Multi-Asset Weekly Newsletter

31 December 2024 | By IFA Global | Category - Market

Weekly Newsletter

Global Developments & Global Equities

'CAUTIOUS OPTIMISM' IS THE THEME FOR 2025 AFTER A STELLAR 2024 FOR GLOBAL EQUITIES.

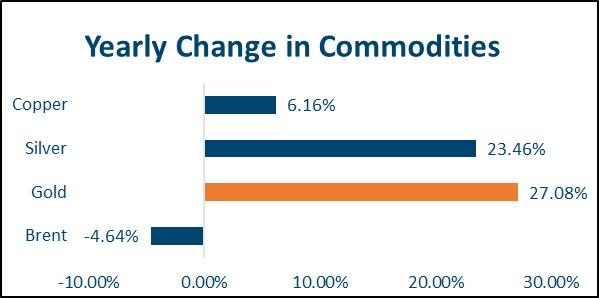

2024 has been a remarkable year indeed. We have had a cocktail of geopolitical uncertainty, political uncertainty, and economic uncertainty, and despite that, equities have had a stellar year globally. On the other hand, bonds have sold off in Developed markets despite central banks turning dovish and starting rate-cut cycles. FX had a relatively quiet year until November. Trump's win has fuelled Dollar strength thereafter. Base metals and Brent have had a steady year while precious metals, (especially Gold) have had a phenomenal year on reserve diversification-driven demand from central banks, as the DeDollarization theme plays on in the background.

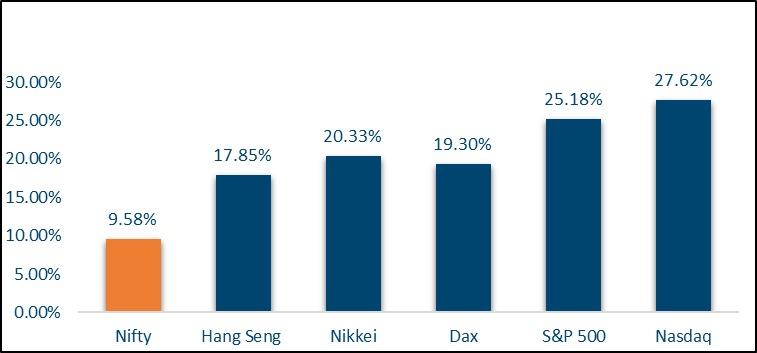

NIFTY V/S GLOBAL MARKETS

Equities globally have had a stellar 2024 causing some Acrophobia (fear of heights) stepping into 2025, given the overstretched valuations. In local currency terms, Nifty (+9.6%) has underperformed other major indices such as S&P500 (+25.2), Nikkei(+20.4%) and Shanghai Composite (+14.3%). It has performed better than a broad index of European stocks I.e. STOXX600 (+5.9%) and MSCI EM index (+5.8) In Dollar terms, the performance of other indices pales out in comparison to the S&P500. Nifty's Dollar return for the year so far is 6.8%. STOXX600 is just flat on a currency-adjusted basis.

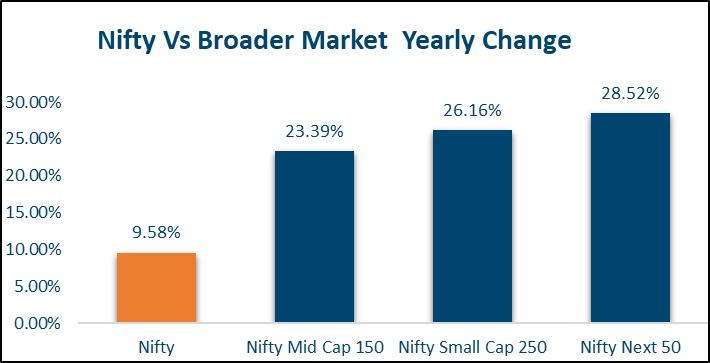

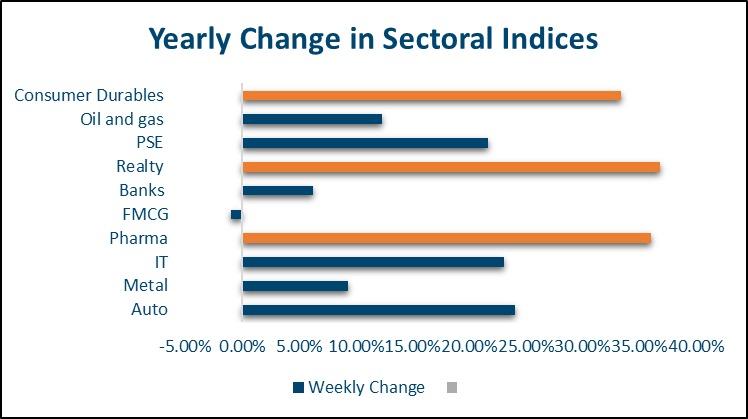

Domestic Equities

Broader markets outperformed the Nifty by a considerable margin. Midcap100 is up 23.4% and Smallcap250 index has gained 26.2%. Nifty next 50 has performed even better, gaining 28.5% There was a wide dispersion among sectoral indices. Realty (+36.8%), Auto (+24.1%), Pharma(+36.7%), Consumer Durables (+28.2%), and IT(+23.1%) indices were the outperformed FMCG (-1%), Energy(+4.7%) and Bank Nifty (+6.2%) were the laggards.

