Weekly Report (12 August, 2023) : Moody's negative outlook on US banks, Higher US yields, weak China data weigh on sentiment

12 August 2023 | By IFA Global | Category - Market

Global Developments

Key data this week was the US CPI data which came in a tad lower than expected. Jobless claims were higher than expected.

Moderating inflation and reducing tightness in labor market would mean that the Fed can afford to be more patient as far as hiking rates further is concerned. While the lower CPI data momentarily triggered Dollar weakness and risk rally, the sentiment turned around quickly as Fed Member Daly sounded hawkish. She said the Fed had more work to do to get inflation to its goal and that it would be premature to say if Fed has done enough on rates. Moody's placing six large US banks on a rating review and downgrading 10 smaller banks hurt sentiment. Tepid response to the 30y bond auction in the US also hurt sentiment and resulted in a sell off in US treasuries. PPI print on Friday were higher than expected.

It appeared this week as though the thought of higher for longer is finally beginning to weigh both on the real economy as well as on market sentiment. Higher US treasury yields increase the opportunity cost of holding riskier assets

China trade and inflation data both pointed to an economy that is reeling under low growth and deflationary pressures. We can expect the PBoC and Chinese government to take further steps to revive growth

UK GDP, industrial production, manufacturing production, business investment and trade data all surprised on the up side on Friday.

Domestic Developments

RBI kept the rates and stance unchanged in its policy on Thursday, along expected lines. RBI acknowledged that the there would be a spike in inflation in short term on higher vegetable prices but said that given the short term nature of such shocks, monetary policy could look through them for some time. RBI raised it's inflation expectation for FY23 to 5.4% from 5.1% while keeping its GDP forecast unchanged at 6.5%

In order to deal with the increase in banking system liquidity on account of demonetization of Rs 2000 notes, the RBI imposed an incremental CRR (ICRR) of 10% on rise in banks' NDTL between 19th May and 28th July. This move will suck out Rs 1 lakh crs from the banking system. The RBI said surplus liquidity could pose risk to price stability and financial stability. The RBI also said that this is a temporary measure to deal with the liquidity overhang. The RBI would be comfortable keeping liquidity in surplus not greater than Rs 1 lakh crs.

June Industrial production came in lower at 3.7% yoy against expectations of 5% yoy

FX Reserves saw a dip of USD 2.4bn to USD 601.4bn in the week ended 4th August

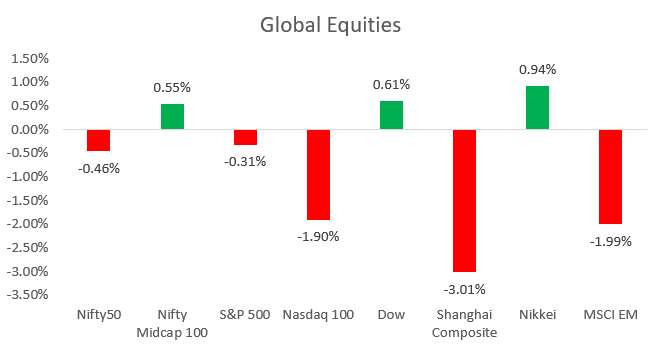

Equities

Nifty ended the week 0.5% lower at 19428. RBI imposing the ICRR spooked bank stocks as banks would not get anything on the CRR while they were getting 6.25% in SDF. Broader markets performed better with Nifty Midcap 100 index ending the week 0.6% higher. IT, Energy and metal stocks performed well this week while bank stocks underperformed. We believe there is a 5-6% further room for Nifty to rise from current levels. 18900 would be a very crucial support. FPIs have invested net USD 400mn in domestic equities in August so far, the pace being much slower than what we have seen over the last 3 months.

IFA Global Quant based investment model is indicating a moderately bullish bias towards equities. Compared to its benchmark having 60-30-10 composition of equities(domestic plus usa), debt and gold, the model is indicating being overweight equities with a portfolio weight of 70%. (Based on the model's quant variables, equity allocation would vary between 40% and 90%.)

Bonds and Rates

Cutoff on the new 10y benchmark came in at 7.18% in yesterday's Gsec auction. Rates continue to remain under pressure given the sell off in US treasuries and higher crude prices. 1y and 5y OIS ended the week at 6.91% and 6.56% respectively. Money market rates have moved higher post RBI imposing ICRR. Overnight call fixings which were happening around 6.40% are now happening close to MSF rate.

We expect the yield on 10y to trade a 7.10-7.25% range over coming week.

USD/INR

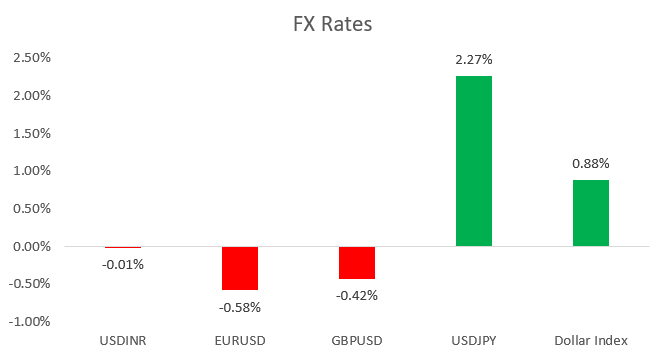

It was a fairly range bound week for USD/INR. We did see USD/INR spike to almost 83 in offshore after Moody's placed 6 large US banks on rating review and downgraded 10 smaller banks. After US CPI Rupee had momentarily strengthened to 82.60

On Friday Rupee closed weak at 82.96 in offshore. Low carry, higher crude prices and cautious global risk sentiment are weighing on the Rupee. RBI has been supplying Dollars around 82.85 but if broad Dollar strength continues and/or Crude breaks USD 90 per barrel and/or Yuan weakens towards 7.30, RBI may allow the Rupee to adjust.

We are revising our expected range a bit higher in USD/INR to 82.10-83.50 over medium term from 81.60-82.90. Over the coming week we expect the Rupee to trade a 82.60-83.25 range with a depreciating bias. Break of 83 could trigger stops losses.

1y forward yield ended at 1.63% while 3m ATMF implied vols ended at 3.89%.

IFA Global hedging barometer unchanged at 108 indicates a neutral outlook on Rupee over the medium term (Range 36-180 with 36 indicating extreme bullishness)

Exporters are advised to hedge partly through forwards considering resistance at 82.90 and partly through RRs with KI on Sell Call to leave room for participation in case we see a breakout. Importers can consider hedging through call spreads.

Key Data to track in coming week

Monday- India CPI and WPI inflation, July trade deficit

Tuesday- China Retail sales, industrial production and fixed asset investment, US July Retail sales

Wednesday- Eurozone Q2 GDP, UK July CPI

Thursday- US jobless claims

Friday- UK retail sales

Expected Ranges and Bias

USD/INR 82.60-83.25 with sideways price action

EUR/USD 1.0840-1.1050 with sideways price action

GBP/USD 1.2640-1.2840 with sideways price action

USD/JPY 143-146 with sideways price action