Multi-Asset Weekly Newsletter

27 October 2024 | By IFA Global | Category - Market

Weekly Newsletter

Global Developments & Global Equities

DOMESTIC EQUITIES CRACK ON LARGEST-EVER FPI OUTFLOWS IN A CALENDAR MONTH

As opinion polls and betting markets indicated that scales were tilting in favor of a Trump win, markets positioned accordingly. Trump seems to be leading in key swing states as of now.

Markets are pricing in 1.6 cuts by the Fed by the end of 2024, almost unchanged on the week. The probability of a 25bps cut in November stands at 96% while that of a 25bps cut in December stands at 67%. US data this week i.e.

PMIs and Jobless claims were stronger than expected. Focus next week will be on the US Oct jobs report due on 1st Nov.

China's parliament will hold a meeting from Nov 4th to 8th in which details of the fiscal stimulus could be unveiled. Markets will keep a close eye on whether there is any change to the budgeted deficit.

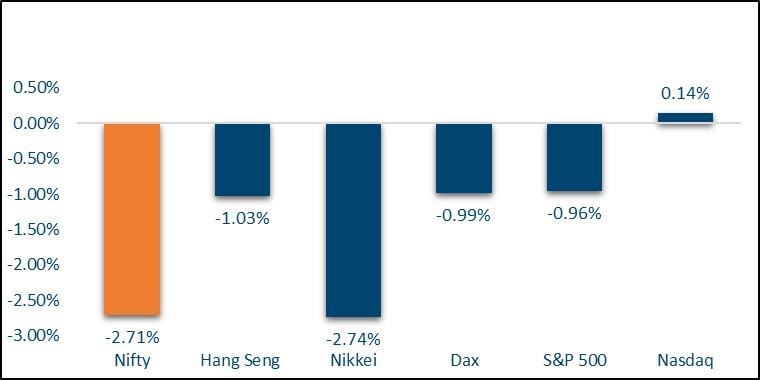

NIFTY V/S GLOBAL MARKETS

Equities globally, except China, had a soft week. Rising bond yields dampened sentiment. S&P500 ended 1% lower. Nvidia was the star, rising on solid earnings and briefly surpassing Apple to be the most valuable company. The broad gauge of European equities too ended 1.25% lower. MSCI EM index dropped 1.8% while Shanghai Composite rose 1.2%.

Domestic Equities

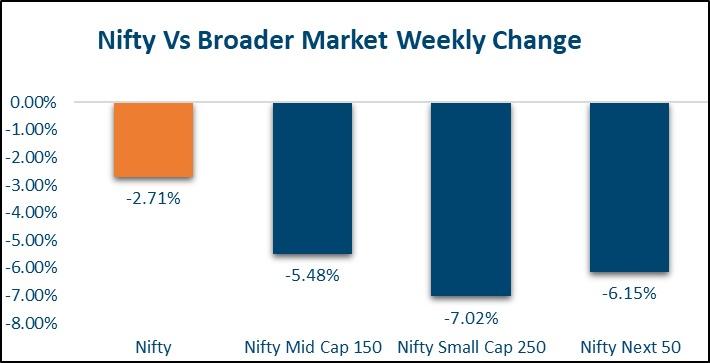

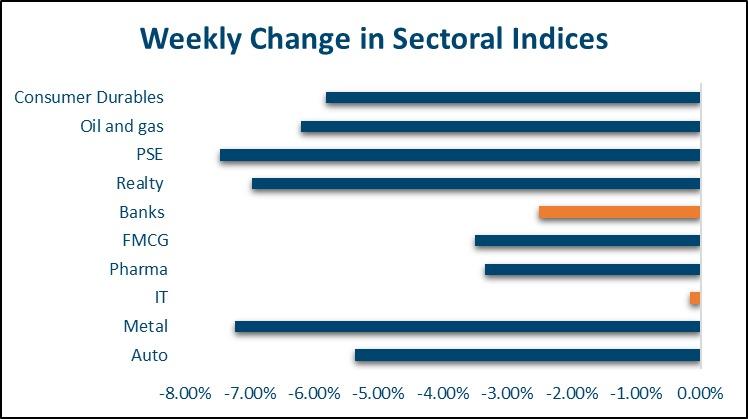

Indian equities underperformed with Nifty ending 2.7% lower. If the Nifty ends the month lower by more than 5% (currently down 6.3% in Oct), it would be the first time in 55 months that it would have done so. Losses were deeper in broader markets with Midcap and Smallcap indices losing 5.8% and 7% respectively. The midcap index had its worst week since Dec'22. All sectoral indices ended with losses. IT index which was just down 0.2% was the outperformer. Metals, Auto, and Realty indices saw cuts of anywhere between 5-7.5%.

Global fund houses trimming their underweight positions in Chinese equities and soft domestic earnings season have contributed to weakness in domestic equities. FPI has sold a net USD 10.2bn of domestic equities in Oct so far, the highest ever in a calendar month.

Fixed Income, IPO, and Institutional Deals

FIXED INCOME:

Renowned investors Stanley Druckenmiller and Paul Tudor Jones expressed pessimism on US fixed income this week, their view predicated on revival in inflation and rising deficits. Sell of in US treasuries continued. Yield on the 10y ended 4bps higher at 4.24% (highest since July) while that on the 2y ended 7bps higher at 4.10%. Yield on the benchmark India 10y ended 3bps higher on the week at 6.85%. 1y OIS climbed 5bps to 6.56% while 5y OIS rose 7bps to 6.26%. FPIs have sold net USD 600mn in domestic debt in October in general category, making it on course to be the first month of outflow since April.

