Investment Report - Sep 2023

26 September 2023 | By IFA Global | Category - Market

Domestic:

Both the manufacturing and services sectors continue to demonstrate strength and stability in their expansionary phase, reflecting strong domestic economic activity upstream.

Inflation has moderated somewhat due to a decrease in vegetable prices compared to the previous month. However, the persistent high global crude oil prices may still exert upward pressure on the headline CPI. August's CPI figure continues to exceed the RBI’s tolerance band of 2% to 6%.

The center’s fiscal deficit widened to around 34% of the full-year target just in the first 4 months of 2023-24.

The domestic trade deficit remains higher than the expectations of 21.0B.

Global:

The persistent global phenomenon of a sluggish manufacturing sector in many of the world's leading economies persists in the face of stringent monetary policies. While the manufacturing PMI in the Eurozone displayed a relatively better performance as compared to both the U.S. and the U.K., however, all three firmly remain in the contractionary territory.

The services sector has likewise faced challenges, with both the Eurozone and the U.K’s PMI falling into contractionary territory. In contrast, the U.S. stands out as an exception, as its services sector is experiencing growth. Inflation data is somewhat mixed as the inflation cooling down in the U.K. and Eurozone but rising by 20 basis points in the U.S.

The U.S. and the U.K’s trade balance narrowed down in July, whereas, the Eurozone had a trade surplus in June.

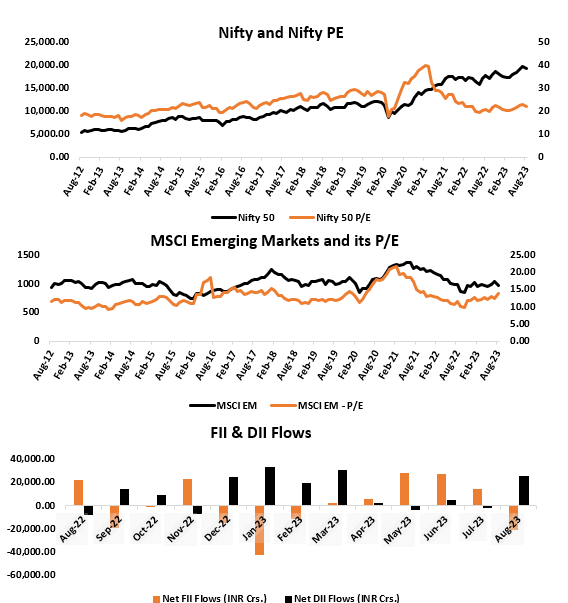

Domestic equities took a breather in August with Nifty correcting around 2.5% and its P/E contracting over 4.5%.

The fact that Nifty's P/E ratio has decreased more than Nifty itself indicates that earnings have risen, solidifying the positive macroeconomic environment and corporate profits within the domestic market.

Indian equities outshone emerging markets and experienced a significantly smaller correction. While emerging markets underwent a 6.4% correction, their P/E ratio increased by a substantial 10.7%, implying a decline in earnings.

The difference between domestic and emerging markets P/E has also reduced by over 22% making the Indian markets more lucrative for investors.

The Midcap and Smallcap indices in the domestic market showed better performance compared to the broader index, benefiting from positive risk sentiment prevailing during the month of August.

FIIs became net sellers for the first time since February 2023, but the inflows from DIIs helped mitigate further declines in the broader indices.

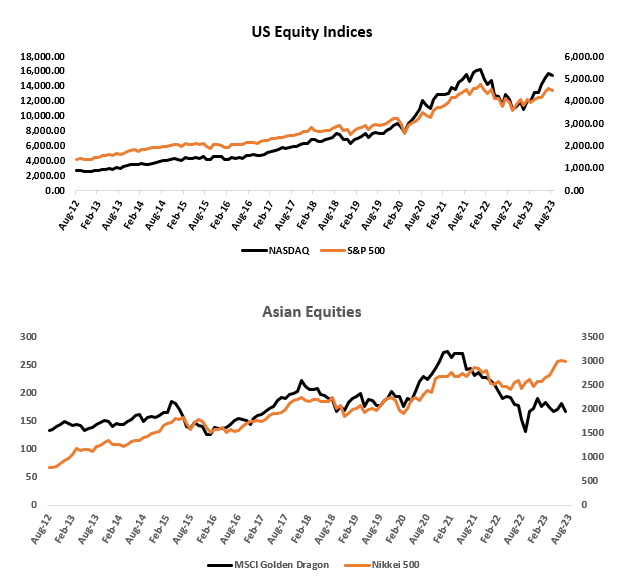

US Equities:

The headline inflation is experiencing slight upticks due to higher energy prices because of which the FED is expected to keep the interest rates elevated for longer.

This is the reason why the risk sentiments were slightly dented and the U.S. equities corrected by more than 1.5%.

The data-driven approach by the FED and firm macroeconomic numbers have reduced the chances of recession.

Nonetheless, the markets remain cautious with Powell sounding extremely hawkish in the latest FOMC.

U.S. equities can serve as a valuable tool for diversification, but the risk-reward ratio may not appear to be the most favorable when compared to other international equity options in the basket.

Asian Equities:

Asian equities have also followed the global trend and corrected in August.

The Chinese index has majorly underperformed and has shed over 7.5% as the government is eagerly trying to revive the economy with aggressive economic stimulus.

In contrast, Japan continues to be a notably safer choice for diversification through its equity market.

