Weekly Report (03rd September, 2023) : US inflation and job market softening in tandem is great news for Fed

3 September 2023 | By IFA Global | Category - Market

Global Developments

Almost all the US data that came out this week indicated that inflation continues to cool off, growth is slowing down and labor market tightness is dissipating.

US Q2 (Apr-Jun) GDP growth was revised lower to 2.1% from previous estimate of 2.4% qoq annualized. PCE and core PCE both rose 0.2% MoM in July. Though headline NFP print beat estimates, unemployment rate ticked higher to 3.8% and wage growth slowed to 0.2% MoM (exp 0.3% MoM). JOLTS job openings have seen the biggest 3 month drop ever. All of this should mean that the Fed may hold rates at current levels through the rest of 2023.

After attempting to tame the Yuan through lower onshore fixings and by squeezing liquidity in offshore, PBoC this week lowered the FX RRR by 200bps to support the Yuan. Troubled Chinese property developer Country Garden said that the outlook is extremely uncertain and that there is a chance it could default on debt. Chinese banks cut term deposit rates by 5-25bps across tenors and will likely lower mortgage rates to support the property sector.

Price action across assets

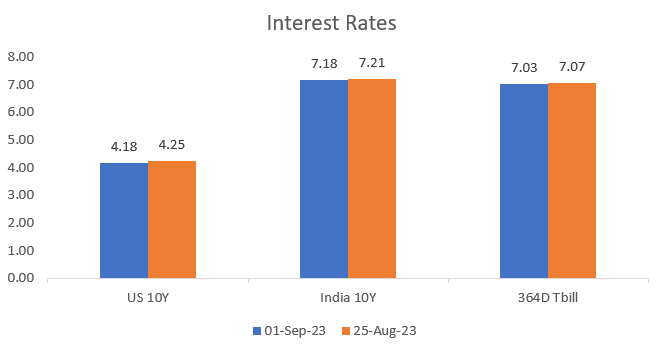

While US yields had moved lower through the week they rose on Friday. US 2y yield ended the week 18bps lower at 4.88% while 10y yield ended 7bps lower at 4.18%

Dollar had weakened through the week but strengthened on Friday

Euro had risen to 1.0940 but ended the week at 1.0780. Sterling had risen to 1.2750 but ended the week at 1.2580. Yen had strengthened to 144.50 but weakened to end the week at 146.15. The Yuan strengthened 0.3% this week to 7.2715

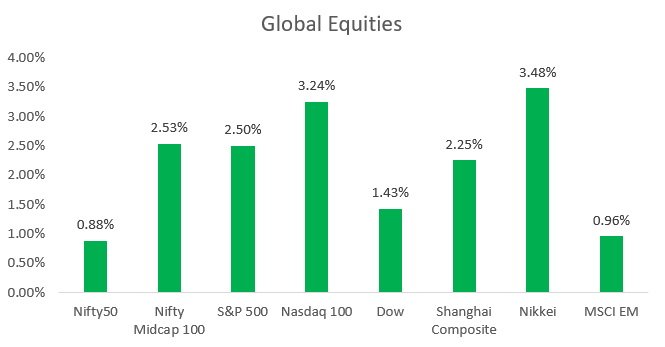

US Equities had a good week with S&P500 and Nasdaq ending 2% and 2.5% higher respectively. European equities' performance was more subdued in comparison. Shanghai composite dropped 2.7% this week

Brent ended the week 5.3% higher at USD 89 per barrel as Saudi is likely to extend its voluntary output cut into October. Gold rose 1.3% to USD 1940 per ounce. Copper gained 1.9% this week.

Domestic Developments

India Apr-Jun quarter GDP growth came in at 7.8% yoy, in line with expectations. Internals were a bit concerning as Manufacturing GVA continues to remain suppressed despite government incentives. While credit offtake to agri, services and retail sectors continues to remain healthy, bank credit to industry has been slowing. Rating agency Moody's has raised India's growth forecast to 6.7% from 5.5% for 2023.

April-July fiscal deficit reached 33% of budgeted target while it was just 20% for the same period last year.

FX Reserves were almost unchanged in the week ended 25th August at USD 594.9bn

Equities

Nifty gained 0.9% this week on account of a short covering rebound on Friday. Below is how the major sectors performed:

Bank Nifty: +0.5%

Nifty IT: 1.9%

Nifty Metal: +5.1%

Nifty energy: +1.4%

Nifty Auto: +3.7%

Nifty FMCG: -0.5%

Nifty Pharma: -0.1%

Broader markets outperformed with Nifty Midcap 100 index gaining 2.5%

FPIs invested net USD 1.5bn in domestic equities in August. It was the sixth straight month of net FPI inflows into Indian equities.

We prefer to enter equities from the long side as long as support at 18900 holds on the Nifty.

Bonds and Rates

Yield on the benchmark 10y ended 3bps lower at 7.17%. 1y and 5y OIS ended 4bps and 6bps lower respectively at 6.97% and 6.57% respectively. The move was largely driven by the dip in US yields. However we may see the yields spike on Monday as US yields bounced back on Friday. FPIs invested net USD 934mn in Indian debt in August. FPI inflow into Indian debt in 2023 is the highest in six years. Despite narrowing rate differential with the US, low volatility in Rupee is encouraging FPIs to invest in domestic bonds. Some of the inflows may also be on account of positioning ahead of anticipated bond index inclusion.

USD/INR

Rupee ended the week almost flat at 82.71. It was quite a range bound week for the Rupee. Despite MSCI rebalancing related inflows, USD/INR was well supported.

MSCI rebalancing related outflows are likely to go through on 5th Sep.

1y forward yield ended 4bps higher on the week at 1.67% while 3m ATMF implied volatility ended 26bps lower at 3.57%

We expect the Rupee to trade a 82.10-82.90 range in the coming week.

Key Data/Events to track in coming week

Tuesday: Reserve Bank of Australia rate decision

Wednesday: US ISM services PMI

Thursday: China August trade balance, Eurozone Q2 GDP

Friday: Japan Q2 GDP

Expected Ranges and Bias

EUR/USD: 1.0710-1.0900 with sideways price action

GBP/USD: 1.2520-1.2780 with up side bias

USD/JPY: 144-147 with downside bias

USD/INR: 82.10-82.90 with sideways price action