Multi-Asset Weekly Newsletter

1 December 2024 | By IFA Global | Category - Market

Weekly Newsletter

Global Developments & Global Equities

INDIA Q2 GDP SHOCKER PUTS NEXT WEEK'S POLICY IN SPOTLIGHT

India's Q2 GDP print was a big negative surprise, coming in at 5.4% against consensus expectations of 6.5% and the RBI estimate of 7%. The GVA print came in at 5.6% against the expected 6.3%. The slowdown in manufacturing activity is particularly concerning. Weak personal consumption offset the effect of higher government spending in Q2. The focus in the coming week will be on the US November jobs report, which is due on Friday.

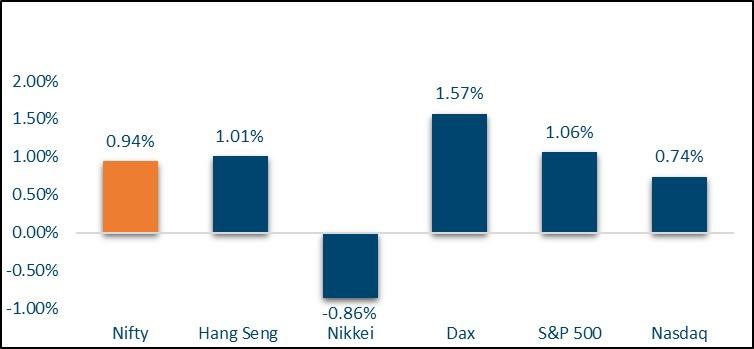

NIFTY V/S GLOBAL MARKETS

Equities globally had a steady week. The S&P500 rose 1.1% to a fresh record high. The Shanghai Composite was up 1.8%, while the MSCI EM index fell 0.8%. A broad gauge of European stocks was up 0.4% this week.

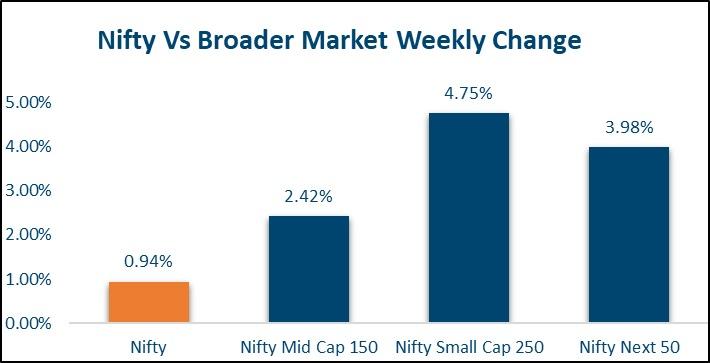

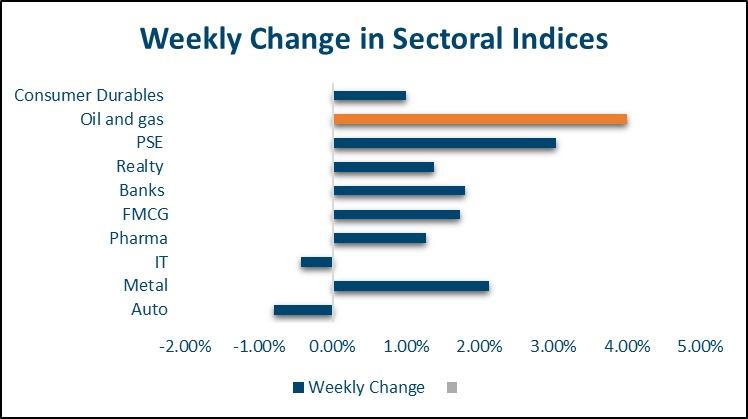

Domestic Equities

Nifty ended the week 0.9% higher at 24131 after having dropped below 24000 at one point midweek. Broader indices got back to winning ways, outperforming the benchmark Nifty. The midcap100 index rose 2.5% while the smallcap 250 index rose 4.8%. Among sectoral indices, IT and Auto indices dragged while oil & energy stocks outperformed. BSE Oil & Gas index was up 4.24% this week. Metals and Banks too did well.

Fixed Income, IPO, and Institutional Deals

INITIAL PUBLIC OFFERING (IPO):

This week witnessed three IPO listings, led by NTPC Green, which debuted with a 3.3% gain and continued to rally despite broader market volatility. In the upcoming week, several IPOs are lined up, mostly in the SME segment. The largest is Suraksha Diagnostic Limited, aiming to raise Rs. 846 crores, though it saw a muted start with just 11% subscription on the first day.

PRIVATE EQUITY AND VENTURE CAPITAL:

This week saw limited activity in the PE and VC space, with only $116.8 million raised across 19 deals, down from 22 deals last week. Key highlights included Singapore-based Temasek Holdings receiving regulatory approval to acquire a stake in Rebel Foods. Other notable deals included HealthQuad and partners investing $14 million in Beta Drugs, and Indore-based Candytoy Corporate Pvt. Ltd. securing $13 million in Series A funding led by 26 investors, including Abakkus Asset Managers. Meanwhile, the M&A sector remained active with six transactions, the largest being the merger of Aster DM Healthcare Ltd. and Quality Care India Ltd. to create one of India's largest hospital networks.

