Weekly Report (06th November, 2023) : Risk assets rally as central banks seen levelling-off on rates

4 November 2023 | By IFA Global | Category - Market

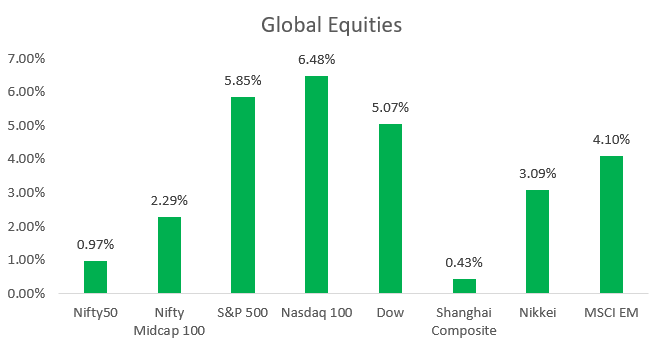

● Major central banks maintain higher for longer stance. Risk assets rally. US equities see best week YTD.

● US treasury reduced auction of longer dated securities, opting to borrow more through T-bills. This triggered a rally in long dated US treasuries.

● Weaker than expected US jobs report further fuelled the rally in US treasuries and caused the Dollar to weaken.

Global Developments

We had three key central bank rate decisions this week, by the BoJ, Fed, and BoE and all kept policy rates unchanged. ECB too last week had kept rates unchanged.

The Fed, ECB and BoE are all in the higher for longer camp. Fed acknowledged the strength of US economy and BoE flagged concerns over crude on account of ongoing Israel Hamas war. BoJ refrained from raising the cap on 10y yield to defend the Yen and maintained it at 1%.

The war receded a bit into the background this week with no fresh escalation or spillover to other parts of Middle East.

We also got the US October Jobs report on Friday which missed expectations on all fronts. Headline NFP print came in at 150k against expected 180k. September print was revised lower to 297k from 336k. Average Hourly Earnings rose 0.2% MoM against expected 0.3% MoM. Unemployment rate came in at 3.9% against expected 3.8%. ISM services too missed estimates coming in at 51.8 against expected 53.

Price action across assets

US treasury announced cut a down in its issuance of longer dated securities. It increased the issuance of t-bills instead. US 2y ended the week 19bps lower at 4.84% and 10y ended 29bps lower at 4.58%. We have been highlighting that close to 5% on US 10y is a great level to go long. We believe there is room for further rally in the near term.

Dollar weakened against majors and EM currencies this week. Major chunk of the move unfolded post the weak US jobs report. Euro rose to 1.0730 from 1.0560 last week. Sterling rose to 1.2380 from close to 1.21 mark. Yen ended at 149.40 after having weakened past 151 earlier this week post BoJ policy. Most Asian currencies too strengthened between 1-2% this week.

S&P500 and Nasdaq rose 5.3% and 5.7% respectively this week. It was the best week for US equities so far this year.

Brent ended the week more than 5% lower at USD 85 per barrel while Gold ended almost flat at USD 1992 per ounce.

Domestic Developments

Passenger vehicle wholesales and UPI transactions by value and volume were the highest ever in October. GST collections in October were the second highest ever. H1 fiscal deficit was well under control at 39% of thag budgeted for full year on robust direct and indirect tax collections. RBI governor commented that Q2 GDP due in November end would most likely surprise on the upside.

FX Reserves rose USD 2.6bn in week ended 27th Oct, on account of maturity of USD 5bn of buy leg of Sell-Buy swap conducted by RBI last year.

Equities

Nifty ended 1% higher this week at 19230. It seems to be respecting the support at 18900 and we continue to maintain a bullish bias till support holds. Broader indices performed even better. Midcap index ended 2.3% higher on the week. Most sectoral indices did well. Energy stocks outperformed. Nifty TTM P/E Ratio stands at 20.9. September and October put together we saw an out flow of USD 3.8bn from domestic equities. November has not started off too well either with a net outflow of USD 400mn over a couple of sessions.

IFA Global Quant based investment model is indicating a moderately bullish bias towards equities. Compared to its benchmark having 60-30-10 composition of equities(domestic plus usa), debt and gold, the model is indicating being overweight equities with a portfolio weight of 70%. (Based on the model's quant variables, equity allocation would vary between 40% and 90%.)

Bonds and Rates

Yield on the benchmark 10y ended 5bps lower at 7.3150% this week on a move lower in US treasury yields and easing crude prices. Liquidity deficit in the banking system has reduced and it is back to almost neutral. First issuance of 50y Gsec went well with cutoff coming in at 7.46%. 1y T-bills are trading around 7.15% and 1y CDs around 7.65%. 10y SDLs are trading around 7.70%

USD/INR

It was yet another extremely range bound week for the Rupee. Onshore spot ended at 83.24 after having weakened to 83.29 on Thursday, its weakest level in a year. We are seeing intraday moves of hardly around 5p. Rupee strengthened in offshore post US jobs data to end at 83.16 implied spot.

Rupee has underperformed during times of Dollar weakness and we expect the under performance to continue as RBI would look to recoup Reserves and correct Rupee overvaluation as well.

We expect the Rupee to trade a 82.80-83.30 range during the coming week.

IFA Global hedging barometer unchanged at 123 is indicating a moderately bearish outlook on Rupee over the medium term of 3-6 months (Range 36-180 with 36 indicating extreme bullishness)

Key Data and Events to track in coming week

China Oct trade data on Tuesday

Eurozone Sep Retail sales and Fed Chair Powell's speech on Wednesday

China Oct CPI on Thursday

UK Q3 GDP and US November Michigan consumer sentiment data on Friday

Expected Ranges and Bias

EUR/USD 1.0670-1.0850 with upside bias

GBP/USD 1.2210-1.2450 with up side bias

USD/JPY 148-150 with downside bias

USD/INR 82.80-83.30 with sideways price action