Investment Report - Jun 2023

21 June 2023 | Category - Market

Domestic Macros

India’s Macroeconomic Outlook: India’s macroeconomic data remains fundamentally sound and shows its resilience despite other major economies struggling with growth. Both the domestic manufacturing and services sector have remained fundamentally strong with the PMI data constantly well in the expansionary territory. Services sector having the upper hand though. The RBI’s monetary policy committee (MPC) has been effective with their policy decisions and contained the inflation well when compared to other developed economies. The primary focus will now turn to economic growth with the markets early anticipating the RBI governor to pivot rather sooner than later. The U.S’s FED rate and the FOMC’s stance will also play a vital role in forecasting when our central bank would most likely pivot.

Furthermore, the first month of the new financial year started on a positive note with the higher tax revenue subsiding the increase in government expenditure. This estimated our fiscal deficit at 7.5% on annualized basis. India’s trade balance, on the other hand, worsened as the magnitude of decline in exports overshadowed the decline in imports. The exports have now contracted for the 4th consecutive month due to weakness in the global demand and the recessionary fears looming around globally.

Global Macros

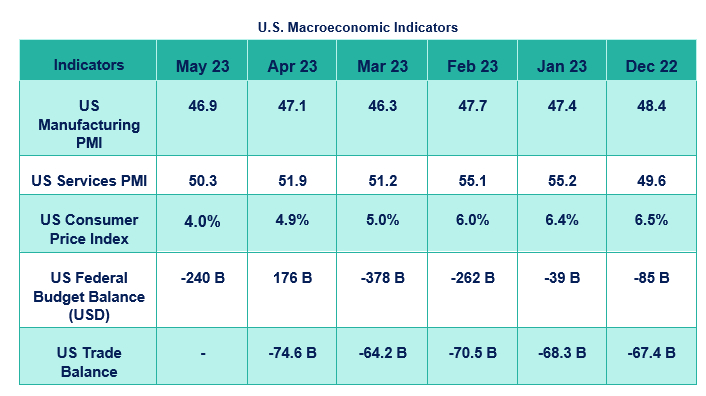

Global Macroeconomic Outlook: The manufacturing sector weakness persists with the sector contracting further in May. The services sector PMI is in the expansionary territory but the rate of expansion has slowed down showcasing the adverse effects of aggressive tightening done by the FED. However, the hawkish behavior of the FED has effectively managed to contain the inflationary pressure with the CPI cooling down to 4%. The U.S. federal budget balance has again widened to a deficit of 240 billion as tax revenues fell to USD 307 billion further reflecting the slowdown in the economic activity. The trade deficit has increased to a 6-month high as exports declined by 3.6% and the imports increased by 1.5% which could be due to the effect of dollar strengthening against the majors for the month of May.

In the Eurozone, the manufacturing sector remains under pressure, as indicated by a worsening monthly PMI data firmly placing it in contraction territory. The services sector has also started to showcase minor weakness with the rate of expansion slowing down. The preliminary CPI data suggests that inflation will subside marginally yet remain elevated above 6% despite the hawkish measures taken by the ECB. These elevated interest rates could he here to stay for longer than expected for Eurozone as inflation remains sticky. The trade balance in April worsened with the surplus turning into a deficit which could possibly be due to the EUR strengthening since the beginning of March up until April end.

Similarly, the United Kingdom's manufacturing sector remains well in contraction territory, aligning with other major economies. The showdown in the rate of expansion in the services sector can also be seen here as the PMI falls from 55.9 to 55.2. The Consumer Price Index eased off to 8.7% but is still well above the target rate of 2%. The trade deficit is on the decline since December 2022 despite the currency trading with a slight bullish bias against the USD.