REAL ESTATE:

The debt investment of Edelweiss Financial Services in Mumbai-based real estate developer Paradigm Realty has been exited, mainly through sales cashflows and partially via a Rs. 135 crore debt facility.

FIXED INCOME:

Bond markets globally saw a rally this week. The US 10y yield fell 10bps to 4.17% while the 2y yield came off 12bps to 4.15%. 10y yields in the UK and Eurozone too fell anywhere between 10 to 18bps. The yield on the India benchmark 10y fell 13bps to 6.74% this week, the fall coming after the dismal Q2 GDP print, which has raised expectations of a rate cut in February. The rates market also rallied. 1y OIS came off 5bps to 6.51% while 5y OIS came off 21bps to 6.05% The RBI monetary policy is due on Friday, 6th December. While the RBI may not cut in the coming week, it may prepare the markets for a possible rate cut in February, given that growth has slowed down dramatically. India's April-October Fiscal deficit was 46.5% of the full-year target compared to 45% for the same period last fiscal. The government seems on course and maybe even better than the budgeted fiscal deficit target of 4.9% for FY25.

FX and Commodities

FOREIGN EXCHANGE:

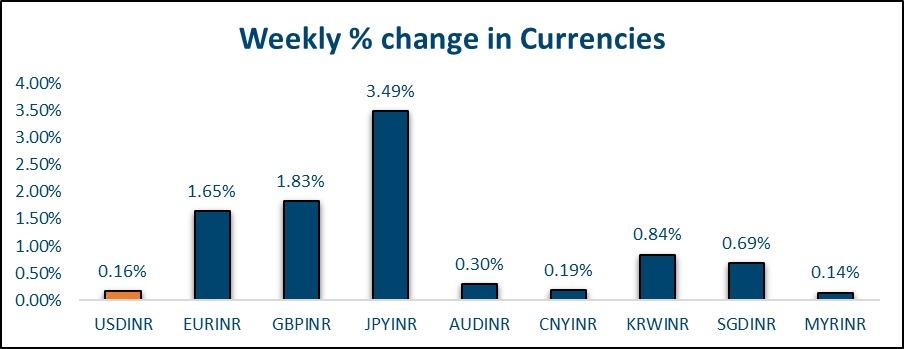

All G10 currencies except CAD (-0.2%) strengthened this week against the Dollar with JPY (+3.35%) being the best performer. Euro (+1.5%) and Pound (+1.6%) also recovered this week Asian currencies all strengthened against the Dollar this week, except the Rupee which ended the week flat at 84.49 after having strengthened to 84.22 intraweek. THB (+3.35%) was the best-performing Asian currency. 3m ATMF implied volatility jumped 50bps to 2.90% as we got out of narrow ranges we had been seeing intra-session of just 1-3p 1y forward yield ended 9bps higher at 2.25% Rupee weakened 3p to 11.66 against the Offshore Yuan and is trading almost in the middle of the 11.40-12 range. FX Reserves fell USD 1.3bn in the week ending 22nd Nov to USD 656.6bn. It was the eighth straight week of drop in Reserves.

COMMODITIES:

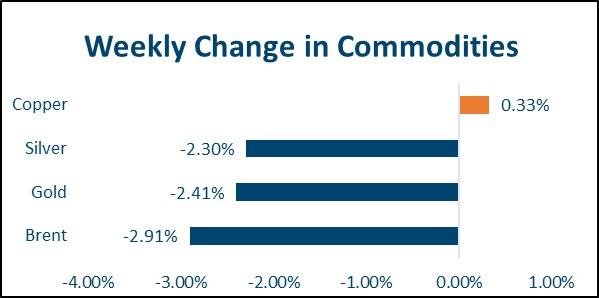

Precious metals had a weak week with gold coming off 2.7% and silver 2.3%. Brent came off 3% this week to USD 73 per barrel. US Natural gas on the other hand extended its rally, rising another 7.5% this week. It is up almost 50% since mid-October. Copper was up 0.5% this week, ending a streak of 8 consecutive weekly losses. Aluminum was down 1% this week.

Ideas and Opportunities

WHAT WE LIKE:

Equities: We remain bullish on the Nifty index with a stop of 23800. Price action this week was encouraging as the sell-off on expiry day did not sustain and the December series began on a positive note. We were a bit skeptical about Midcaps and Smallcaps. Despite the broad market outperformance this week we prefer to express the long view through the benchmark Nifty50 index.

FX: If Euro closes the next week above 1.06 post the US jobs data, we could possibly have seen the bottom in the medium term. A break below 1.05 again would keep doors for parity open on the other hand.

Fixed Income: We were waiting for a break of 6.90% on 10y to change our long-duration view. Given this week's price action we continue to remain bullish. A break below 6.70% this time could trigger a few stops. The key trigger would be the RBI monetary policy.

Commodities: We continue to hold our bearish view on Brent with the possibility of the USD 70 per barrel mark being retested soon. We continue to remain bullish on precious metals despite the recent correction.