Multi-Asset Weekly Newsletter

3 November 2024 | By IFA Global | Category - Market

Weekly Newsletter

Global Developments & Global Equities

US ELECTION A VERY CLOSE CONTEST, EXPECT VOLATILITY ACROSS ASSETS

While opinion polls have Trump and Harris evensteven, betting markets have Trump in the lead. Trump seems ahead in key battleground states such as Georgia, North Carolina, Pennsylvania, Arizona, and Nevada and seems to be lagging in Michigan and Wisconsin. Nevertheless, the election is too close to call and therefore we can see volatility given the extremely divergent views of both candidates on key issues such as corporate taxation, global trade, climate change, and immigration. However, we expect to come out of the event with a positive risk tone eventually. We also have the Fed rate decision in the coming week. OIS market is indicating an 84% chance of a 25bps cut.

The probability of a 25bps cut in December stands at 67%. The focus will be on the expectations that the Fed sets for further rate cuts. Most US economic releases surprised on the downside this week. US Oct NFP print surprised this week, coming in at just 12k against the expected 100k. Jobs were lost in both the manufacturing and services sectors. However, the lower print can be attributed to hurricane-related disruptions. Previous print too saw a downward revision. US Q3 GDP preliminary estimate, Sep JOLTS job openings, and Oct ISM manufacturing were lower than expected. Core PCE was a tad higher than expected.

NIFTY V/S GLOBAL MARKETS

Global equities were under pressure this week. Uncertainty around US presidential elections is keeping investors on the edge. S&P500 ended 1.4% lower this week. Magnificent 7 earnings released so far have beaten expectations. Broad index of European stocks too was down 1.5% for the week.

Domestic Equities

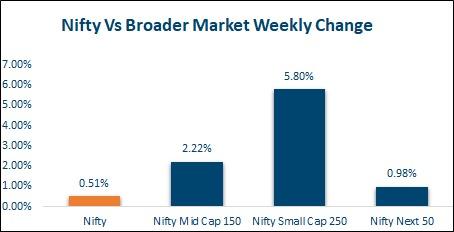

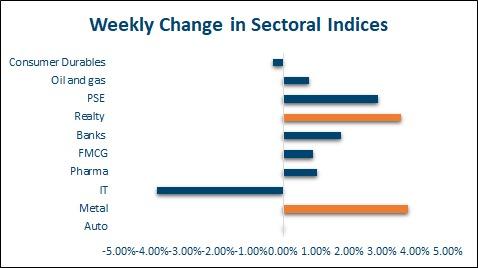

Nifty consolidated this week, ending 0.5% higher. Broader markets performed much better with the Midcap index gaining 2.2% and Smallcap index gaining 5.8%. Among sectoral indices, Realty and Metals made a strong comeback, ending 3.6% and 3.8% higher respectively. The IT index was the worst performer, down 3.8% on concerns around immigration if Trump were to become president. Earnings releases so far have been positive. SBI Q2 results are due in the coming week.

FPIs sold net USD 11.2bn of domestic equities in October, the most ever in any single month. Nifty ended October month 6.2% lower, the biggest monthly drop since Mar'20. Nifty is trading at a P/E of 23.3 on a trailing 12-month basis and 22.8 on a forward 12-month basis.

Fixed Income, IPO, and Institutional Deals

INITIAL PUBLIC OFFERING (IPO):

Waaree Energies and Godavari Biorefineries Limited were two of the major IPO listings of the previous week with the former listing 66% higher and the latter listing on a discount of around 12%. In the coming week, all eyes shall be on the mega issue of Swiggy IPO opening on 6th Nov with the issue band of Rs. 371- 390.

PRIVATE EQUITY AND VENTURE CAPITAL:

The PE and VC sectors remained fairly subdued during Diwali week. Indian beverage company Archian Foods Pvt. Ltd. aims to raise approximately Rs. 400 crore from various interested investors, including A91 Partners, Venturi Partners, and MO Alts, who have shown readiness to invest in the Punjab-based firm. The M&A market also saw limited activity. Indian gaming tech company Nazara Technologies, however, took a step toward expanding globally by acquiring a U.K.-based marketing agency for Rs. 52 crore. In addition, the Indian government is considering increased flexibility for strategic foreign investors to acquire stakes in domestic firms, following a five-year low in offshore investments. Policymakers are exploring options like allowing mezzanine investments, which combine equity and debt—a structure currently not permitted.

