Multi-Asset Weekly Newsletter

16 February 2025 | By IFA Global | Category - Market

Weekly Newsletter

Global Developments & Global Equities

DOLLAR WEAKENS, AND RISK SENTIMENT IS POSITIVE DESPITE RECIPROCAL TARIFFS, HAWKISH POWELL, AND HIGHER US CPI.

It was an action-packed week with US President Trump announcing reciprocal tariffs, PM Modi visiting the US, Fed Chair Powell testifying in Congress, and US CPI and Retail sales data coming outTrump announced reciprocal tariff. Still, vagueness around timelines of them being effective meant that markets were not spooked. The takeaway from Fed chair Powell's testimony was that the Fed is no rush to cut Rates as inflation remains elevated. The market is pricing in 1.5 cuts by the Fed by the end of 2025 Possible easing of Russia-Ukraine tensions also supported risk sentiment.

NIFTY V/S GLOBAL MARKETS

Equities overall had a good week globally. S&P500 was up 1.5%. CAC and DAX rose 2.6% and 3.3%, respectively. HangSeng gained 7% on AI fuelled enthusiasts, while Kospi rose 2.7%.

FIXED INCOME:

The yield on the US 10y was down 2bps this week. It had surged to 4.62% but ended at 4.48%. 2y yield too ended 2bps lower at 4.26% 10y Yields across Europe were 4-10bps higher Yield on the benchmark 10y traded a 6.68-6.73% range this week. RBI had increased the OMO purchase amount to Rs 40000crs given that banking system liquidity is still in a deficit of around Rs 2 lakh crores. RBI conducted a 49-day VRR as well. The market offered Rs 180000crs of securities in OMO against notified Rs 40000crs, and this helped support yields. 1y and 5y OIS ended the week 4bps and 2bps lower respectively at 6.30% and 6.09%.

FX and Commodities

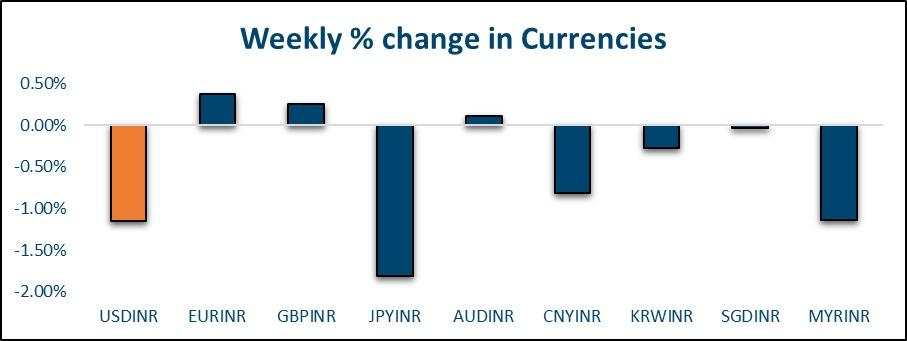

FOREIGN EXCHANGE:

Despite the higher-than-expected CPI and PPI prints and Powell's hawkish testimony, we saw the Dollar weaken against majors and EM currencies. The components of PPI that feed into PCE, the Fed's preferred inflation gauge, rose less than expected,d and therefore, it is expected that the PCE print later this month could be softer. All G10 currencies strengthened against the Dollar except Yen (-0.6%). The euro and Pound gained about 1.5% each. Among Asian currencies, SGD (+1.1%) was the best performer, followed by the Indian Rupee (+0.7%). THB and TWD underperformed and ended the week almost flat. After opening the week close to 88, RBI intervened heavily on Monday and Tuesday and simply annihilated long USDINR speculative positions.The rupee has thereafter been consolidating in the 86.65 to 86.95 zone. 3m ATMF implied volatility had jumped above the 4% mark but ended the week flat at 3.72%. 1y forward yield has been in the 2.18-2.28% range, ending the week at 2.20%. FX Reserves rose USD 7.6bn in the week ended 7th Feb to USD 638.3bn.

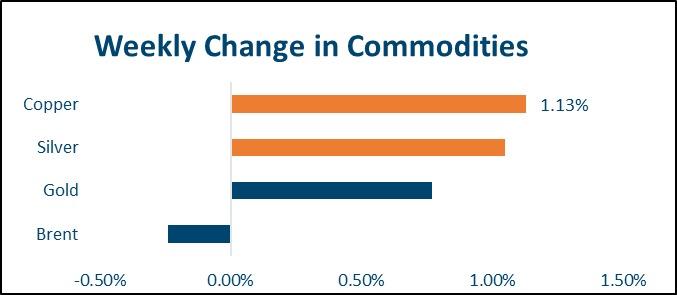

COMMODITIES:

Brent was down 0.4% for the week to USD 74.7 per barrel. Base metals had a steady week with LME Copper and Aluminum gaining 0.7% and 0.4% respectively. Precious metals continue their upward trend. Gold and Silver were up 0.7% and 0.9% respectively.