Weekly Report (15th July, 2023) : Lower US inflation sends risk assets soaring

15 July 2023 | Category - Market

Global Developments

The highlight of the week was the lower than expected US June CPI print and PPI print. Inflation is gradually cooling off, labor market continues to demonstrate resilience and growth is still holding up. This is a perfect goldilocks set up for the markets

Nevertheless, the Fed is likely to go ahead with a 25bps hike in July. The market is pricing in a 93% chance of a 25bps hike. However the market implied probability of a hike in September has come off from 24% to 11%. The July hike could well be the last hike by the Fed in current hike cycle and the markets are drawing a lot of comfort from this.

Elsewhere, UK May GDP data was better then expected. China trade data indicated that exports and Imports dropped by more than expected in June, indicating the challenging growth environment in China

Price action across assets

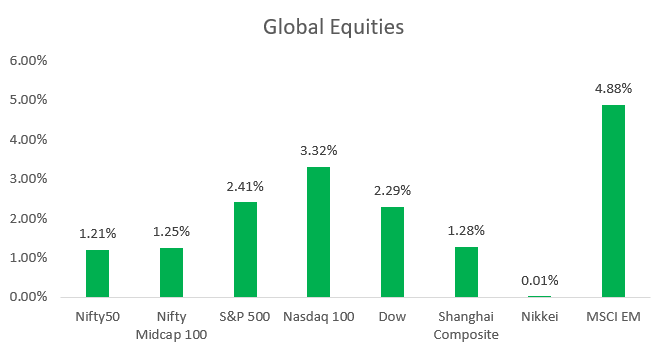

Risk assets had an excellent run this week as investors drew comfort from the lower US CPI print

US treasuries rallied with 2y yield dropping to 4.67% from close to 5% and 10y yield dropping to 3.79% from around 4% last week

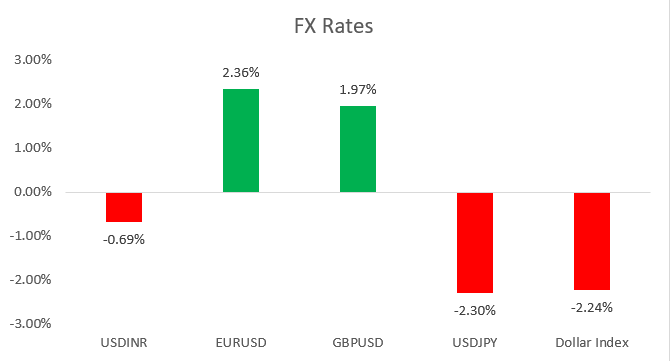

Dollar got hammered against majors as well as EM currencies. Dollar weakened against all G10 currencies with Scandies i.e. NOK (+6.2%) and SEK (+5.7%) being the best performers. EUR and GBP strengthened 2.4% and 2.2% respectively to their highest levels in last 15 months against the Dollar. Asian and EM currencies strengthened between 1% to 4% against the Dollar this week with ZAR (+4.2%) and KRW (+3%) being the top performers

Brent rose 3% this week to USD 81 per barrel as US energy secretary highlighted commitment to replenishing the Strategic Petroleum Reserves (SPRs) which were drawn down to soften the impact of crude spike as a result of Russia-Ukraine war. The Reserves currently are at a four decade low. Gold climbed 1.8% this week to USD 1960 per ounce on a dip in US treasury yields and a softer Dollar. Copper prices rose 4.2% to USD 392 per Pound amid positive risk backdrop

Equities had a tremendous week with S&P500 and Nasdaq rising 2.7% and 3.8% respectively. DAX and FTSE rose 3.4% and 3% respectively. MSCI EM index rose 4%

Domestic Developments

June CPI print came in higher than expected at 4.81% on account of higher food prices. Going forward, risk remains to the up side owing to uneven distribution of monsoon and heavy rains in the northern states

IIP rose at a healthy 5.2% yoy in May compared to 4.5% YoY in April

Trade deficit contracted to USD 20.1bn in June from a five month high of USD 22.1bn in May. Services surplus declined marginally to USD 11.2bn in June from USD 11.8bn in May on a larger than expected uptick in Services Imports

Equities

Nifty rose 0.8% this week to 19565, a new all time weekly closing high. Earnings season got off to a good start with TCS delivering better than expected performance in Q1 on all fronts. IT Index was the best performer this week, gaining 4.7%. We expect the bullish momentum to continue with 18900 likely to remain the floor over the medium term. We may well be on our way to the 20000 mark as long as 18900 holds

IFA Global Quant based investment model is indicating a moderately bullish bias towards equities. Compared to its benchmark having 60-30-10 composition of equities(domestic plus usa), debt and gold, the model is indicating being overweight equities with a portfolio weight of 70%. (Based on the model's quant variables, equity allocation would vary between 40% and 90%.)

Bonds and Rates

Rally in US treasuries offset the impact of higher than expected domestic CPI print. Yield on the 10y benchmark ended at 7.09%. The Gsec auction went through smoothly on Friday. Liquidity situation is comfortable with banks placing close to Rs 60000crs in 14 day VRRR with RBI. 1y and 5y OIS ended the week at 6.77% and 6.28% respectively.

USD/INR

Rupee strengthened 0.7% this week to 82.17. Rupee however expectedly underperformed Asian and EM peers amid a weak Dollar environment. This has resulted in a phenomenal rally in Cross/INR with GBP/INR breaching 107 and EUR/INR breaching 92

We expect overall USD weakness to continue in the coming week and expect the Rupee to continue to underperform as RBI looks to accumulate reserves.

We expect the Rupee to trade in a 81.60-82.35 range in coming week with appreciation bias.

One needs to keep a close eye on crude prices. After the recent uptick, Russian Urals crude is now above the price cap of USD 60 per barrel set by Western nations. If India is forced to comply, it would mean trimming procurement of discounted crude from Russia. This would increase the cost of our crude basket and alter the current favorable CAD and BoP dynamics for the worse.

IFA Global hedging barometer unchanged at 94 continues to indicate a moderately bullish bias for Rupee over the medium term. (Range 36-180 with 36 indicating extreme bullishness)

Key Data/Events to track in coming week

China June IIP, fixed asset investment and Retail sales for June on Monday

US June Retail sales on Tuesday

UK June CPI print on Wednesday

UK June retail sales on Friday

Expected Ranges and Bias

EUR/USD: 1.1180-1.1320 with up side bias

GBP/USD: 1.2960-1.3240 with up side bias

USD/JPY: 137.50-140 with downside bias