Equity Outlook

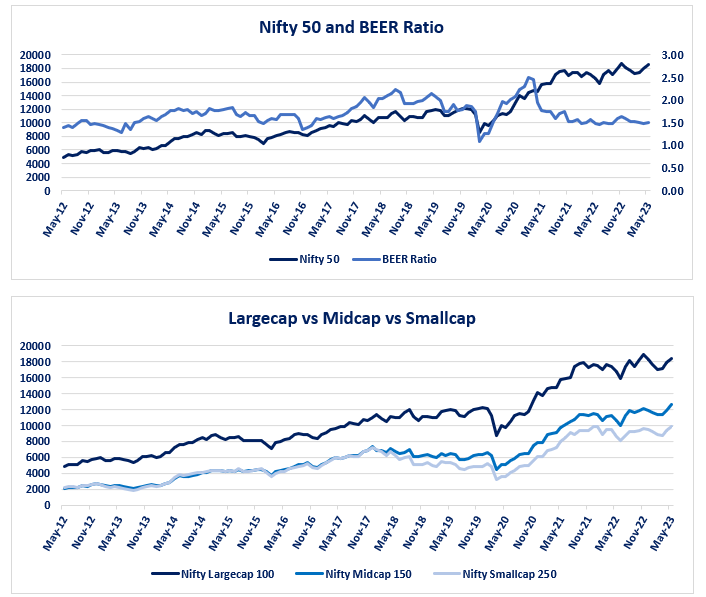

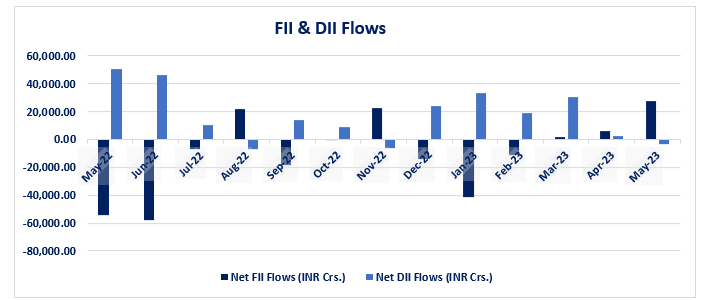

Equity Outlook: Indian equities have once again demonstrated notable resilience, outperforming the emerging markets index by a substantial margin. With a gain of over 2.5% for the month of May, they surpassed the MSCI EM, which recorded a negative return of 1.9%. This impressive achievement can be attributed to the significant influx of funds from Foreign Institutional Investors (FIIs), amounting to over Rs. 27.5 thousand crores.

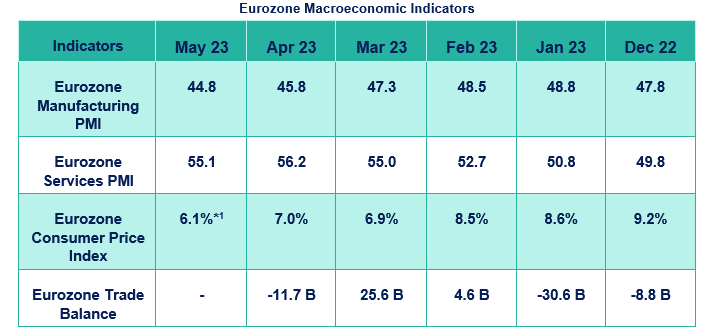

Despite a decrease in Indian 10-year bond yields, the BEER ratio has seen a slight increase to 1.51. This can be mainly attributed to the significant decrease in earnings yields outweighing the decline in bond yields. As a result, it indicates that Indian equities remain overvalued, despite the influx of smart money into domestic equities.

The gap between the Nifty price-to-earnings (P/E) ratio and the MSCI EM P/E ratio widened massively as Nifty P/E increased exponentially. The Indian equities outperformed the other emerging markets and this disparity in both their P/Es suggests that domestic equities are overvalued. This was back by the BEER ratio analysis as well.

Midcap and smallcap equity indices outperformed largecap index with IT, FMCG, and Realty sectoral indices leading the rally. However, despite the improving sentiment in the equity markets, investors should exercise caution when making equity investments due to their ongoing overvaluation when compared to the global emerging markets' P/E and BEER ratio analysis.

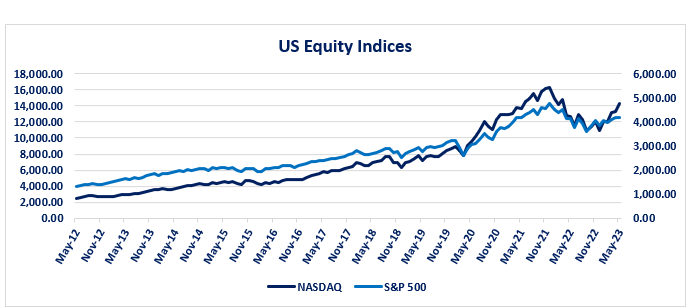

US Equity: With the overall risk sentiments improving globally and smart money flowing into equities the U.S. indices ended higher with the IT sector outperforming. The S&P 500 recorded a modest gain of 0.25%, while the Nasdaq rallied significantly with a 7.6% increase. This rally was supported by the resolution of the debt ceiling issue, as the U.S. raised the upper limit on its national debt to finance government expenditures. Given the risk-on sentiments worldwide, it presents a favorable opportunity to diversify portfolios and consider investing in international equity indices, which helps minimize overall portfolio risk. Furthermore, the long-term trend of the Indian Rupee (INR) depreciating against the U.S. dollar adds to the potential returns when investing in the S&P 500 and Nasdaq.

