Multi-Asset Weekly Newsletter

24 November 2024 | By IFA Global | Category - Market

Weekly Newsletter

Global Developments & Global Equities

DATA DIVERGENCE BETWEEN THE US AND OTHER MAJOR ECONOMIES BECOMES MORE STARK

High-frequency indicators are increasingly pointing towards a stark difference in sentiment and business outlook between the US and the Rest of the Major economies. Data divergence is resulting in expectations of monetary policy divergence. This is evident in how Bond yields and the Dollar moved this week. OIS implied probability of a 25bps cut by the Fed in December 18th policy has moved down further to 36% from 40% last week. On the other hand, there is a 50% chance that the ECB may cut rates by 50bps in the December meeting By Oct'25 while the Fed is expected to lower rates by 60bps, ECB is expected to cut 150bps, and BoE by 70bps.

NIFTY V/S GLOBAL MARKETS

US and European equity indices had a good week. S&P500 rose 1.7% this week. The broader index of European equities rose 1.1%. Shanghai composite (-1.9%) and Hang Seng (-1%) underperformed.

Domestic Equities

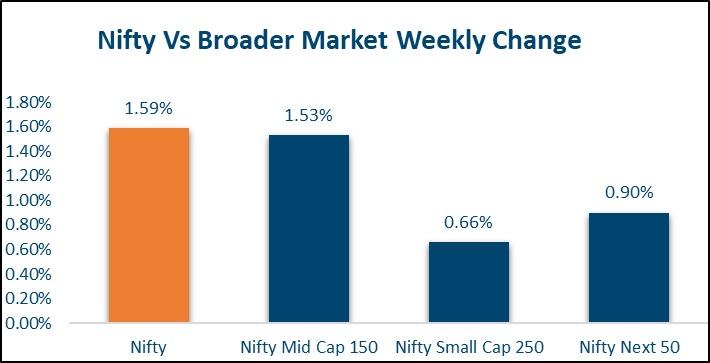

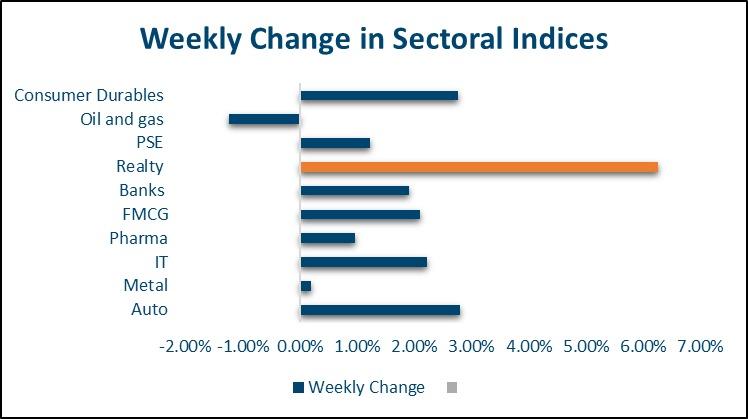

Nifty ended the week 1.6% higher this week despite the setback for Adani group on SEC indictment for alleged bribery. Adani Enterprises stock fell 21% this week. Midcap and Smallcap indices rose 1.8% and 0.7% respectively. Realty index came back strongly, rising 6.3% this week. Banks, FMCG, Auto, and IT indices rose between 2-2.8%. The energy index was the worst performer, dropping 1.4% this week. FPI outflows from equities halted this week. FPIs have sold a net of USD 3.1bn in November so far.

Fixed Income, IPO, and Institutional Deals

FIXED INCOME:

Sovereign 10y bond yields in the UK and Eurozone came down much more (7-13bps) than 10y US treasury yield. US 10y ended the week 1.4bps lower while 2y yield ended 9bps higher. On the other hand, 2y yields in the Eurozone and the UK fell anywhere between 9-17bps. The yield on the benchmark 10y ended 0.5bps higher this week at 6.87%. 1y OIS ended flat at 6.56% while 5y OIS ended 6bps lower at 6.26%. Dollar outflows have resulted in banking system liquidity coming back to neutral. Overnight call fixings have moved higher and yesterday happened above the MSF rate at 6.84%. 3m T-bill yield is at 6.45% while 12m T-bill yield is at 6.61%.

PRIVATE EQUITY AND VENTURE CAPITAL:

Fundraising activity gained momentum this week, driven by two major deals. A total of $570 million was raised across 22 deals, the same volume as last week. Indian quick commerce giant Zepto secured $350 million in funding, with participation from prominent Indian family offices like Taparias, RP Goenka, and Cello, in a round led by Motilal Oswal AMC. The second-largest deal was Healthkart, a nutrition platform, raising $153 million led by ChrysCapital and Motilal Oswal Alternates. The M&A segment saw limited activity, with only four major announcements. The largest deal involved Mavco Investments and Avenue Capital Group funds acquiring an international print solutions provider for approximately $490 million.

