Multi-Asset Weekly Newsletter

12 January 2025 | By IFA Global | Category - Market

Weekly Newsletter

Global Developments & Global Equities

BONDS SELL OFF GLOBALLY ON INFLATION CONCERNS AND PUSH BACK IN FED RATE CUT EXPECTATIONS.

US jobs report beat expectations. Headline NFP print came in at 256k against 165k expected. The unemployment rate too came off to 4.1% from 4.2% in November. This has further dampened Fed Rate cut expectations. Until last week markets were pricing in 1.6 cuts by the end of 2025. Now they are only pricing in 1.1 cuts. The Fed is expected to stay on hold in January.

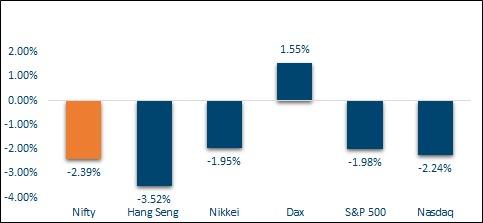

NIFTY V/S GLOBAL MARKETS

S&P500 and Nasdaq ended 0.7% lower this week. European Equities did well with DAX and CAC gaining 1.6% and 2% respectively. FTSE too was up 0.3% In Asia, all markets except Korea ended lower for the week. The KOSPI gained 3%. Chinese Equities were about 1.3% lower. Hang Seng lost 3.5%.

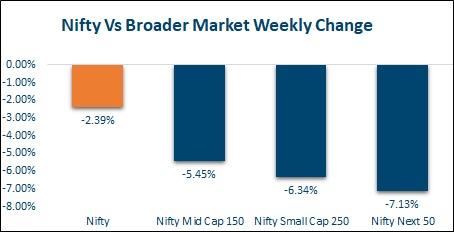

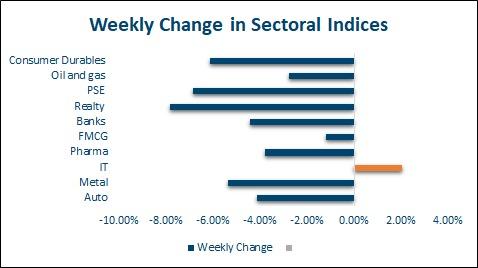

Domestic Equities

The benchmark Nifty50 lost 2.4%. The cuts in the broader markets were deeper with Midcap100 and Smallcap250 indices falling 5.8% and 6.3% respectively. High beta sectors sold off with Realty, metals, banks, and auto indices down 7.8%, 5.3%, 4.4,%, and 4.1% respectively. Energy index too was down 6%. It was the only sector that ended with gains this week with the IT index ending 2% higher. FPIs have pulled out USD 2.6bn from domestic Equities in the first few sessions of 2025. AMFI data for December that came out revealed that domestic flows into Equities continue to remain encouraging. Amount invested through SIPs crossed the Rs 26000crs mark. Sectoral and Thematic funds continue to see great traction. Equities MFs on the whole saw inflows of Rs 41000crs, up 14%yoy.

Fixed Income, IPO, and Institutional Deals

INITIAL PUBLIC OFFERING (IPO):

This week, a major highlight was the IPO of Indo Farm, which received an overwhelming response with subscriptions exceeding 229 times. Despite the subdued performance of domestic equities, the stock debuted with a 20.2% premium. Looking ahead, five IPOs are scheduled for the coming week, primarily from the SME segment, with Laxmi Dental being the sole mainline IPO.

PRIVATE EQUITY AND VENTURE CAPITAL:

Funding activity in the PE and VC space gained momentum in the second week of the year, following a couple of quiet weeks during the holiday season. Total funds raised surged by 73% week-over-week to $533 million across 25 deals. The largest deal of the week was healthcare-focused unicorn Innovacer’s $275 million Series F round, led by U.S.-based investors B Capital Group and Danaher Ventures. Neuberg Diagnostics followed with $109.5 million raised from Kotak Strategic Situations Fund II. Meanwhile, the M&A space remained strong with four recorded transactions. Gujarat-based Intas Pharma signed a $558 million deal to acquire the biologic medication brand Udenyca.

REAL ESTATE:

Blackstone-backed ASK group’s real estate investment arm has launched its maiden luxury real estate fund in partnership with India Sotheby’s International Realty amid a boom in the property segment.

