Multi-Asset Weekly Newsletter

15 December 2024 | By IFA Global | Category - Market

Weekly Newsletter

Global Developments & Global Equities

DOMESTIC EQUITIES CONTINUE TO DEMONSTRATE RESILIENCE; AND STAGE A PHENOMENAL INTRADAY RECOVERY ON FRIDAY.

The US October CPI print this week came in line with expectations. CPI growing at 0.3% on a MoM sequential basis however indicates that progress on the inflation front, in its journey towards the Fed's target of 2% yoy seems to be stalling in the US. The November PPI print came in much higher than expected.

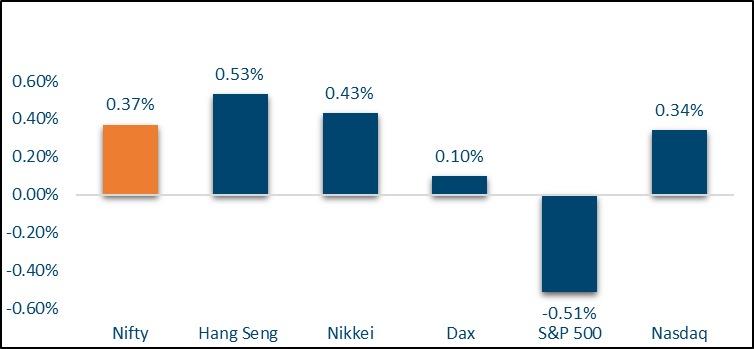

NIFTY V/S GLOBAL MARKETS

Global equities were steady this week. The S&P500 ended the week 0.6% lower. The broad index of European stocks was down 0.8%. Shanghai Composite lost 0.4%. MSCI EM was up 0.2%

Domestic Equities

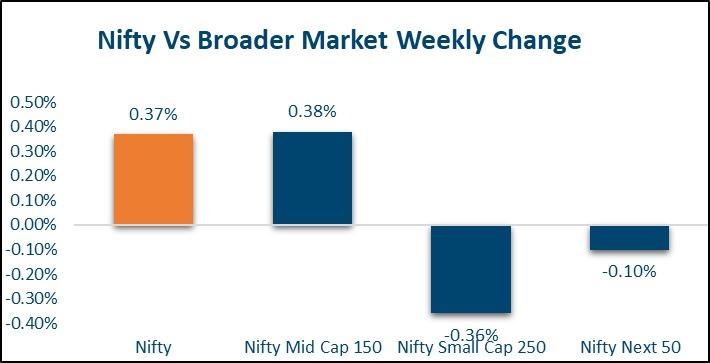

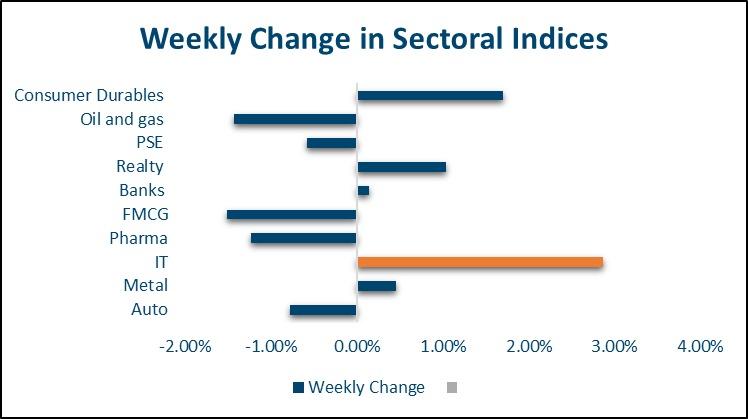

Monthly AMFI data came out this week. While the monthly SIP amount remained steady at over Rs 25000crs a month, SIP account additions declined for the fourth month in a row in November. Domestic equities continue to remain extremely resilient as the price action on Friday suggests. Domestic equities saw a phenomenal V-shaped intraday recovery on Friday. Nifty ended the week marginally higher at 0.3%. On Friday it was down more than 1% at one point but ultimately ended close to 1% higher. Broader markets were a mixed bag. Midcap 100 ended 0.5% higher while Smallcap250 ended 0.4% lower on the week. Among sectoral indices IT index (+2.9%) was the top performer while the Pharma (-1.2%) and FMCG (-1.5%) indices underperformed. FPIs have invested a net USD 2.6bn in domestic equities in December so far.

Fixed Income, IPO, and Institutional Deals

INITIAL PUBLIC OFFERING (IPO):

Nisus Finance Services IPO was listed at a premium of 25% and continued its upward trajectory this week with overall mixed sentiments in domestic equities. This week there are multiple IPOs in line for listing with some of the major ones being Vishal Mega Mart raising Rs. 8,000 crores and Inventurus Knowledge Solutions raising around Rs. 2,500 crores. Both these IPOs are expected to list at over 25% as per the prevailing GMP.

REAL ESTATE:

Brookfield India Real Estate Trust has raised ₹3,500 crore ($415 million) from institutional investors, including the International Finance Corporation. The funds will primarily be used to reduce debt, create capacity for acquiring high-quality assets, and support its long-term strategic vision. Demand and rents for warehousing in India’s top eight cities have surged, driven by growth in manufacturing, e-commerce, and logistics, according to Knight Frank India. The occupier base has also diversified, supported by initiatives like the National Logistics Policy, National Manufacturing Policy, Gati Shakti, and multimodal logistics parks.

