Weekly Report (07th May, 2023): Strong US jobs report and Apple Q1 earnings lift risk sentiment

7 May 2023 | By IFA Global | Category - Market

Global Developments

We had an event packed and data heavy week but it failed to bring in much volatility.

The Fed hiked rates by 25bps along expected lines to take the Federal funds rate range to 5-5.25%. It softened it's stance on further tightening but maintained that inflation was too high and labor market still too tight. It seemed it was preparing the markets for a high hold i.e. for rates to remain higher for longer. It would remain data dependent and decide on rate action on a meeting to meeting basis.

The market is pricing in only a 3% change of a 25bps hike in June from 25% before the policy. The market is pricing in 3 cuts by the Fed till December end despite the Fed ruling out any possibility of loosening policy in near term. Market is expecting that high rates would cause something to break in the financial system which would cause the Fed to step in by loosening policy.

US April Jobs report saw a beat on every aspect. Headline NFP came in at 253k against expected 185k;

Unemployment rate came in at 3.4% against expected 3.6%;

Average Hourly Earnings rose 0.5% MoM against expected 0.3% MoM.

Data underscores the resilience of the US labor market despite 500bps of rate hikes done by the Fed so far.

The ECB hiked rates by 25bps to take the deposit rate to 3.25% and sounded hawkish. It said it would end APP reinvestments from July onwards. Market is pricing in a 25bps hike by the ECB in its June policy. Eurozone April CPI print came in at 7% yoy against expected 6.9% yoy. Core CPI continues to remain elevated at 5.6% yoy.

Price action across assets

US 2y yield ended 9bps lower at 3.91%

this week. It had fallen to as low as 3.65% intra week. US 10y yield ended the week 2bps higher at 3.44%. It had dipped to 3.29% on Thursday.

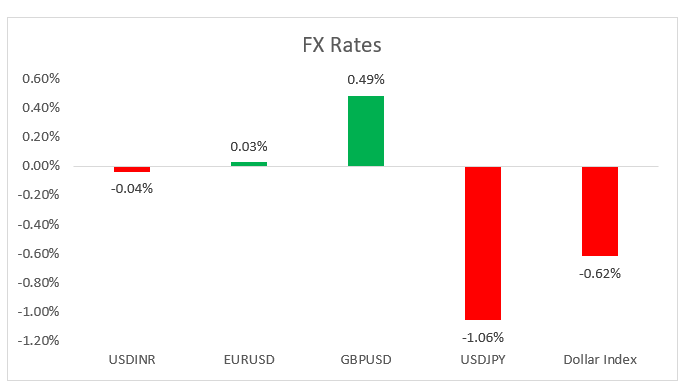

Dollar weakened against all G10 currencies this week. Commodity currencies saw a sharp rebound on revival in risk sentiment. AUD (+2%) nd NZD (1.8%) were the best performers. All Asian currencies too strengthened against the Dollar, with the expection of IDR which ended the week flat. KRW (+1.2%) and SGD (0.6%) were the top performers.

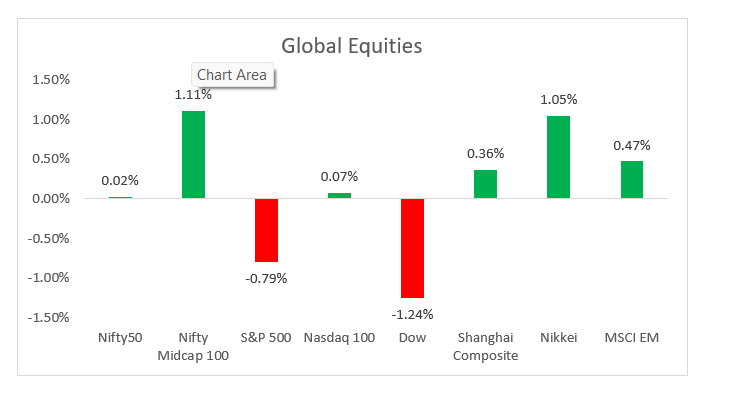

S&P500 was down almost 3% until Thursday but a sharp pull back on Friday on Apple's Q1 results saw it end the week only 0.8% lower. Nasdaq in fact, managed to end the week in positive territory, only just. Asian and EM equities held up quite well and ended up with modest gains for the week.

At USD 71.5 per barrel, Brent was down almost 10% for the week on Thursday but revival in risk sentiment on strong US jobs report and Apple's earnings saw it end the week 5% lower at USD 75.3 per barrel. Gold was up 3.6% at one point but ended the week 1.3% higher at USD 2016 per ounce. Copper ended the week almost flat at USD 387 per pound.

Domestic Developments

RBI's FX Reserves rose USD 4.5bn to USD 588.8bn as on week ended 28th April.

Equities

Nifty ended the week at 18069 as profit booking into weekend saw the Nifty drop 1% on Friday. Losses on Friday were led by HDFC twins as MSCI said the weight of the merged entity would be lower in the MSCI index. Banks with exposure to troubled Go first airline also were under pressure this week. Midcaps and Smallcaps outperformed. We expect the Nifty to trade with a bullish bias in 17800-18400 in the sessions ahead.

Bonds and Rates

Yield on the benchmark 10y dropped 10bps to 7.01%, a thirteen month low. 1y OIS ended the week flat at 6.59% while 5y OIS dropped 9bps to 5.97%.

The recent rally in domestic bonds has been on account of multiple factors i.e. SLR related buying by HDFC Bank (as post merger NDTL would be higher), lower state and central government bonds' combined supply, lower crude prices and rally in US rates.

We expect the 10y to trade 6.90-7.1% range and remain biased towards owning duration.

USD/INR

Rupee ended the week almost flat at 81.80. Agent banks continues to mop up Dollars aggressively on behalf of the central bank. 81.60 is pricing to be a difficult support to break. On the other hand, up side in USD/INR has been called by overall USD weakness. Rupee underperformance has meant that Cross/INR has seen a tremendous rally with EUR/INR ending the week at 90.44 and GBP/INR at 103.10

1y forward yield ended the week 2bps lower at 2.27% while 3m ATMF implied volatility plummeted 30bps to 4.26%, lowest since 2007.

We expect the Rupee to trade a 81.40-82.20 range in the coming week with a slight appreciation bias.

IFA Global hedging barometer at 94 is indicating a bullish bias in Rupee over the medium term (Range 36-180 with 36 indicating extreme bullishness and 180 indicating extreme bearishness)

Key Data and Events to track in coming week

China trade balance on Tuesday

US April CPI on Wednesday and PPI on Thursday

BoE rate decision on Thursday

India March IIP and April CPI on Friday.

Expected Ranges and Bias

EUR/USD 1.0940-1.11 with up side bias

GBP/USD 1.2520-1.2690 with up side bias

USD/JPY 133.50-136 with sideways price action

USD/INR 81.40-82.20 with downside bias