Weekly Report (12th February, 2023): Markets align with Fed; Revise terminal rate expectations higher.

12 February 2023 | By IFA Global | Category - Market

Markets fell in line with Fed communication as they revised higher their terminal rate expectations after the stellar January jobs report that came out last Friday.

Before the Jobs data, market was expecting the Fed funds rate to peak out at 4.90% in June'23. After the jobs report came out last Friday, the expectations got revised higher to 5.02%. After hawkish comments from Fed Chair at an event this week referencing the strong jobs report and all other Fed members who spoke as well, the peak rate expectations have got revised higher now to 5.18%.

Another confirmation of the resilience of the US economy came in the form of February preliminary University of Michigan consumer sentiment data which came in higher than expected.

Overall sentiment in markets is that of caution as uncertainty around where the Fed would end the current hike cycle is back.

Geopolitics is also warming up with US-China tensions rising post the balloon incident last week and Russia intensifying it's attacks on key Ukrainian cities. In retaliation to the price caps imposed by the West, Russia decided to cut crude output by 0.5mn barrels per day.

Price action across assets

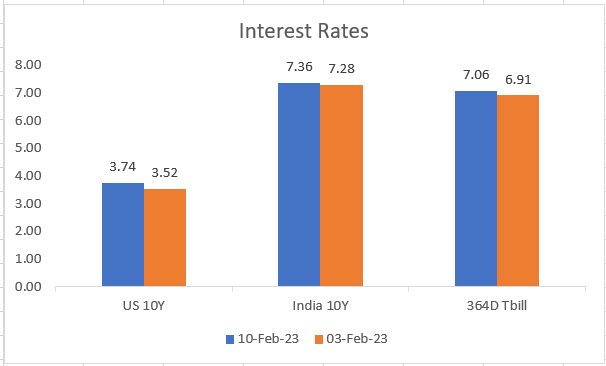

US yields rose 20-23bps across the curve with 2y at 4.52% and 10y at 3.73%. US yield curve as measured by the 2s10s differential, is close to being the most inverted in over 4 decades. Similar moves were seen in German bunds (17-22bps up move across tenors) and UK Gilts (about 35bps higher across tenors)

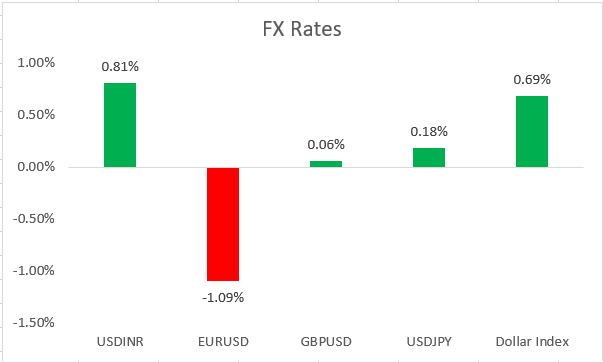

Dollar was mixed against G10 currencies with SEK (+0.7%) being the best performer and Euro and DKK being the worst performers (-1.1%). All Asian currencies weakened against the Dollar with KRW (-2.8%) being the worst performer and Yen (-0.1%) being the best performer on news that BoJ deputy governor seen as being dovish has refused the offer to become governor.

Crude prices rose during the week on decline in US stock piles and on news of Russia deciding to cir production. Brent ended at USD 86.3 per barrel compared to USD 80 per barrel last week. Gold process ended the week flat at USD 1865 per ounce.

US Equities ran into some profit taking with S&P500 and Nasdaq ending 1.1% and 2.4% lower respectively.

Domestic Developments

RBI hiked repo rate by 25bps to 6.50% but refrained from indicating that this was the last hike in this cycle. It refrained from changing the stance as well to neutral from 'withdrawal of accommodation'. Possibility of US Fed continuing to push rates much higher after last week's payroll data may have influenced RBI's tone.

Equities

Sentiment in Domestic equities stabilized somewhat with Adani group stocks recovering. Adani group stocks however gave up some gains after MSCI post a review said some shares of Adani group companies would no longer be considered as free float. This would result in the weightage of Adani stocks being reduced in the MSCI EM index (likely from next month onwards). Nifty ended the week flat at 17856. We expect 17550 to be a crucial support. Break and close above 18100 could result in a short covering spike.

Bonds and Rates

Rates sold off with RBI policy being more hawkish than expected. 1y OIS rose 22bps to 6.84%. The Gsec curve flattened with 1y yield rising to 7.07% and 10y to 7.36%. RBI conducted a 14 day Rs 50000 crs variable rate repo auction to ease liquidity tightness in the banking system. We expect the shorter end of the curve to remain under pressure. We could see the curve flatten out even further.

FX Strategy

Rupee weakened 0.8% to 82.50. It was in the middle of the pack, as far as relative depreciation is concerned.

The central bank was likely offering Dollars around 82.80. Rupee is likely to continue to remain under pressure as crude prices are threatening to move higher and FPIs continue to pull money out of domestic equities.

We expect a 82.20-83.30 range in the coming week with weakening bias.

Forwards dropped as spot moved higher. 1y forward yield ended 14bps lower at 2.15%. 3m ATMF implied vols ended 12bps lower at 5.13% give that after the gap opening on Monday, spot traded in a range through most part of the week.

Key Events/Data in coming week

US Feb CPI on Tuesday, Retail sales on Wednesday, PPI on Thursday.

Domestic Jan CPI on Monday and trade data on Wednesday.

Eurozone Q4 GDP on Tuesday.

UK Jan CPI on Wednesday.

Expected Ranges:

USD/INR: 82.20-83.30 with up side bias

EUR/USD: 1.0550-1.0750 with downside bias.

GBP/USD: 1.1960-1.2250 with downside bias.

USD/JPY: 129.50-132.50 with up side bias.