Weekly Report (05th August, 2023) : US Sovereign downgrade: A tremor, not a Quake

5 August 2023 | By IFA Global | Category - Market

Global Development

The highlight of the week gone by was the downgrade of US sovereign rating to AA+ from AAA by Fitch. Fitch cited expected fiscal deterioration over next 3 years, a high and growing general government debt burden and steady deterioration in governance over the last 20 years as reasons for the downgrade.

The downgrade did spoil risk sentiment this week but did not cause any major panic or mayhem across risk assets.

ISM services data indicated that the resilient US services sector is gradually showing signs of slowing down. This had dented sentiment further. Sentiment however recovered on Friday as the US Jobs report indicated that the US economy added an impressive 187k jobs in July (exp 200k). Unemployment rate ticked lower to 3.5% (exp 3.6%). Wage growth came in higher at 4.4% yoy (exp 4.2%).

We expect the risk sentiment to remain stable till the US CPI on Thursday. It will be an extremely crucial print given that the Fed is now data dependent. Powell had stressed in the press conference that Fed would be closely watching the next two jobs reports and inflation prints to decide on rate action to be taken in September.

BoE hiked Rates by 25bps to 5.25% (highest level in 15 years) and sounded hawkish, unlike the ECB and Fed, both of whom had signalled willingness to be patient to allow impact of past hikes to play out. Two out of nine MPC members voted for a 50bps hike. Despite a larger than expected drop in June, inflation in UK continues to remain extremely elevated at 7.9% yoy, highest among developed economies.

Price action across assets

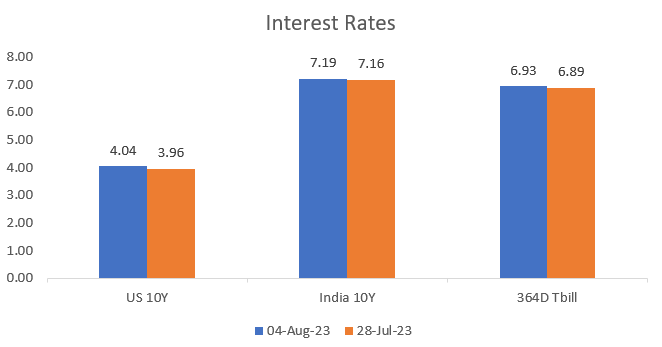

Yield on the US 2y ended 8bps lower at 4.81% compared to last week while 10y yield ended 11bps higher at 4.07%

Dollar had strengthened through most part of the week but gave up gains towards the end on Friday, as risk sentiment recovered.

Euro reclaimed 1.10 after having dropped to 1.0915 mid week. Sterling approached 1.28 after having fallen to as low as 1.2610 after the BoE rate decision. Yen had weakened to 143.80 but strengthened to 141.80 against the Dollar as yield on 10y JGB continued to inch higher despite BoJ intervening twice this week by carrying out unscheduled bond buying operations.

S&P500 and Nasdaq trimmed losses for the week to 1.1% and 1.6% respectively on the back of Friday's recovery. European indices underperformed with CAC ending 2% lower and DAX 3% lower. MSCI EM index lost 2.6% this week.

Brent had a volatile week. It was up initially after the US API data indicated a massive drawdown. Fitch' US sovereign rating downgrade then hurt global risk sentiment, sending Brent to USD 80 per barrel. However it recovered entirely on Friday to reclaim the USD 85 per barrel mark as risk sentiment recovered. Gold rose 1% to USD 1942 per ounce while Copper was down 1% to USD 3.86 per Pound.

Domestic Developments

GST collections, domestic four wheeler sales and July Services PMI were all impressive

April-June fiscal deficit as a percentage of full year budgeted fiscal deficit at 25.3% was higher than 21.2%, comparable number of last fiscal.

RBI's FX Reserves dipped USD 3.2bn to USD 603.9bn in the week ending 28th July

Equities

Nifty managed to trim losses for the week to just 0.7% helped by a short covering bounce on Friday. Nifty managed to close above the 19500 mark. Midcap index in fact ended the week 0.7% higher. IT index rose 3.2% this week and was a clear outperformer, when rest of the sectors struggled. We continue to remain bullish on domestic equities and believe there is another potential 4-5% up side from current levels.

IFA Global Quant based investment model is indicating a moderately bullish bias towards equities. Compared to its benchmark having 60-30-10 composition of equities(domestic plus usa), debt and gold, the model is indicating being overweight equities with a portfolio weight of 70%. (Based on the model's quant variables, equity allocation would vary between 40% and 90%.)

Bonds and Rates

Yield on the benchmark 10y rose 4bps to 7.19%. Higher crude prices and higher long term US treasury yields dampened sentiment in the bond market. 1y t-bill cutoff also came in higher at 6.93% this week. Liquidity in the banking system is comfortable with banks parking close to Rs 2 lakh crs in SDF with RBI. Overnight call Rates have been fixing below repo. 1y and 5y OIS ended the week at 6.88% and 6.55% respectively. We expect the yield on the 10y to trade a 7-7.25% range over the next few weeks.

USD/INR

Rupee ended the week at 82.84, compared to previous week's close of 82.26. It strengthened to 82.70 in offshore trading post the NFP print.

Weakness in domestic equities and higher crude prices weighed on sentiment through the week. In the absence of FPI flows, there is no offset to the usual Dollar demand. Exporters are reluctant to sell long term anticipated exposures given suppressed carry.

We saw some exporter selling around 82.80 and likely some RBI intervention as well. 82.90 is an extremely crucial resistance for the USD/INR pair. We expect it to hold unless we see sustained Dollar strength and weak risk sentiment globally.

We expect USD/INR to trade a 82.30-83.15 range in the coming week.

1y forward yield declined 9bps to 1.59% this week while 3m ATMF implied vols rose 18bps to 4.01%

Key Data/Events to track in coming week

China July CPI on Wednesday

US July CPI on Thursday

RBI monetary policy on Thursday

UK Q2 GDP and US August Michigan consumer sentiment index on Friday

Expected Ranges and Bias

EUR/USD 1.0940-1.1275 with up side bias

GBP/USD 1.2690-1.2980 with up side bias

USD/JPY 140-144 with sideways price action

USD/INR 82.30-83.15 with sideways price action

IFA Global hedging barometer higher at 108 indicates a neutral outlook on Rupee over the medium term (Range 36-180 with 36 indicating extreme bullishness)

Exporters are advised to hedge partly through forwards considering resistance at 82.90 and partly through RRs with KI on Sell Call to leave room for participation in case we see a breakout. Importers can consider hedging through call spreads.