FPI flow into equities is almost flat for the calendar year. September was the best month, seeing an inflow of USD 6.8bn and October was the worst month ever with a net outflow of USD 11.1bn.

Fixed Income, IPO, and Institutional Deals

INITIAL PUBLIC OFFERING (IPO):

Dealmakers expect the momentum for new share sales in India, now the world's busiest market for initial public offerings, and Australia in 2025 will cushion the impact of sluggish Chinese deals in the Asia Pacific. The Mumbai-based National Stock Exchange outranked the bigger U.S. exchanges in the amounts raised by IPOs for the first time, driven by India's robust economic growth and increasingly active domestic investors, following the rush of IPOs in 2024. There was a 149% increase in the value of IPOs in India in the past year to $18.4 billion, according to LSEG data, which contributed to total equity capital market activity almost doubling.

PRIVATE EQUITY AND VENTURE CAPITAL:

The overall funding activity, particularly in the VC space, for the calendar year 2024 was notably strong, with over $16.7 billion raised across 888 deals. This represents a 14% increase in value and a 21.5% rise in deal volume compared to 2023. Technology sector fundraising surged by over 50%, reaching $6.5 billion, while consumer discretionary saw a 32% increase, raising $2.3 billion. The largest deal was $1.3 billion raised by the fast-growing quick commerce company Zepto, followed by $500 million raised by Poolside AI SAS. Both 2023 and 2024 were challenging years, as global VC investments declined, with limited partners showing reduced interest in the asset class. The potential impact of the US market, particularly under the incoming Trump administration, continues to be a significant factor influencing global capital flows.

REAL ESTATE:

Private equity inflows into India's real estate sector rose by 10% in 2024, with warehousing and logistics assets receiving the largest share, according to a new report. Total PE investment in India's property market reached $4.3 billion this year, driven by strong macroeconomic factors boosting investor confidence. This marks the third consecutive year of growth after a low of $3.4 billion in 2021. In 2024, over half of the PE inflows, approximately $2.3 billion, were directed towards the warehousing and logistics segment. This reflects India's growing role as a supply chain hub, positioning industrial and logistics sectors at the forefront of PE investments. While the commercial office segment continues to draw steady interest, the rising demand for premium housing has made the residential sector a key investment opportunity.

FIXED INCOME:

Bond traders globally had a difficult year, coming to grips with a sell-off despite monetary policies turning dovish in most major economies Below is the performance of 10y yields across developed markets;

US +74bps

UK +110bps

France +65bps

Germany +37bps

Japan +48bps

On the other hand, the story was a bit different in Asia with China's 10y yield slumping 87bps, Korea's 29bps, and India's 40bps. While China and Korean bond yields fell on worries around the state of the economy, India bond yields fell on bond index inclusion-related flows helping tilt the demand-supply balance. FPIs have poured in a net of USD 20bn in domestic debt in 2024.

FX and Commodities

FOREIGN EXCHANGE:

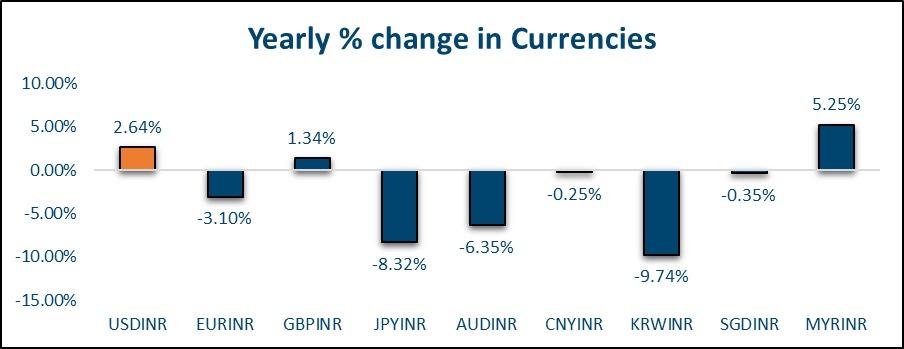

The rupee weakened 1% in December and with that is 2.7% down YTD against the Dollar. While the recent move in Rupee has caught many by surprise, given the low volatility environment we were in for a long period, Rupee is still in the middle of the pack in its peer group as far as YTD performance is concerned. Among Asian currencies, MYR(+2.8%) has been the best-performing currency while KRW(-12.4%) has been the worst performer. CNH (-2.7%) has weakened almost as much as the Rupee. PHP (-4.2%) and IDR (-5.2%) have performed worse than the Rupee. All G10 currencies have weakened against the Dollar in 2024 with GBP(-1.2%) and EUR(-5.6%) being the two best performers. JPY (-10.7%) and NZD(-10.8%) have been the worst performers.

COMMODITIES:

Brent is down 3.7% of the year, having traded a USD 68.6-92.2 per barrel despite all the geopolitical risk that has been around. Production outside the OPEC+ continues to remain elevated and under the Trump regime, US output may rise even further. US and European natural gas prices have risen 40% and 50% respectively this year. Precious metals had a stellar year with Gold and Silver rising 27% and 23.5% respectively. Diversification of Reserves amid concerns around De-Dollarization could be a theme that could gain even more prominence going forward. Base metals had a good year despite weak China demand. Copper is up 5% while Aluminum is up 7.3% for the year.