Multi-Asset Weekly Newsletter

17 November 2024 | By IFA Global | Category - Market

Weekly Newsletter

Global Developments & Global Equities

POWELL'S COMMENTS TRIGGER BROAD RISK-OFF TONE

This week's key data included the US October CPI print, which aligned with expectations at 2.6%. The October PPI print came in higher than expected. US October retail sales beat estimates but ex-auto missed expectations. Fed Chair Powell's comments that the Fed is in no hurry to cut interest rates dampened risk sentiment this week. Republicans now have control of the White House, Senate, and House of Representatives which makes passage of legislation easy. All of Trump's policies are likely to be inflationary and therefore expectations of the pace and extent of Fed cuts have been dialed back whereas that of other central banks have remained either unchanged or have risen. OIS implied probability of a 25bps cut by the Fed in December stands at 40% against 50% last week.

NIFTY V/S GLOBAL MARKETS

Global equities retraced in the week gone by. Fed Chair Powell's comments weighed on US equities with S&P500 and Nasdaq ending 2% and 3.2% lower respectively.

Domestic Equities

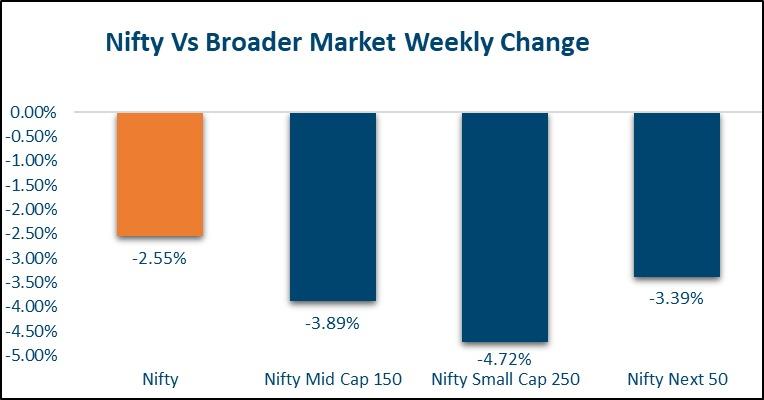

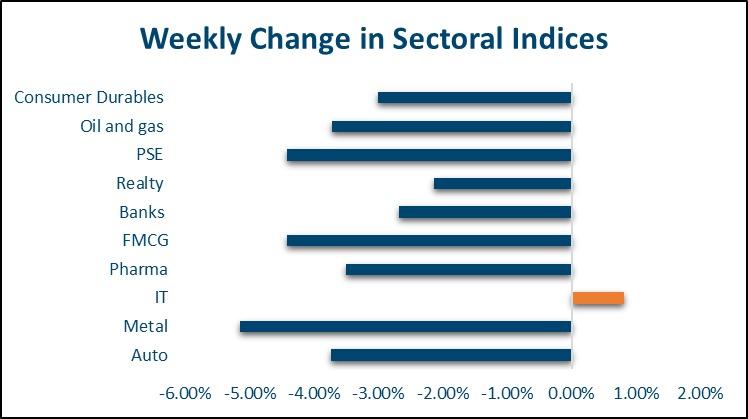

Indian equities continue to underperform. Benchmark Nifty 50 fell 2.6% this week. Broader markets saw deeper cuts with Midcap and Smallcap indices ending 4.1% and 4.7% lower respectively. Disappointing Q2 earnings have made lofty valuations seem even more unreasonable. Almost all sectoral indices except the IT index (+0.8%) saw cuts. Metals (-5.2%), FMCG (-4.4%), Oil&Gas (-4.1%), and Auto (-3.7%) were among the worst performers. Nifty is trading at a P/E of 21.7 on a trailing 12-month basis (at close to the lower end of the 20.8- 24.4 range seen YTD) FPIs have sold net USD 2.6bn in November so far, following a withdrawal of USD 11.1bn from domestic equities in October.

Fixed Income, IPO, and Institutional Deals

FIXED INCOME:

10y US treasury yield climbed 13bps to 4.44%. 2y treasury yield climbed 5bps to 4.30% this week. The yield on the benchmark 10y ended 5bps higher at 6.86%, following the sell-off in US treasuries. There were also a few more negatives for domestic bonds. It is unlikely that the central government may borrow less than budgeted borrowing for H2FY25. Oct CPI print came in higher than expected and above RBI's tolerance band of 6% which pretty much shuts down the possibility of a December rate cut. 1y OIS climbed 6bps to 6.57% while 5y OIS rose 10bps to 6.33%.

PRIVATE EQUITY AND VENTURE CAPITAL:

Some of the major developments in the PE and VC space revolve around Blackstone’s plan to acquire a stake in Haldiram at a valuation of $8 billion. In May this year Blackstone was eyeing to acquire a 75% majority stake in Haldiram but now has changed to plan to acquire a just a 20% stake. Specifically on the VC front, SarvaGram Solutions, an India rural household fund has raised another $67 in a series D funding led by Peak XV Partners as it plans on expanding its rural operations. In the M&A space, an 11% stake in the Mumbai-based real estate advisory firm Guardians is being acquired by Kunal Shah-backed prop-tech platform Blox for $12 million (Rs 101 crore). The company aims to increase its ownership to 50% over the next three years.

INITIAL PUBLIC OFFERING (IPO):

New listing in the past week comprised of the mega swiggy shares that listed at 7.7% premiums. Sagility India is also listed at a premium of 3.5% despite the overall dented risk sentiments in domestic equities. In terms of the new listings for the coming week, we have Zinka Logistics Solutions which is looking at around Rs. 1,114 crores but has received an underwhelming response by getting subscribed only 32% and the GMP standing at zero.

REAL ESTATE:

Mumbai-based Build Capital has completed fundraising for its first investment vehicle, Build Nivesh LLP, securing Rs 40 crore as targeted. Registered as a Category-II AIF with SEBI in 2020, the fund will invest in real estate projects by Mumbai developer Labdhi Lifestyle Ltd.

FX and Commodities

FOREIGN EXCHANGE:

Opening up of policy divergence between the Fed and other central banks has fuelled Dollar strength. All G10 currencies weakened against the Dollar this week. The pound (-2.3%) was the worst performer slumping to a 4-month low as UK Sep GDP, manufacturing production, and industrial production missed estimates, raising concerns over the state of the UK economy Rupee (0.0%) has outperformed amid broad Dollar strength, as expected. The rupee was flat this week while other Asian currencies weakened by anywhere between 0.2% to 2.3%. FX Reserves fell USD 6bn in the week ending 8th Nov to USD 676bn. India's October trade deficit widened to USD 27.1bn from USD 20.8bn in September. Exports rose 17.3% yoy to USD 39.2bn, the fastest pace in 28 months. However, imports hit an all-time high of USD 66.3bn.

COMMODITIES:

Brent came off 3.8% to USD 71 per barrel amid an overall risk-off tone Gold came off 4.5% to USD 2563 per ounce on broad Dollar strength. Silver too fell 3.3% this week to USD 30.3 per troy ounce. Among base metals Copper came off 4.6% while Aluminium rose 1.1% this week.