PRIVATE EQUITY AND VENTURE CAPITAL:

The overall funding activity for Indian startups remained extremely upbeat with the cumulative capital raised touching a multi-week high of $1 billion. The overall volume more than doubled to over 40 deals with the biggest one being $210 million raised by a cloud kitchen unicorn Rebel Foods. The round was led by a Singapore state-owned investor Temasek. From a global perspective, Omnicom has announced plans to acquire Interpublic Group (IPG) in an all-stock deal, forming a global advertising giant with over 100,000 employees, $30 billion in annual revenue, and a roster of top-tier clients. The merger, set to finalize in late 2025, will retain the Omnicom name.

FIXED INCOME:

US 10y yield rose 20bps to 4.40%. 10y yields across the Eurozone and the UK rose anywhere between 10-20bps. US 2y yield rose 12bps to 4.25%. Domestic CPI print came in line with expectations, within the RBI's tolerance band. This makes a rate cut in February almost certain. The yield on the benchmark 10y ended 1bps lower at 6.73%. 1y and 5y OIS ended 4bps and 3bps lower respectively at 6.40% and 6.04%. Banking System liquidity is close to neutral. It will improve as the CRR cut comes into effect. That should ease pressure on money market rates. FPIs have invested a net of USD 1.4bn in domestic debt in December so far.

FX and Commodities

FOREIGN EXCHANGE:

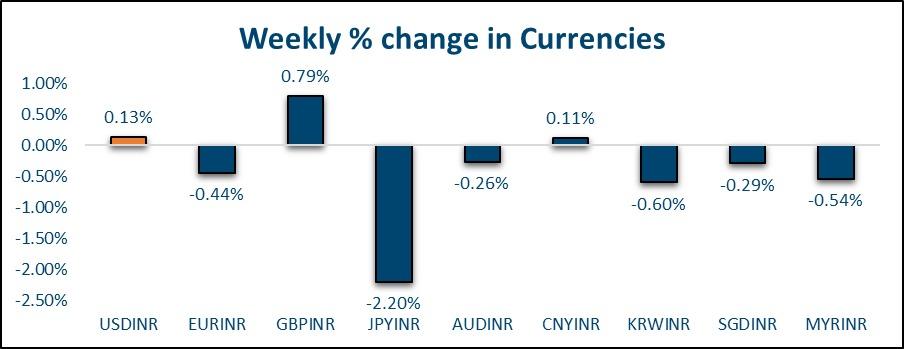

All G10 currencies weakened this week against the Dollar except NOK (+0.1%). JPY(-2.4%) was the worst-performing currency on chances that BoJ may not hike next week. Euro (-0.6%) weakened on a dovish ECB. ECB cut rates by 25bps. It removed the phrase 'rates will be kept sufficiently restrictive' from its policy statement. It highlighted that the balance of risks was tilted to the downside and lowered growth and inflation projections for FY25. GBP (-1%) weakened on disappointing UK data. UK October GDP, industrial production, and manufacturing production all missed estimates by a huge margin and came in contraction territory. We have the US retail sales data on Tuesday, the Fed rate decision on Wednesday, and the BoE and BoJ rate decisions on Thursday. While Fed is expected to cut rates by 25bps while BoE and BoJ are expected to keep rates unchanged. Asian currencies were either flat or weakened slightly against the Dollar. PHP(-1.2%) was the worst performer. The rupee (-0.1%) was steady through the week. It will be interesting to see if RBI's tight control over the Rupee continues under the new regime with Mr Sanjay Malhotra taking over the reins from Mr Shaktikanta Das as RBI governor.

COMMODITIES:

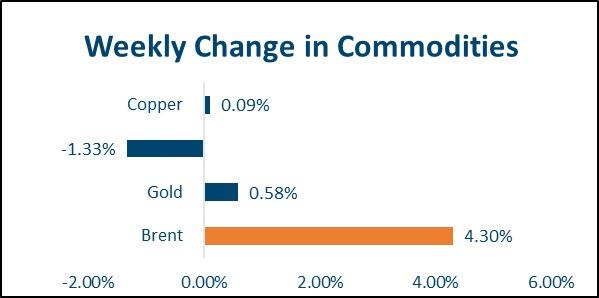

Brent rose 4.7% this week to USD 74.5 per barrel. European natural gas prices came off 10% this week, easing from 2024 highs. Base metals were steady this week. LME Aluminum ended flat while Copper came off 0.7%. In the precious metals space, gold was up 0.6% this week while Silver fell 1.3%. Gold retreated from highs around USD 2720 to end the week at USD 2648 per ounce.

Ideas and Opportunities

WHAT WE LIKE:

Equities:

We continue to hold our bullish view on domestic equities. India equities are likely to outperform Asian and EM peers on strong domestic flows as long as there is no major FPI withdrawal. We prefer expressing our bullish view through large caps and avoid Midcap and Smallcap space given lofty valuations and strong vulnerability to negative earnings surprises

FX:

We expect the Dollar to trade with a slightly bullish bias going forward on growth and policy divergence between the US and the rest of the major global economies. Euro is likely to encounter resistance around 1.06-1.0650 USD/INR is likely to demonstrate a low beta to broad Dollar moves. CNH is likely to be the most important factor driving the Rupee. In periods of Dollar weakness, the RBI is likely to keep a firm floor under the USD/INR pair. We expect USD/INR to trade with a slightly bullish bias.

Fixed Income:

Upticks to 4.50% on the 10y is a good opportunity to add duration in US treasuries. Domestic bonds are likely to trade sideways. A move lower on 10y to 6.60% can be used to book profits on long-duration trades. A move lower to 5.90% on the 5y OIS can be used to convert floating rate exposures to fixed.

Commodities:

We continue to hold our bearish view on Brent given global demand-supply dynamics. Production outside OPEC+ is quite elevated. Concerns around China's demand continue to linger. In the precious metals space, we continue to hold our bullish view on gold and silver and prefer using any downtick to add to positions.