Multi-Asset Weekly Newsletter

22 December 2024 | By IFA Global | Category - Market

Weekly Newsletter

Global Developments & Global Equities

HAWKISH FED, US DEBT CEILING CONCERNS DASH HOPES OF SANTA CLAUS RALLY

This week, the Fed delivered a 25bps cut as expected, but it sounded extremely hawkish. It predicated further rate cuts on progress on the inflation front. It indicated only 2 cuts in 2025. To put things in perspective, just a couple of months ago the market was expecting 3-4 cuts in 2025. At present the OIS market is pricing in just 1.5 cuts in 2025. This is in stark contrast to other major central banks. The ECB cut by 25bps and sounded dovish. The market is pricing in 5 cuts this year by ECB. The BoJ did not hike rates. A section of the market was expecting one. The BoE kept rates unchanged but more members voted for a cut than expected (3 MPC members against 1 expected).

Moreover, debt ceiling concerns are back in play as President-elect Trump denounced the deal reached earlier to avert a shutdown. Trump's proposed spending bill that included a two-year suspension of the debt ceiling failed to get past the House. If the bill is not passed, it could result in a government shutdown. However, the government with its existing cash balances can carry on its operations for another 3-4 months at least after which it could potentially default. A hawkish Fed and uncertainty around the debt ceiling triggered risk aversion and flight to safety. Price action will likely remain muted next week due to the holiday season.

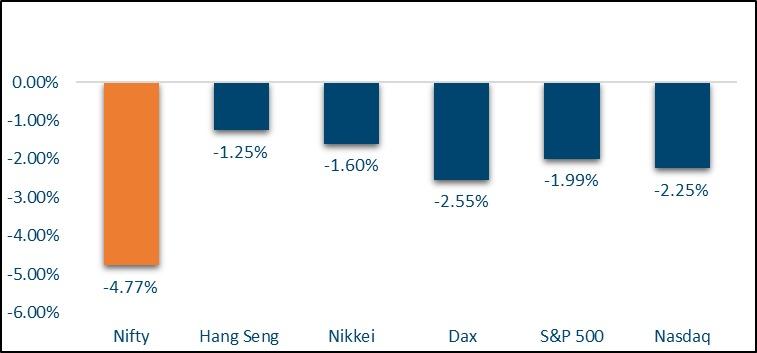

NIFTY V/S GLOBAL MARKETS

Equities globally sold off this week. S&P500 lost 2%. Wednesday was the worst Fed day for S&P500 since 2001. The index fell 3% that day. Shanghai composite, HangSeng, and Nikkei were down 0.7%,1.25%, and 2% respectively. Nifty fell 4.8% this week. With other weekly expiries having been discontinued, Sensex expiry days have become volatile

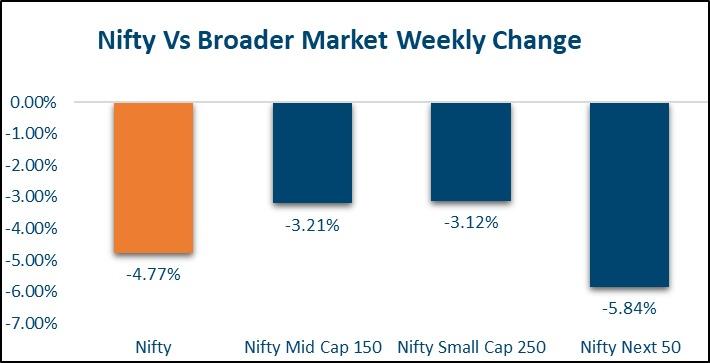

Domestic Equities

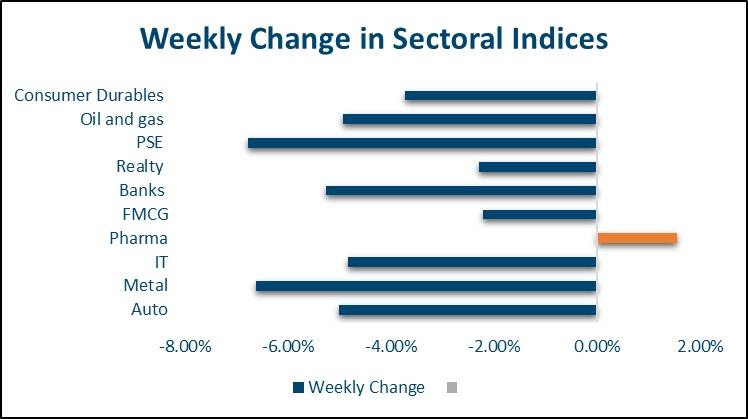

Broader markets outperformed with NSE Midcap100 and Smallcap indices both dropping 3.5% this week. Among sectoral indices, IT, Banks, Auto, Metal, and Energy all fell between 4.8% to 6.6%. Pharma (+1.6%) was the lone sector which gained. Realty and FMCG indices also outperformed relative to the benchmark, dropping 2.3% each.FPIs have invested a net USD 2.5bn in domestic equities in December so far. Nifty P/E on a trailing 12m basis has moderated to 22. Midcap 100 and Smallcap 250. P/E ratios stand at 39 and 30 respectively.

Fixed Income, IPO, and Institutional Deals

INITIAL PUBLIC OFFERING (IPO):

Dealmakers expect the momentum for new share sales in India, now the world's busiest market for initial public offerings, and Australia in 2025 will cushion the impact of sluggish Chinese deals in the Asia Pacific. The Mumbai-based National Stock Exchange outranked the bigger U.S. exchanges in the amounts raised by IPOs for the first time, driven by India's robust economic growth and increasingly active domestic investors, following the rush of IPOs in 2024. There was a 149% increase in the value of IPOs in India in the past year to $18.4 billion, according to LSEG data, which contributed to total equity capital market activity almost doubling.