REAL ESTATE:

America-based real estate asset management firm Hines is now exploring residential investments on a deal-by-deal basis. Additionally, the firm is in discussions to launch an India-focused private equity fund aimed at directing capital into the property market.

FIXED INCOME:

US 10Y treasury yield rose 10bps to 4.38% while 2Y rose 7bps to 4.20% this week. Price action is being driven by fears around irresponsible fiscal management post-elections and concerns around the persistence of inflation. French, German, and UK 10y yields too rose between 12-19bps this week India's 10y bond yield was unchanged on the week at 6.85%. 5y OIS ended 4bps higher at 6.30% while 1y OIS ended almost flat at 6.55%. 1y T-bill yield was 3bps lower at 6.54% and 1y CD rates were 4bps lower at 7.46%. Banking System liquidity is in ample surplus and recent call fixings have been in the 6.50-6.61% range FPIs pulled out a net USD 500m from domestic debt in Oct. It was the first month of outflows since April.

FX and Commodities

FOREIGN EXCHANGE:

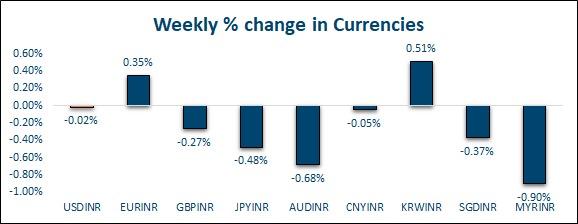

FX and Commodities Euro (+0.4%) was the best-performing G10 currency while SEK (-1.1%) was the worst-performing currency. Commodity currencies slid lower this week. KRW (+0.8%) was the best-performing Asian currency while MYR was the worst-performing Asian currency (-0.9%) Rupee was unchanged this week, ending at

84.0850. It barely traded a 4p range intraweek. Price action and volumes were impacted by the ongoing festive season.

COMMODITIES:

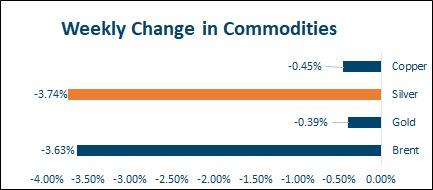

Brent dropped almost 4% this week to end at USD 73.1 per barrel. The next OPEC meeting is due on 1st Dec. OPEC+ may postpone the rollback of production

cuts. Gold retraced from all-time highs and touched intra-week to end 0.4% lower at USD 2736 per ounce. Silver saw a deeper cut, ending 3.7% lower at USD 32.5 per troy ounce. Copper came off 0.5% to USD 9570 per tonne. Aluminum ended the week 2.9% lower at USD 2600 per metric tonne.

Ideas and Opportunities

WHAT WE LIKE:

Equities:

With resilient price action in domestic equities this week, we believe a large part of the correction has already happened. However, we could see a prolonged period of consolidation. In case we see some volatility around US elections, 23600 technically seems a strong support where one can look to add exposure to the index. We prefer the Nifty50 over broader indices. Among sectors, we prefer defensives over high beta. SBI Q2 earnings this week will be in focus.

FX:

We expect the Dollar to weaken from current levels. The US economy is not too strong to cause the Fed not to cut and is not too weak to trigger a risk-off. We therefore believe we are somewhere in the middle of the Dollar smile curve which implies Dollar weakness.

Fixed Income:

We believe the current sell-off presents an opportunity to add duration to the portfolio. We see 6.85-6.90% as a strong resistance zone in terms of yield on the India 10y.

Commodities:

Crude prices could continue to head south on weak demand from China, ample supply, and as geopolitical risk premium wanes. We continue to maintain our bullish view on precious metals and target another 5-7% up move from current levels in both Gold as well as Silver