Investment Report - July 2023

24 July 2023 | Category - Market

Domestic:

• Both sectors remain strong with the PMI well in the expansionary territory, but the rate of growth seems to have slowed down after an extensive rally in economic activity.

• Conversely, inflation is on the rise again amidst 2 consecutive status quo decisions by RBI’s MPC. This is the first time in 4-months that average prices have shot up higher led by a spike in vegetable prices.

• Central government fiscal deficit for April-May reached Rs 2.1 lakh crores i.e. 11.8% of full-year budgeted fiscal deficit. This compares with 12.3% for the same period in FY23.

• The trade deficit narrowed to USD 20.1bn in June from a fivemonth high of USD 22.1bn in May on account of a larger drop in Imports compared to exports.

Global:

• Contrary to the services sector, weakness in the manufacturing sector across major global economies continues with Eurozone’s manufacturing sector suffering the most due to extremely tight

monetary policies across the board.

• The U.S. federal fiscal deficit has reduced but is still exponentially high as compared to the previous year. FED officials believe that government finances are not on a long-term sustainable path.

• Rapid quantitative tightening by central banks seems to be in effect with the CPI cooling down across the major countries. However, it still remains above their respective comfortable

thresholds.

• The trade deficit for both the U.S. and Eurozone has shown signs of improvement. In the U.S., imports have declined significantly, reaching their lowest level since December 2021, while exports have slightly increased. On the other hand, the Eurozone witnessed a decrease in both imports and exports, with imports experiencing a more significant decline compared to exports.

Domestic Equities

Domestic equities continue to outperform with persistent FII inflows and risk-on sentiments in global markets. Nifty and its P/E both shot up by more than 3.5%.

It gave higher returns as compared to its peers with the MSCI EM index increasing by 3.2%. On the other hand, MSCI EM P/E shot up significantly and increased the difference between India’s P/E and Emerging Market’s P/E.

Indian equity markets ended the month at an all-time high of 19,189 and signaled a technical breakout supported by a fundamentally strong economic front.

Midcap and Smallcap indices outperformed the Largecap index showcasing an increased risk appetite of the investors.

FII and DII were both net buyers in the cash markets with cumulative inflows of over Rs. 31,000 crores.

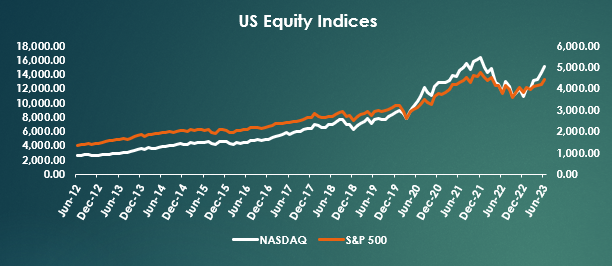

US Equities:

The U.S. inflation has continued its downtrend which is why the markets are now pricing in a terminal rate of 5.25% to 5.50% with the rate hike in July being the last one. This has bolstered the confidence of investors coupled with minimizing recessionary fears as the labor market remains solid.

Global risk-on sentiments and smart money flowing into risky assets have helped equities all over the world to rally with Nasdaq and S&P 500 both ending the month with over 6% gains.

A smooth recessionary landing and easing inflationary fears would continue the inflows in equities and given the indices are still further away from their respective all-time highs, it provides a good opportunity to invest and diversify the portfolio with all-time highs as the target.

Asian Equities:

Inflows in equities have helped the Asian equity markets recover from their recent lows with Japan’s Nikkei leading the rally among Asia’s largest economies. It ended the month around 5.3% higher.

The Chinese equity market, on the other hand, has had a major correction recently and has underperformed. But given the latest stimulus package by the Chinese government to revive the second-largest economy in the world, the upside potential should attract a lot of investments to aid growth.

The addition of Asian equities would further diversify the portfolio by providing a varied risk profile as compared to domestic and U.S. equities.

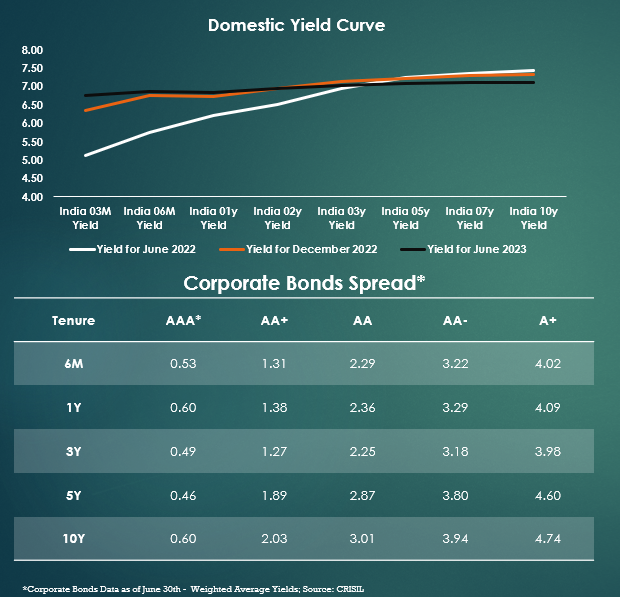

Domestic Debt:

The domestic yields are marginally higher across the curve despite the RBI’s MPC maintaining the status quo in the last 2 of their meeting and keeping the rate intact at 6.50%.