INITIAL PUBLIC OFFERING (IPO):

Amid heightened volatility in domestic equity indices, Zinka Logistics saw a decent response, being oversubscribed by 1.85 times and listing with over 2% gains. The highlight of the week was NTPC Green Energy's IPO, aiming to raise ₹10,000 crores, which was oversubscribed 2.4 times with a current GMP of ₹1.85. Additionally, six smaller IPOs are set to open for subscription this week, with fundraising targets ranging from ₹50 crores to ₹350 crores.

REAL ESTATE:

Bengaluru-based real estate developer, Shriram Properties, aims to expand its development portfolio from 18 million sq. ft. to 30-35 million sq. ft. by FY 2026-27. The company plans to invest approximately ₹350 crore in new projects over the next three years.

FX and Commodities

FOREIGN EXCHANGE:

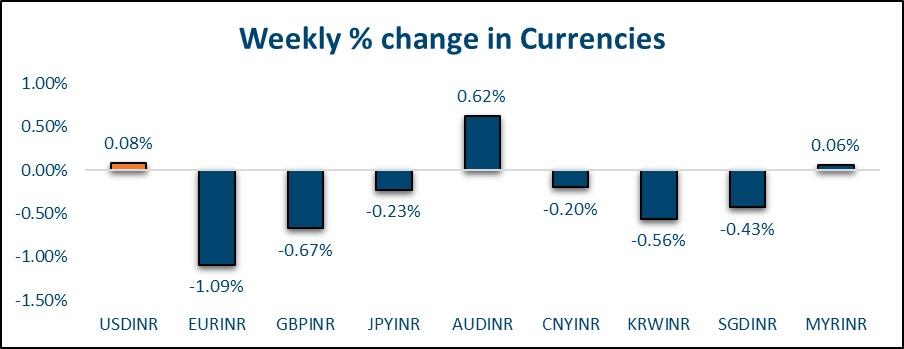

Among G10 currencies, commodity currencies outperformed this week. CAD (+0.8%) was the best performer with AUD (+0.6%) being the second best. Euro dropped 1.1% this week (3rd successive week of fall) on disappointing November PMI prints. Services PMI slipped into contraction territory and manufacturing PMI too came in lower than expected. The pound too fell 0.7% this week as October Retail sales came in much weaker than expected. UK November PMIs too came in lower than expected. On the other hand, US Nov Services PMI beat expectations and jobless claims too came in lower than expected. This highlights the data divergence between the US and the rest of the major global economies, which is leading to expectations of policy divergence and in turn resulting in Dollar strength. Few Asian currencies saw some respite this week. THB (+0.7%) was the best performer this week. The rupee was almost flat, weakening 4p this week. FX Reserves fell USD 18bn in the week ending 15th Nov. Though part of the fall can be attributed to the valuation effect, it reflects the pressure of outflows the central bank has had to contend with to ensure a stable Rupee. The rupee strengthened marginally against the offshore Yuan to 11.63 this week and continues to remain in the middle of the 11.40-12 band. Bitcoin rose 8% this week. It is up almost 50% in a month.

COMMODITIES:

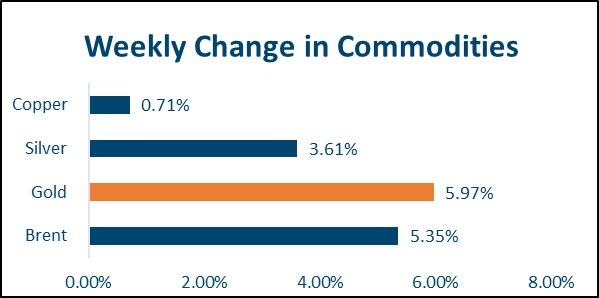

Precious metals rose this week while Gold gained 6% and Silver 3.5% Base metals on the other hand had a quiet week. LME 3m copper ended 0.4% lower while Aluminum ended 1% lower Brent rose 5.8% this week to USD 75.2 per barrel while Natural gas rose 10.8% Positioning Ideas.

Ideas and Opportunities

WHAT WE LIKE:

Equities: With a strong show by Mahayuti in the Maharashtra elections, the sentiment in domestic equities should turn around. We prefer to increase the allocation in the large-cap universe on every dip towards 23400. We may see idiosyncratic moves in the small-cap space.

FX: We may see a bounce back in crosses over the short term as the narrative and positioning seem to be a bit stretched in favor of extreme Dollar strength. The medium-term underlying trend however is that of Dollar strength and therefore we would prefer selling crosses on upticks.

Fixed Income: We continue to watch the 6.90% mark on the 10y closely, above which we would reconsider our long-duration view. On the US 10y, we are watching the 4.50% level closely. If we see a daily close above 4.50%, then we may reconsider our long-duration view.

Commodities: We continue to hold a bearish view on Brent and prefer selling on upticks. We are neutral on base metals and continue to hold our bullish view on precious metals in INR terms.