Debt Outlook

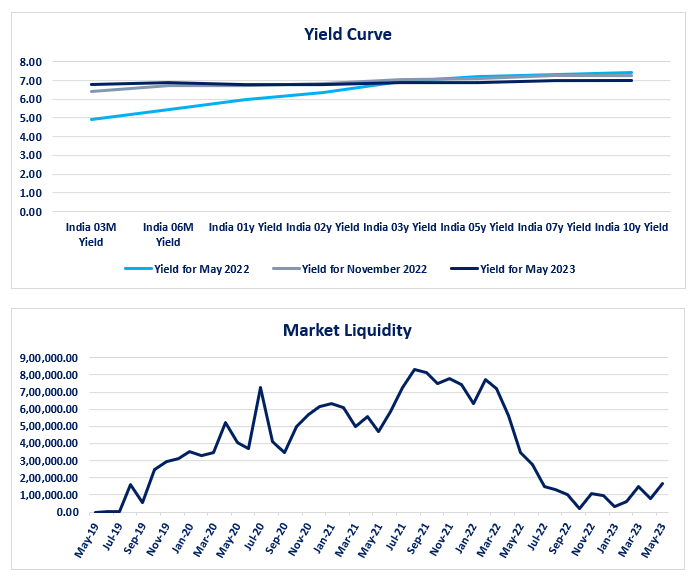

Debt Outlook: The domestic yield curve has experienced a slight downward shift as the Reserve Bank of India's Monetary Policy Committee (MPC) has halted rate hikes in two consecutive sessions. This decision was influenced by the cooling off of domestic inflation and their focus on stimulating economic growth. Additionally, the yield curve appears flatter compared to April, indicating that investors remain cautious about the long-term macroeconomic outlook and uncertainty surrounding monetary policy, as the MPC did not provide a clear indication of when it plans to pivot. The more hawkish commentary by the RBI governor could be a significant factor contributing to this cautious behavior.

With a BEER ratio above 1 and a higher yet flatter yield curve, there is an attractive opportunity to invest in 3-5 year duration bonds to potentially benefit from future interest rate cuts in the medium term. The yield spreads for AAA-rated corporate bonds have increased, making them more appealing as investment options. On the other hand, the yield on lower-rated corporate bonds has decreased on a monthly basis, which is why they remain highly risky due to the uncertain macroeconomic scenario and concerns about a possible recession. As a result, the risk-reward balance for these corporate bonds may not be favorable for slightly risk-averse investors.

Global Debt Outlook

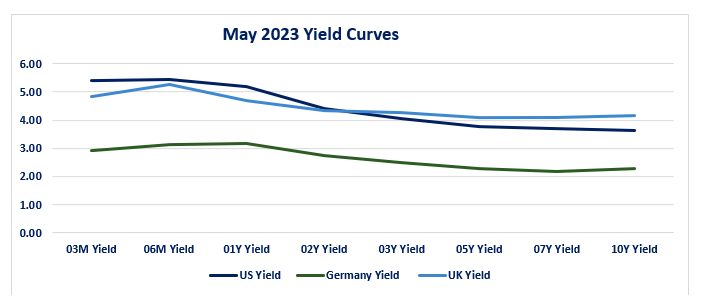

Global Debt Outlook: The yield curves across major economies have inverted further with the U.K’s yield curve inverting the most followed by the U.S. and then the German yield curve. This further increased the expectations of a minor recession in some of the most major economies in the world. The U.S. and the U.K. yield curve shifted higher due to the extremely hawkish comments by their respective central banks, whereas, the German yield curve was slightly lower primarily due to the long-term bond yields ending lower. However, the short-term yields were marginally higher due to inflation remaining sticky in Europe.