PRIVATE EQUITY AND VENTURE CAPITAL:

Funding activity declined to USD 361mn from USD 905mn in the previous week. Deal volume moderated to 25 from 30. M&A space saw muted activity as well. The largest transaction this week was Sterlite Power raising of USD 85mn in primary funding from private Equity investor GEF capital and investment group Enam Holding. On the M&A side, Team Lease Services, a listed staffing company said it would acquire TSR Darashaw's payroll processing business and Crystal HR.

REAL ESTATE:

Singapore-based real assets investor CapitaLand, which marked the final close of its latest India-focused fund last year, has sold two office park assets to an Indian realty player for about $68 million CapitaLand, which acquired Chennai's Radial IT Park as the seed asset for its investment vehicle, CapitaLand India Growth Fund I1, has sold the second and third phases of the asset to TVS Emerald, a real estate development.

FIXED INCOME:

US treasury yields firmed up on a hawkish Fed. 10y treasury yield rose 12bps to 4.52%. 10y yields across Eurozone countries rose between 2-7bps. Yield on the benchmark India 10y rose 6bps to 6.79%, tracking the sell-off in US treasuries. There was an even more pronounced sell-off in Rates. 1y OIS rose 14bps to 6.54%. 5y OIS rose 18bps to 6.22%. US high-yield corporate bond spreads to Treasuries widened almost 20bps this week in 10y tenor. Banking system liquidity continues to remain tight. This is keeping overnight rates elevated. Fixings were consistently above the MSF this week. USD/INR Cash-tom implied had spiked to almost 11% this week, highlighting the liquidity deficit.

FX and Commodities

FOREIGN EXCHANGE:

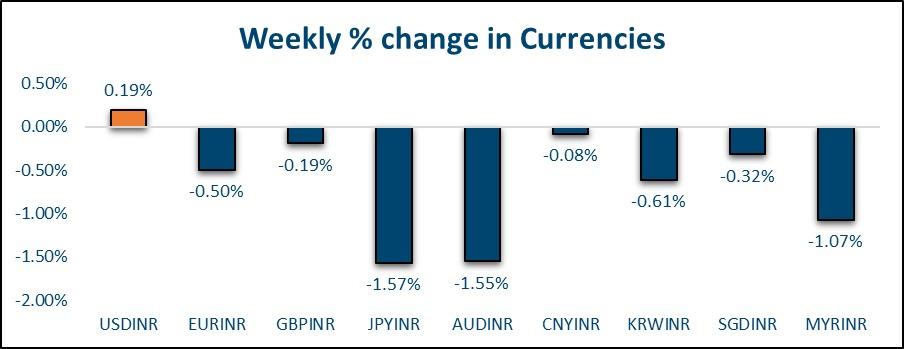

The dollar strengthened across major and Emerging market currencies on a hawkish Fed. The dollar strengthened against all G10 currencies. Commodity currencies, NZD (-1.9%) and AUD (-1.7%) were the worst performers. All Asian currencies weakened against the Dollar. MYR (-1.2%) and IDR (-1.2%) were the worst performers Rupee weakened 0.3% to end at 85.02, a new record low against the Dollar. 1y forward yield rose 5bps this week to 2.22%. 3m ATMF implied volatility rose 35bps to 3.15%.

COMMODITIES:

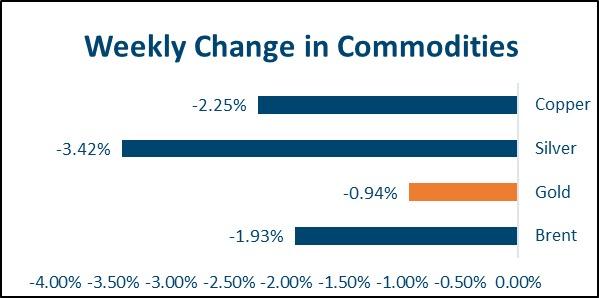

In the energy complex, Brent ended the week 2% lower at USD 73 per barrel. US Natural gas prices rose 14% on fears of a colder winter and an uptick in LNG exports. Among precious metals, Gold ended the week 1% lower while Silver ended 3.3% lower on overall Dollar strength. Among base metals, Copper ended 1.3% lower while Aluminum ended 2.7% lower on broad risk off.

Ideas and Opportunities

WHAT WE LIKE:

Equities:

Global equities could continue to remain under pressure in the near term due to debt ceiling and US policy uncertainty. However, we see them being in consolidation mode and do not see a dramatic sell-off. Domestic equity indices are likely to outperform global peers given the strong domestic demand. We expect value buying to emerge on dips, especially in the large-cap universe. Small and Midcap universes may see a protracted period of consolidation. We see the Nifty trade in a 22800-24700 range over the coming few weeks.

FX:

We see the Dollar continue to strengthen into early 2025. The rupee will likely have a low beta to the overall Dollar movement. It will continue to be driven mainly by the Yuan. RBI seems to be comfortable with a slow drift higher in USD/INR. However, we believe it will continue intervening to keep volatility in check. We see an 84.70-85.50 range for USD/INR over the next few weeks.

Fixed Income:

We believe current levels are attractive to add duration in US treasuries. The domestic 10y yield is likely to consolidate in the 6.65-6.85% band. Any dip in 5y OIS towards 6% is a good opportunity to convert floating rate exposures to fixed.

Commodities:

We continue to hold our bearish view on Brent given the oversupply and China demand concerns. Base metals could remain under pressure in the near term on risk aversion. We continue to remain bullish on precious metals both in USD and INR terms.