Weekly Report (14th May, 2023): Concerns around Debt Ceiling and Small banks in US dampen risk sentiment

14 May 2023 | By IFA Global | Category - Market

Global Developments

Fears of debt ceiling not being raised and US government running out of cash by June and defaulting on its debt has dampened risk sentiment. The second meeting between President Biden and House speaker Kevin McCarthy was postponed to early next week from Friday as attempts to strike a deal continue in the background. US T-bill maturing on 30th May is yielding 3.06% while US T-bill maturing 13th June is trading at 5.41%, indicating the strong preference to hold government securities maturing before the likely default date. Cost of insuring against US default as represented by the 1y Credit Default Swap (CDS) spread has risen to a whopping 177bps!

Sentiment was also soured by index of small bank stocks in US plunging another 3.5% this week as PacWest Bancorp said its deposits fell 9.5% last week after reports said it was exploring strategic options. The stocks ended the week 21% lower on the back of a 42% fall in previous week.

Both, April CPI as well as PPI prints showed that inflation in the US was coming off. Weekly Jobless claims too were higher. Markets are pricing in a 13% chance of a 25bps hike by the Fed in June and are pricing in 2.7 cuts of 25bps by end of 2023.

Bank of England hiked rates for the 12th consecutive time by 25bps to a 15y high of 4.50% and indicated that further hikes were likely as inflation continues to remain elevated. Market is now pricing in a terminal rate of close to 5%.

Price action across assets

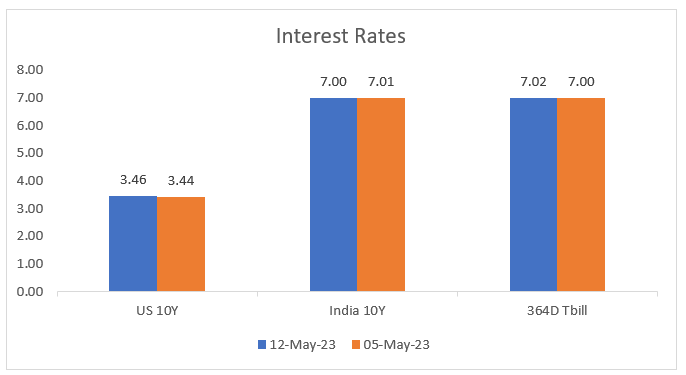

US 2y yield rose 7bps to 3.98% while 10y yield rose 2bps to 3.46%

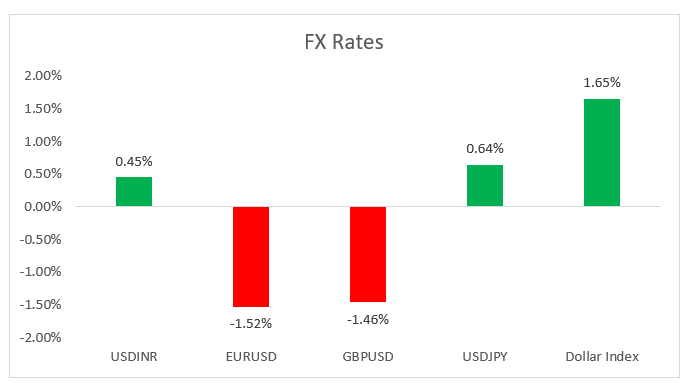

Dollar strengthened against all G10 currencies this week. Safe haves JPY (-0.66%) and CHF (-0.74%) outperformed while SEK (-2%) and NZD (-1.6%) underperformed.

Asian currencies too weakened against the Dollar with the exception of THB (+0.1%). MYR(-1%) and SGD(-0.9%) underperformed.

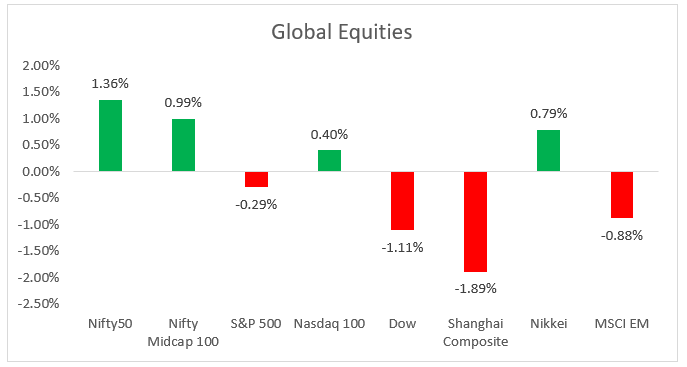

S&P500 ended the week 0.3% lower while Nasdaq ended with a gain of 0.4%. Shanghai composite dropped 1.9%. MSCI EM index fell 0.9% while STOXX 600 ended the week flat.

Brent ended the week 1.5% lower at USD 74.2 per barrel. Gold ended almost flat at USD 2010 per ounce. Copper prices fell 4% on risk aversion and weak global demand outlook.

Domestic Developments

Domestic April CPI print came in at 4.7% yoy against expected 4.76%. Core inflation softened to 5.2% yoy. IIP grew a meagre 1.1% in March, indicating slowing growth. Comfortable inflation coupled with emerging growth concerns mean it is likely the RBI could continue to keep rates on hold in the June policy.

FX Reserves rose USD 7.2bn to USD 596bn, confirming the agressive Dollar buying in spot we have been sensing in 81.60-81.80 zone

Equities

Domestic equities registered a third straight week of gains. The momentum remains strong on FPI flows. FPIs have poured USD 2.8bn into domestic equities in May so far. Nifty ended 1.4% higher at 18314. Borader indices trailed the benchmark. Metals was the worst performing sector while Auto and Bank stocks outperformed. We expect the Nifty to continue to trade with a positive bias. A move towards 18700-18800 is likely as long as 18050 holds.

Bonds and Rates

Yield on the benchmark 10y ended below the 7% (at 6.995%) mark for the first time since April'22. Yield curve is now absolutely flat with overnight rate at 6.9%, 1y t-bill at 7% and 10y yield also at about 7%. 1y OIS ended flat at 6.60% while 5y OIS ended 5bps higher at 6.02%. We can expect to see a rally on Monday given softer CPI and IIP prints. Overall we expect the 10y yield to trade 6.90-7.10% range with downside bias.

USD/INR

Rupee weakened 0.45% this week from 81.80 to 82.17. Rupee ended at 82.26 implied spot in offshore.

Persistent buying by the central bank caused shorts to stop out above 81.95. Thereafter, global Dollar strength continues to keep the Rupee under pressure. Rupee though expectedly outperformed in a strong Dollar backdrop.

1y forward yield dropped 15bps to 2.11%. We could see further pressure on forwards as the RBI hold seems imminent given the CPI and IIP prints. 3m ATMF implied vols rose 18bps to 4.44% as spot moved out of range.

We expect the Rupee to trade a 81.80-82.60 range in the coming week with sideways price action

Key Data/Events to track next week

US April Retail sales on Tuesday.

US Housing Starts and Building permits on Wednesday.

Eurozone Q1 GDP estimate on Tuesday.

Developments around Debt Ceiling.

Expected Ranges and Bias

EUR/USD 1.0760-1.0930 with sideways price action

GBP/USD: 1.2410-1.2610 with a slight up side bias

USD/JPY: 134.90-137.60 with up side bias

USD/INR: 81.80-82.60 with sideways price action.