There are no indications of any further rate hikes by the RBI despite the inflation rate inching slightly higher for the month of June. Therefore, the upside potential of domestic bond yields seems capped for now.

Expectations of the U.S. interest rate decisions could change lead to a change in RBI’s stance though, that is if the FOMC decides to remain extremely hawkish and continue the hiking cycle further.

Short-term corporate bond yields have gone up as the investors seem to transfer their funds from the corporate debt market to the equity market amid risk-on sentiments.

This has provided a good opportunity to invest in higher-yielding AAA short-term corporate bonds to increase the returns on the overall debt allocation without increasing the risk of the portfolio by a high degree.

The long-term yield spread has tumbled slightly on the back of uncertainty revolving around the period when RBI decides to pivot.

Global Debt:

The benchmark yields of most major economies are primarily higher across the curve and they remain inverted with the U.S. leading the way by its inversion of over 1% (2y and 10y).

The curves have inverted further with the short-term yields rising by a higher magnitude as compared to the long-term yields.

Given the easing inflationary numbers across these developed economies, we may now expect the central banks to take a less hawkish stance which will cap any major upside tick on the bond yields.

The markets are expecting the July FOMC rate hike to be the last one and rate cuts to begin by March 2024.

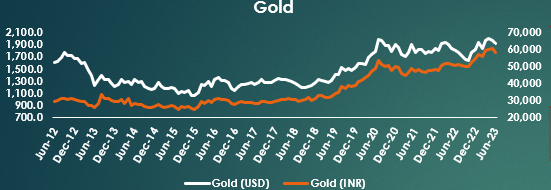

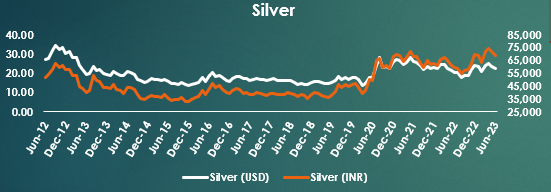

Metals:

Both the precious metals declined in June with silver underperforming gold as improved risk sentiments led to a sell-off in safe assets.

Gold and silver in INR terms further amplified the drawdown due to the rupee appreciating against the greenback

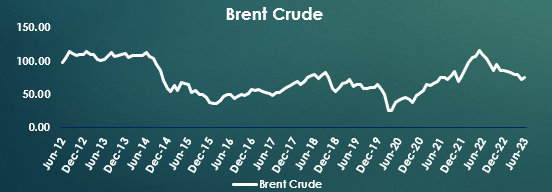

Brent:

Crude prices recovered slightly from the recent lows as recessionary fears eased out globally due to the U.S. labor market remaining resilient and corporate earnings still remaining quite solid.

Crude staying below 80 and procurement of cheaper crude from Russia is a massive boost for the domestic economy.

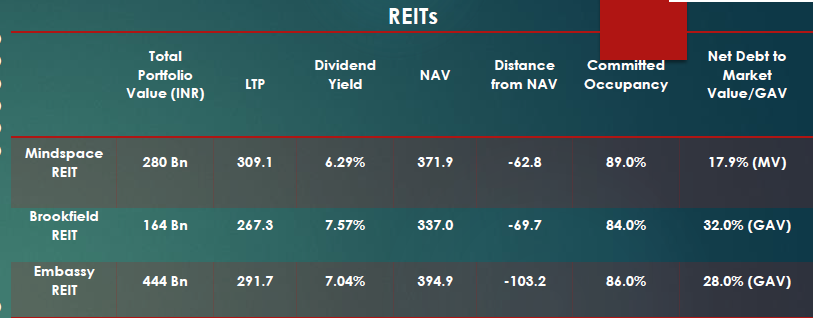

REITs:

REIT prices have corrected quite a bit and have drifted further away from their respective NAVs which provides a good opportunity for investors to diversify their investments into commercial real estate. A softer recessionary landing would further improve the returns on REITs as an investment instrument.

IFA Market Mantra

The U.S. economy remains quite resilient with a smooth recessionary landing expected amid easing inflationary fears and a sound labor market. This has improved the overall risk sentiments across the globe with the markets expecting the July 25 basis points rate hike by the FED to be the last one. It is a perfect goldilocks to which the markets have reacted well.

The smart money has started flowing into riskier assets with the equities rallying massively in June. The FII inflows have led Nifty to a fresh all-time high. International equities also seem to be on the rise, having recently corrected massively.

India is outperforming its emerging market peers due to its fundamental strength and positive economic outlook. So we can expect the domestic markets to outperform their peers and even some major developed economies.

The yields have risen but any further rise seems capped due to the change in risk environment globally.

Comparatively safer assets like Gold and Silver have come across selling pressure as smart money has begun its flow into equities.

Due to multiple such factors, our investment barometer is suggesting being overweight in equities and has increased its weightage from 60% to 70% (the standard ratio being 60:30:10 for Equities, Debt, and Gold respectively).