Other Asset Classes

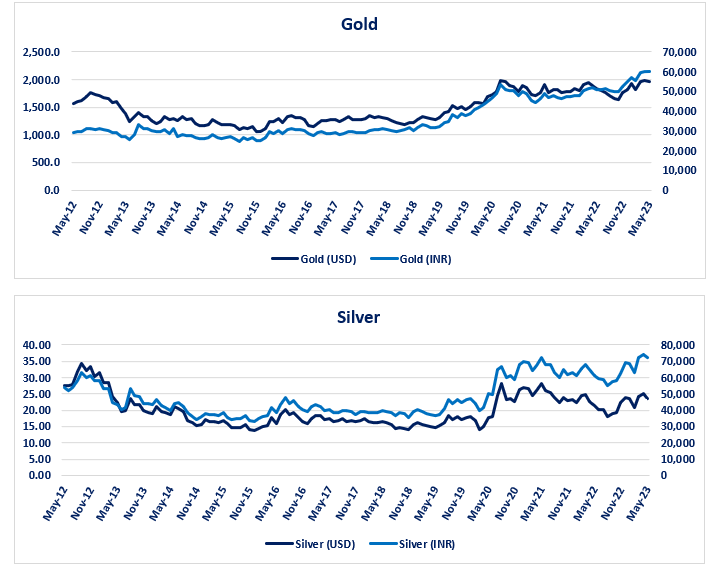

Other Asset Classes Outlook: Due to a boost in risk sentiments and increased investments in global equities, precious metals experienced a general decline in performance. Following a two-month rally, silver prices, both internationally and domestically, experienced a larger correction compared to gold prices. However, there was a notable disparity between international and domestic gold prices, as XAU/USD closed lower, while gold in INR terms ended slightly higher. This divergence can be primarily attributed to the depreciation of the Indian rupee against the USD.

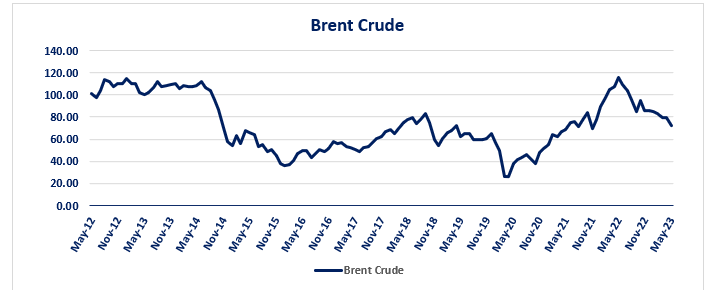

Global Brent prices as well contracted massively due to the slowdown in Chinese economic activity which further instilled recessionary fears worldwide. The downward pressure on crude prices continues despite Saudi Arabia’s decision to slash its oil supply.

REITs: All three of the REITs corrected in May as recessionary fears loomed across major economies. This means that the prices moved further away from their NAV and therefore provide a good opportunity to diversify the portfolio and invest in commercial real estate to earn from rent income. This undervaluation would pay off highly if the global economy has a smooth recessionary landing and then such investment instruments could provide higher than expected returns.

Currency: We are currently experiencing an extraordinary period characterized by low carry and low volatility in the USD/INR currency pair. Despite the 3-month carry reaching an exceptionally low level of 1.5%, the 3-month volatility has also decreased significantly to 4.1%. This combination of low carry and low volatility is highly unusual. Unlike the US Federal Reserve, the Reserve Bank of India (RBI) aims to maintain a monetary policy that supports domestic growth and inflation dynamics. As a result, interest rate differentials have narrowed, which can potentially lead to increased foreign exchange (FX) volatility.

However, the RBI's intention appears to be using its reserve buffer to manage currency volatility effectively. We have observed the RBI accumulating reserves around the 81.60 level and utilizing them to defend the 82.90 level. We anticipate that the RBI will continue to manage volatility using similar strategies in the future. With favorable current and capital account dynamics, we expect the Rupee to trade within the range of 81.60-82.90 over the next few weeks.

IFA Market Mantra

Market Outlook:

Despite central banks in major economies maintaining a hawkish stance and not providing clear indications of when they will pivot to address risk-on sentiments and curb inflation in light of increased consumer confidence, market risk sentiments have improved among investors. Many central banks worldwide have adopted a data-driven and flexible approach to counter inflation without hindering economic growth, which is why they have not been able to specify the timing of their pivot. However, considering the slowdown in economies and the onset of disinflation, we can anticipate that the peak of the rate hike cycle will arrive sooner rather than later.

Consequently, this presents an opportune moment to invest in long-term bonds with varying durations, as it is expected to yield capital gains once rate cuts commence. With a marginal increase in corporate yield spreads for AAA-rated bonds, they can offer an attractive opportunity for investors with a slightly higher risk appetite to achieve greater returns on debt.

Equities, as an asset class, remain highly risky due to the prevailing high-interest rate environment and concerns of a possible recession. On the other hand, international equities, particularly US equities, currently present a favorable opportunity for investment and further portfolio diversification, as they have undergone significant corrections and are likely to generate favorable returns in the medium to long term. Although the US debt ceiling crisis seems to be resolved for now, economies worldwide would hope for a smooth recessionary landing should the largest global economy enter a phase of recession, in order to minimize any adverse spillover effects on smaller developing economies. However, it is important to exercise caution when managing exposures to international equities, as they are highly sensitive to the current macroeconomic changes and geopolitical landscape.

Additionally, allocating a portion of the portfolio to gold and real estate investment trusts (REITs) is a prudent approach to further diversify the portfolio and mitigate unsystematic risk during a period of high inflation and economic uncertainty. Implementing appropriate diversification based on an individual's risk appetite will help maximize their risk-adjusted returns.