Multi-Asset Weekly Newsletter

10 November 2024 | By IFA Global | Category - Market

Weekly Newsletter

Global Developments & Global Equities

RETURN OF TRUMP IMPLIES RETURN OF VOLATILITY

Trump won the US presidential election quite emphatically. While opinion polls indicated a tight race, the outcome was far more decisive. Trump won the popular vote as well, which was quite surprising. In the coming few days, the focus will be on Trump's statements about his action plan, whom he gives key positions in his administration, and whether the Republicans also manage to get control of the lower house of parliament i.e. The House of Representatives. If Republicans do end up controlling the House, we may see that Trump's trade has further legs as it strengthens Trump's hand further by making the passage of legislation easier. Trump's election means traders/investors must brace for volatility again. We saw a glimpse of that in the past week. Overall, Trump's policies are likely to boost economic activity and are likely to be inflationary. It will have a bearing on how fast and deep the Fed could cut rates. That should be positive for equities, negative for bonds, and positive for the Dollar. There could be concerns about his policies putting US government finances on an unstable path which is negative for bonds again. His policies would certainly be protectionist. The extent is what remains to be seen. Thus it would weigh on the currencies of countries that are major exporters to the US, particularly China and Mexico. The Fed cut rates by 25bps this week to 4.50- 4.75%. The probability of a December cut stands at 60%. China announced a USD 1.4tn package over five years to tackle local governments' hidden debt problems. It has signaled more economic support next year, actively using the available deficit space.

NIFTY V/S GLOBAL MARKETS

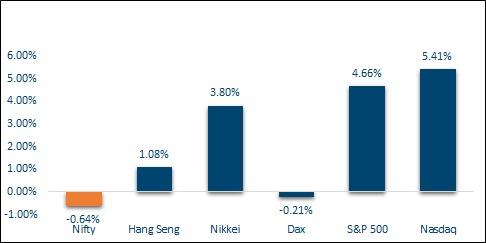

US equities outperformed on the US election outcome. The possibility of corporate tax cuts buoyed sentiment. S&P500 and Nasdaq rose 4.7% and 5.8% respectively to end at new record highs. Asian equities gained as well, piggybacking on gains in US equities. Shanghai Composite gained 5.5% while Nikkei ended the week 3.8% higher.

Domestic Equities

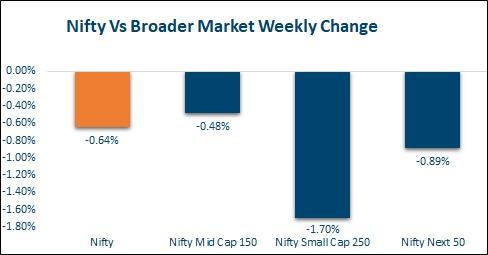

Indian equities underperformed global and Asian peers. Nifty50 ended 0.6% lower. There is rotation happening out of India. Foreign funds seem to be rebalancing their allocations and reducing India's weightage. Q2 earnings overall have fallen short of expectations. FPIs have sold a net USD 2.4bn of domestic equities in November so far after pulling out a record USD 11.2bn in October. Smallcap stocks saw deeper cuts. The Smallcap 250 index was down 1.7% this week while Midcap100 index was down just 0.25%.

Fixed Income, IPO, and Institutional Deals

INITIAL PUBLIC OFFERING (IPO):

In terms of the new listings this week, the activity was relatively muted with just one listing of Afcons Infrastructure Limited which listed at a discount of around 7% but later recovered and is currently positive. The upcoming week is up for some big listings with the likes of Swiggy set to raise over Rs. 11 thousand crores. The issue was moderately subscribed just over 3 times amidst the dented risk sentiments in Indian equities.

PRIVATE EQUITY AND VENTURE CAPITAL:

The PE and VC space remained relatively muted with just $173 million raised as compared to the $269 million raised pre-diwali week. The overall volume remained stable at around 26 deals for the week but the average ticket size shrank. The largest deal of the week was worth the $122 million purchase of Sagility India Ltd, a Bangalore-based firm, led by Adani Properties Pvt. Ltd., Avendus Future Leaders Fund II, and other funds managed by 360 One. In terms of the mergers and acquisition activity, only 5 major deals were announced with the largest one being L&T acquiring a 21% stake in an AI-focused firm (E2E Networks Ltd.) for Rs. 1,407 crores.

REAL ESTATE:

CapitaLand Investment Ltd., a Singapore-based real asset manager focused on investing in the Asia-pacific region and confirmed this week that they have wrapped up the fundraising for its latest India-based real estate vehicle after securing commitment from Daibiru Corporation (real estate subsidiary of shipping major Mitsui O S K Lines, Ltd in Japan).