FIXED INCOME:

Bonds sold off across developed markets this week. US 10y yield climbed 13bps, UK 23bps, Germany 15bps and Japan 8bps. There are concerns that inflationary pressures will mount post Trump takes office as he implements tariffs and immigration curbs and cuts corporate taxes. Solid US jobs report further exacerbated the sell-off in US treasuries. The unusual thing though is that despite such elevated yield levels, the term structure is still upward-sloping. India's 10-year bond yield ended almost flat at 6.77% this week. The response to the government buyback was encouraging with offers received for Rs 45710 crs against notified buyback of Rs 25000crs. The government accepted Rs 19217crs of offers. Such buybacks would help lower the gross borrowing for FY26 but the fact that the government is using cash to buyback bonds instead of spending could be negative for growth. 1y and 5y OIS ended flat at 6.51% and 6.22% respectively. Overnight call fixing is happening close to 7%, way above the MSF rate of 6.75% as the banking system liquidity deficit is now over Rs 2 lakh crs.

FX and Commodities

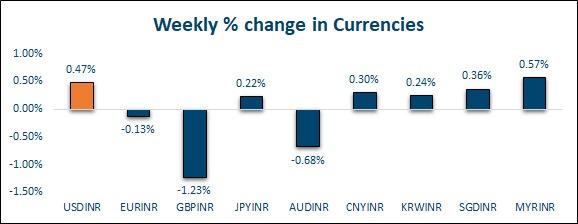

FOREIGN EXCHANGE:

Canadian Dollar (+0.2%) was the only G10the currency strengthened this week. Justin Trudeau stepping down as PM ushered in hopes of political calm. Canada's jobs report too came in way better than expected, resulting in markets slashing rate cut bets by the BoC. The pound (-1.7%) was the worst-performing currency. A rout in UK gilts put pressure on the Pound. The yield on UK 10y Gilts rose to 4.85%, the highest since 2008 on government finances and inflation concerns. Euro weakened 0.6% this week, a major move happening after the strong US payroll print. Asian currencies were steady this week. Offshore Yuan is being supported around 7.36 on stronger than expected onshore fixings by PBoC and tightening of Yuan liquidity in the offshore market,

deterring speculators. The rupee weakened 0.2% this week to 85.97, a new record low. The rupee weakened past 86 in offshore post the US jobs report. FX Reserves dropped USD 5.6bn to USD 634.6bn in the week ending 3rd Jan. This was the 13th weekly drop in the last 14 weeks. 1y forward yield had risen to 2.70%, highest level since Oct'22 but cooled off on Friday to end at 2.56%.

COMMODITIES:

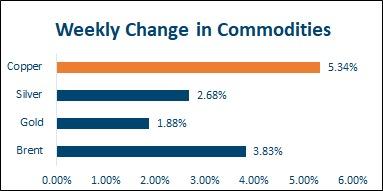

Precious metals gained this week with gold and silver ending 1.8% and 2.6% higher respectively Brent rose 4.3% this week and touched the USD 80 per barrel mark for the first time since Oct'24 as the US targeted 180 tankers carrying Russian oil as well as maritime insurance providers based in Russia. US natural gas prices rose 19% this week on cold weather in the US. Base metals too did well with LME Copper and Aluminum gaining 2.4% and 3.1% this week.

Ideas and Opportunities

WHAT WE LIKE

Equities:

We continue to remain optimistic on domestic Equities but prefer the comfort of large caps and defensives. We believe the Midcap and Smallcap space remains vulnerable to Earnings misses given the still lofty valuations. Energy and Banks are sectors we believe will outperform over the medium term.

FX:

We continue to see the Dollar strengthening. US December CPI next week will be the key data point to look forward to. Importers are advised to be cautious and keep hedging on any dips to 85.70. For export exposures, we believe hedging through participating option structures is the way to go.

Fixed Income:

We may continue to see further pressure on Bonds in the near term. A spike in Brent adds to the inflationary concerns. Domestic Bonds may however trade sideways with a 10y yield expected to remain in a 6.70-6.85% band until the budget.

Commodities:

Brent spiked this week, against the run of play causing us to reconsider our bearish view. We would still like to see one more weekly close above the USD 80 per barrel mark before revising our view though. We continue to remain bullish on precious metals, both in USD and INR terms.