PRIVATE EQUITY AND VENTURE CAPITAL:

PE and VC funding activity declined this week, with total funds raised dropping about 60% to $269 million across 15 deals, compared to $651 million across 38 deals last week. The largest deal was Elan Group securing $142.7 million from Kotak Real Estate Fund for growth capital. Another notable deal was Neysa, a Mumbai-based AI company, raising $30 million in a round co-led by NTTVC, Z47, and Nexus Venture Partners.

Meanwhile, the M&A sector remained steady, with a total transaction value exceeding $1.3 billion. The largest deal was Ambuja Cement (Adani Group) acquiring a 46.8% stake in Orient Cement (CK Birla Group) for $964 million.

Another major transaction was Adar Poonawalla's Serene Production acquiring a 50% stake in Karan Johar’s Dharma Production for Rs. 1,000 crores.

REAL ESTATE:

Mumbai-based real estate investment firm Nisus Finance announced on Tuesday the completion of its penultimate exit transaction from its structured credit Real Estate CAT II AIF. The industrial and logistics real estate sector has experienced strong demand, with absorption rates jumping over 50% in the third quarter. This growth is primarily driven by tier 1 cities, fueled by the rise of quick commerce alongside existing e-commerce operations.

INITIAL PUBLIC OFFERING (IPO):

Amidst weakened sentiment in the domestic equity markets and a lukewarm response from retail investors, the Hyundai IPO listed at a discount of around 7%. Looking ahead, there are eight listings scheduled for the coming week, with Waaree Energies and Godavari Biorefineries being the most anticipated. However, there are no new IPOs set to open this week, reflecting a muted market Diwali week.

FX and Commodities

FOREIGN EXCHANGE:

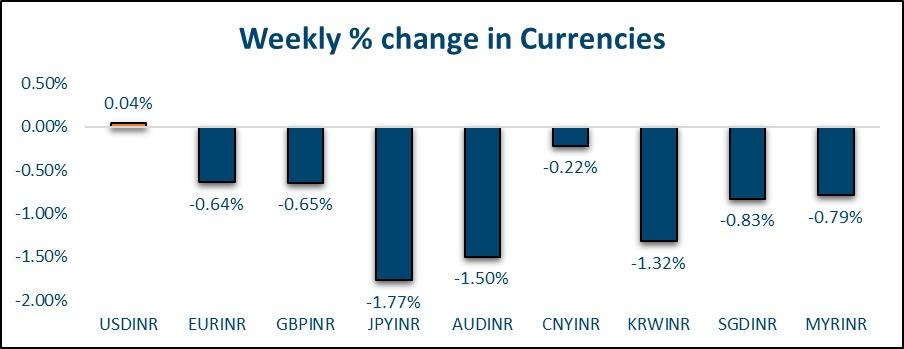

All G10 currencies weakened against the Dollar this week with Yen (-1.8%) being the worst performer. Higher US treasury yields, softening inflation in Tokyo and dovish comments from BoJ governor Ueda all contributed to Yen weakness. All Asian currencies too weakened against the Dollar. IDR, PHP, KRW, THB all weakened more than 1% against the Dollar. Rupee was the best performer, ending flat on the week. Infact, Rupee just traded a 84.05-84.09 range this week. Activity is likely to remain muted in the coming week on account of the festive season. 1y forward yield climbed 6bps to 2.27% while 3m ATMF implied volatility continues to remain suppressed at 2.30%

COMMODITIES:

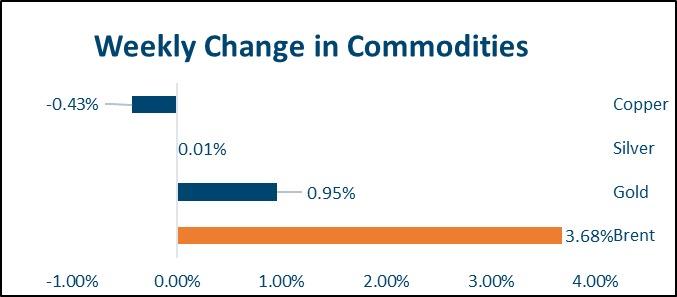

Brent ended the week 4% higher at USD 76 per barrel. Gold ended the week 1% higher while Silver ended the week flat. Among base metals Copper ended 0.2% lower while Aluminum ended 2.6% higher.

Ideas and Opportunities

WHAT WE LIKE:

Equities:

Now that the Nifty has broken through the crucial support of 24500, we could see the down-move extend to 23600. We expect the broader markets to underperform the benchmark and among sectors we expect the defensives I.e. IT, Pharma, and FMCG to outperform.

FX:

We expect the Crosses to recover and still consider the current move as a retracement rather than a reversal. We expect the Rupee to outperform amid Dollar strength and underperform amid Dollar weakness. We believe the range in USD/INR has shifted higher to 83.80-84.30 from 83.50-84.00 previously.

Fixed Income:

We believe current levels are attractive for adding duration to fixed-income portfolios. 6.85-6.90 is a key resistance in terms of yield on the benchmark 10y. One can look to gain exposure through GILT funds running a high duration.

Commodities:

Crude is likely to be driven by geopolitical risk premiums in the short term but we believe the overall trend is lower given the demand concerns. We expect the ongoing rally in precious metals, particularly silver to continue. One can look to participate in the move through silver ETFs.