FIXED INCOME:

The yield on the US 10y ended 7bps lower on the week at 4.30% after having risen to 4.47% intra-week in reaction to Trump's win, on fears of irresponsible fiscal management. The yield on the 2y treasury ended 5bps higher on the week at 4.25% on expectations that the Fed might cut at a less rapid clip. The yield on the India benchmark 10y ended 2bps lower at 6.81%. 1y OIS ended 4bps lower at 6.51% while 5y OIS ended 6bps lower at 6.23%. RBI governor said that a change in stance does not imply that a rate cut would happen at the very next meeting There are discussions around the introduction of a Secured Overnight Rupee Rate (SORR) like the SOFR to replace MIBOR, given its limitations.

FX and Commodities

FOREIGN EXCHANGE:

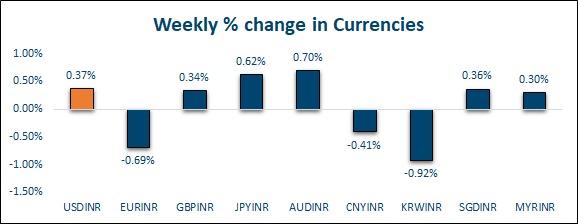

Among G10 currencies, commodity currencies outperformed this week on reflationary expectations, with NOK (+0.6%) being the best performer. Euro (-1.1%) was the worst performer. The dollar in general strengthened as Trump's policies are likely to be inflationary, which may cause the Fed to normalize monetary policy at a slower pace. BoE cut rates by 25bps this week through an 8-1 vote.Among Asian currencies CNH (-0.9%) and KRW (-1.2%) were the worst performing. Fears of imposition of tariffs on imports from these countries to at least some degree weighed on these currencies. IDR (+0.3%) was the best-performing Asian currency this week. The Rupee was in the middle of the pack, weakening 0.35% this week to fresh all-time lows. Weakness in the Yuan weighed on the Rupee. A weakening Yuan would increase RBI's tolerance for Rupee depreciation to keep Rupee competitive. The rupee has strengthened to 11.71 against the Yuan from around 12 in Sep end. 11.30-12 seems to be the range targeted by the central bank. RBI's FX Reserves have dropped from an all-time highs of USD 705bn reached in Sep end to USD 682bn in the week ended 2nd Nov. 3m ATMF implied vols continue to remain incredibly stable at 2.31% despite the spot weakness this week. 1y forward yield came off 9bps to 2.21% this week.

COMMODITIES:

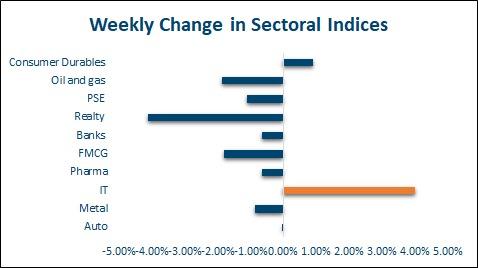

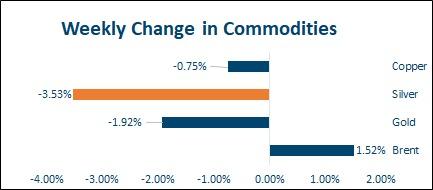

Brent rose 1% this week to USD 73.9 per barrel. Energy prices could remain capped given Trump's views on climate change and fracking, which would mean more crude output in the US. Additionally, geopolitical risk premiums could also wane and that would put further pressure on crude prices. Gold came off 1.9% this week on Dollar strength. Silver too fell 1.8%. Aluminum ended the week 0.8% higher while Copper fell 1.3%. 3m LME Copper came off from intraweek highs around USD 9782 to end at USD 9433 per metric tonne Smallcap stocks saw deeper cuts. The Smallcap 250 index was down 1.7% this week while the Midcap100 index was down just 0.25% Among sectors, IT was the best performer on hopes of an increase in IT spending in the US. Realty stocks took a beating with the index down 3.2% on the week.

Ideas and Opportunities

WHAT WE LIKE:

Equities: We may see the Nifty consolidate in the 23500-24500 range. While changes in sectoral leadership may keep the benchmark steady, we may continue to see deeper corrections in the broader markers where there still are pockets of overvaluation.

FX: We were seeing the USD weaken earlier but with Trump's win we are inclined to tone down our bearish Dollar view a bit. There could be pockets of strength and weakness as opposed to the broad-based Dollar weakness that we were seeing earlier. We see Yuan as being the main driver for USDINR. We expect the new range to be 84.10-84.55 over the coming few weeks.

Fixed Income: We believe 6.85-6.90% are good levels on the India 10y to add duration to the portfolio. We do not see a rate cut in FY25. Likewise, 4.30-4.50% seem to be attractive levels to go long on US 10y.

Commodities: With Trump's election and China's stimulus, we may see renewed traction in base metals. Energy prices may continue to remain capped given Trump's views on geopolitics, fracking, and climate change. The precious metals rally may take a bit of a breather. We however see it as a pause in the rally rather than fizzling out of the move