Weekly Report (15th January, 2023): Risk Sentiment buoyant as Inflation seen cooling off

15 January 2023 | By IFA Global | Category - Market

Global Developments

The big data this week was the US December inflation data. Both headline and core CPI came in line with expectations at 6.5% (-0.1% MoM) and 5.7% (0.3% yoy) respectively. The cool off was mainly on account of a drop in energy prices.

Market is now expecting a 25bps hike at the February Fed meeting to be the most likely outcome. This would imply a further downshift from the 50bps December hike. Market is also ascribing some probability to the Fed not hiking at the March meeting at all. Market's expectation of the terminal Fed funds rate continues to hover around 4.90%

University of Michigan preliminary consumer sentiment for January came in better than expected at 64.6 (exp 60.7). 1 year inflation expectation came in at 4% against expected 4.3% and prior 4.4%.

Price action across assets

US Inflation print coming in line with expectations has buoyed risk sentiment.

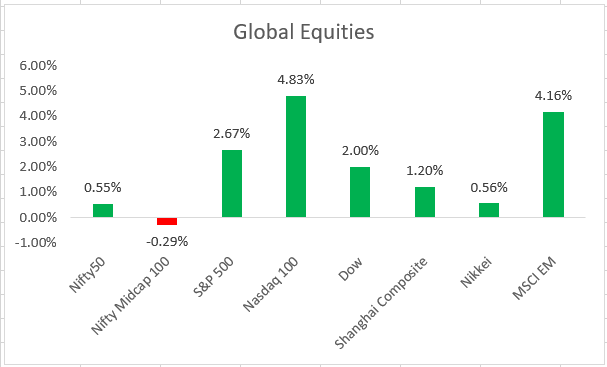

S&P500 and Nasdaq ended 2.7% and 4.8% higher respectively on the week. MSCI EM index rose 4.2% this week.

US 2y yield ended the week almost flat at 4.23% while the 10y yield dropped 6bps to 3.50%. Entire selloff in the 10y triggered by the BoJ yield cap revision has been reversed. German and UK 2y yields ended 1bp and ,5bps higher respectively.

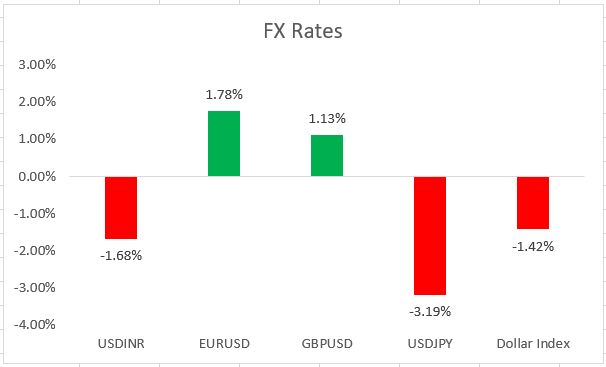

Dollar weakened against all G10 currencies. JPY (+3.3%) was the best performer followed by Euro (+1.8%). BOJ is to review the side effects of its ultra loose monetary policy at its meeting in the coming week. Markets have been emboldened to sell the 10y JGB beyond BoJ's recently revised upper cap of 0.50% in anticipation of further upward revision. Among Asian currencies, Thai Baht (+3.25%) was the best performer followed by the Indonesian Rupiah (+3.20%)

Brent rose 8.5% this week to end at USD 85.3 per barrel. Gold rose 3% to scale the USD 1900 mark again on expectations of lower US rates after the CPI print met expectations. Copper rose 7.8% this week to the highest since June'22.

Domestic Developments

Domestic CPI print came in below expectations at 5.72%. This is the second consecutive print below the RBI's tolerance cap of 6%. IIP too beat estimates and came in at 7.1% yoy (exp 2.8%) on a much stronger than expected manufacturing output.

FX Reserves dropped USD 1.2bn to USD 561.6bn as on week ended 6th January.

Equities

Nifty gained 0.5% this week to end at 17956. Midcaps and Smallcap indices underperformed. IT stocks rallied as results were mostly in line or marginally beat estimates despite a challenging backdrop. Metal stocks did well as commodities rallied. We expect the Nifty to trade a 17750-18400 range. Break above 18105 could result in momentum shifting to the up side.

Bonds and Rates

1y OIS cooled off 16bps this week to 6.60%. Yield on the benchmark 10y ended 5bps lower at 7.30%. Long tenor Bonds haven't reacted much to better than expected CPI numbers. There is some nervousness around supply ahead of the union budget. Belly of the curve i.e. 3-7yrs has seen a rally of about 15bps this week, resulting in the curve becoming steeper. We expect the 10y yield to trade a 7.25-7.35% range heading into the budget.

USD/INR

Rupee strengthened 1.7% this week against the Dollar to end at 81.34 on broad Dollar weakness.

NDF related selling triggered the move lower in USD/INR which got extended as stops got triggered on break below 82. 1m offshore and onshore are almost trading at par now. As we had highlighted in our note last week, the RBI is likely to tone down its buy side intervention and is likely to let the Rupee adjust and catch up with its peers.

Rupee nevertheless underperformed against KRW, IDR and THB this week.

Forwards got paid this week, as one would expect when spot comes off. 1y forward yield ended 23bps higher at 2.28%. There is speculation that the RBI has paid the curve to roll over it's long side maturities.

3m ATMF implied vols ended 23bps higher at 5.15%

We expect the Rupee to trade with a strengthening bias in the coming week with an expected range of 80.50-81.55

Key Data and Events in the coming week

India December WPI and Trade data on Monday

US December retail sales on Wednesday.

Bank of Japan and UK December CPI on Thursday

Expected Ranges and Bias

USD/INR 80.50-81.55 with down side bias.

EUR/USD 1.07-1.0850 with up side bias.

GBP/USD 1.2150-1.24 with up side bias.

USD/JPY 126.40-128.90 with down side bias.