encouraging. US March PPI print too came in much below expectations.

Headline Retail sales fell by a larger than expected 1% MoM in March (exp 0.5% MoM decline). A detailed break up seems to suggest consumers are holding back on discretionary spending. Core retail sales i.e. ex auto and gas however fell by less than estimated in March.

FOMC minutes indicated that several members had considered a pause in the March meeting given the turmoil in banking sector but eventually decided to go ahead with a 25bps hike considering how elevated inflation was.

Despite the lower inflation prints and weak Retail sales, markets are pricing in a 80% chance of a 25bps hike in the May policy. This is up from 70% last week.

Price action across assets

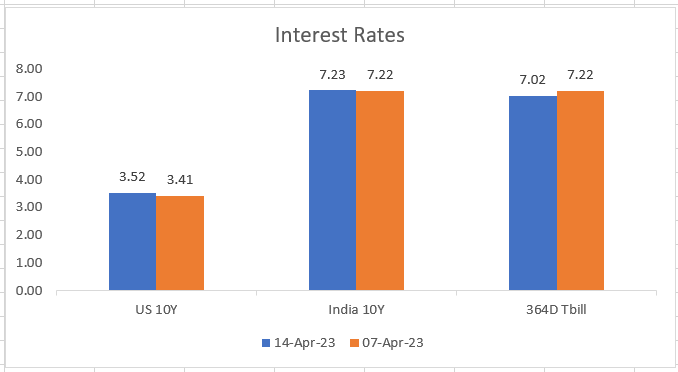

US 2y and 10y yield rose 12bps on the week to 4.10% and 3.51% respectively.

Dollar weakened across the board through most part of the week but recovered on Friday as core retail sales fell by less than expected.

Among G10 currencies SEK (+1.4%) was the best performer and Yen (-1.2%) the worst performer against the Dollar this week. Among Asian currencies, IDR( +1.5%) and PHP (-1.4%) were the best and worst performers respectively against the Dollar.

Brent rose 1.4% this week to USD 86.3 per barrel. Gold managed to end the week above the USD 2000 per ounce mark.

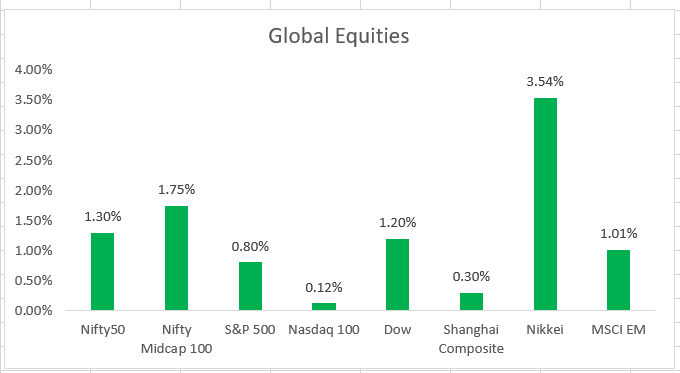

S&P500 and Nasdaq ended the week 0.8% and 0.2% higher respectively. Nikkei was the best performing major index, gaining 3.7%. European STOXX600 ended 1.7% higher on the week. Copper prices ended the week flat at USD 411 per Pound.

Domestic Developments

March trade deficit at USD 19.7bn came in higher than in Jan and Feb. Net Service sector exports too cooled off a bit, coming in at USD 13.7bn. IIP rose at a healthy 5.6% yoy in February.

RBI's FX Reserves rose USD 6.3bn to USD 584.7bn as on week ended 7th April.

Equities

Nifty has gained for 9 straight sessions now. It ended the holiday shortened week 1.3% higher. Broader indices too did well with Midcap and Smallcap indices gaining 1.8% and 1.5% respectively. Banks, Metals, energy and Autos did well while IT index was the laggard given bleak outlook for FY'24. FPIs have invested net USD 1bn in domestic equities in April so far. Gross inflows through the SIP route in March breached the Rs 14000crs mark.

Bonds and Rates

Yield on the benchmark 10y ended 1bp higher at 7.21%. Cutoff on the 1y T-bill came in at 7.02% against 7.22% last week, as a result of RBI keeping rates on hold. 1y and 5y OIS ended 1bps and 4bps higher respectively at 6.60% and 6.14%. Banking system liquidity has been comfortable with overnight call rates fixing below the repo rate. Surplus Liquidity in banking system is around Rs 2,50,000crs.

USD/INR

Rupee was mostly range bound through the week in 81.76-82.15. It ended the week almost flat at 81.85. It had strengthened to 81.55 in offshore but gave up gains as Dollar recovered after Retail sales, heading into weekend.

1y forward yield ended 14bps lower at 2.30%. 3m ATMF implied vols fell another 20bps to 4.62%, lowest levels since Feb'22

We expect the Rupee to trade a 81.50-82.40 range in the coming week with sideways price action.

IFA Global Hedging barometer at 102 is indicating a moderately bullish outlook on the Rupee in the medium term.

Key data/events to track in the coming week

US March Housing Starts on Tuesday, US March existing home sales on Thursday, US Apr S&P Global PMI on Friday

Eurozone Mar Final CPI print on Wednesday, Apr S&P Global PMIs on Friday.

UK March CPI on Wednesday and Retail sales on Friday.

Expected Ranges and Bias

EUR/USD: 1.0850-1.1050 with downside bias

GBP/USD: 1.2290-1.2540 with downside bias

USD/JPY: 132.90-134.90 with sideways price action

USD/INR: 81.50-82.40 with sideways price action