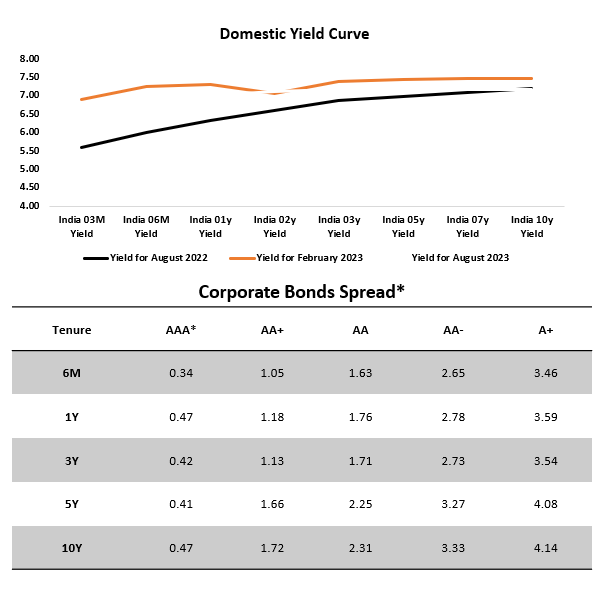

Domestic Debt:

The short-term domestic yields are marginally higher and the long-term bond yields are mostly unchanged.

The curve has become flatter and the recent domestic CPI data has triggered a rally in bonds.

The RBI is likely to be hesitant about raising interest rates to tackle inflation, as it could potentially disrupt our growth trajectory. The FED decision of a status quo has further cemented the peak of interest rate hikes in India as well despite the tone of the FOMC being more on the hawkish side.

Corporate bond yields have corrected with a slight decrease in the yield spreads making corporate bonds less lucrative.

An increase in the government bond yields has further reduced the yield spread.

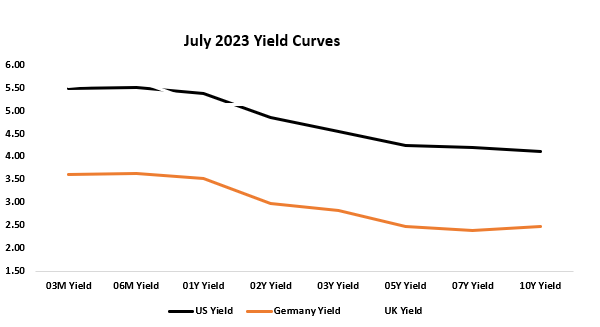

Global Debt:

Benchmark yields for both the U.S. and U.K. have slightly increased along the yield curve, resulting in a flatter yield curve compared to previous levels. Notably, long-term yields have risen to a greater extent than short-term bond yields.

German government bond yields, on the other hand, are mostly lower as the economy has entered an economic recession.

In spite of the encouraging economic data coming from the U.S., the market is not anticipating another interest rate increase by the Federal Reserve. The consensus now suggests that the terminal rate will hold steady within the range of 5.25% to 5.50%, and there are expectations of rate cuts starting in July 2024.

With the U.S. inflation marginally above expectations, the markets have priced in the FED rates to remain elevated.

Metals:

Both the precious metals ended the month marginally lower with major asset classes correcting across the board.

Gold and Silver in INR terms outperformed as the rupee traded slightly lower in August.

Brent:

Crude prices inched higher by 1.6% as voluntary supply cuts by Saudi and Russia disrupted the market forces.

Elevated crude oil prices could have a negative impact on the Indian economy, even though India is sourcing less expensive crude from Russia because the price gap between regular crude and discounted options is narrowing.

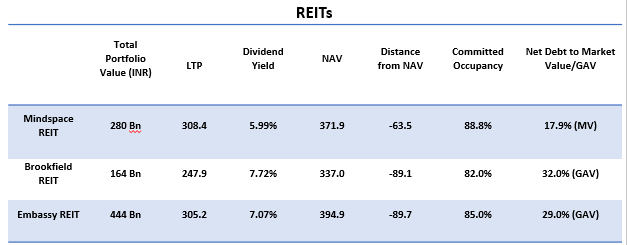

REITs:

REIT values have experienced a substantial correction, presenting a good opportunity for investors to broaden their portfolios by entering the commercial real estate market. A milder recessionary outlook could additionally enhance the potential returns from REIT investments.

The US economy continues to demonstrate resilience, showcasing positive retail sales and real estate data, even amidst the already heightened interest rates. This optimistic data allows the FED more flexibility to maintain a hawkish stance, prolonging the elevated rates.

The U.S. labor market, however, is sending mixed signals regarding the employment landscape. Initial jobless claims and NFP data reflect positivity, while hourly earnings and job openings data imply a weakening labor market strength.

Global equities have taken a moment to correct, presenting a favorable opportunity for investment due to a promising risk-reward ratio. Overall sentiments suggest a "buy on dips" approach. The anticipated Chinese economic stimulus is expected to boost global risk sentiments, positively impacting equities worldwide.

India has consistently outperformed the emerging markets in recent months, undergoing a marginal correction. Indian equities remain attractive for investors, having returned near their all-time high. A further rally of 4% - 5% is plausible.

Yields have seen an increase, but the potential for significant escalation seems limited unless there is a sustained presence of substantial inflationary pressure.

In contrast, relatively secure asset classes like Gold and Silver have experienced corrections and continue to trade sideways, indicating an increased risk appetite among investors.

The IFA Global Quantitative investment model indicates a moderately bullish inclination toward equities. Its benchmark, comprising a 60-30-10 ratio of domestic and U.S. equities, debt, and gold, the model recommends an overweight position in equities, constituting 70% of the portfolio. As per the model's quantitative factors, equity allocation may fluctuate between 40% and 90%