Investment Report - Feb 2023

22 March 2023 | By IFA Global | Category - Investment

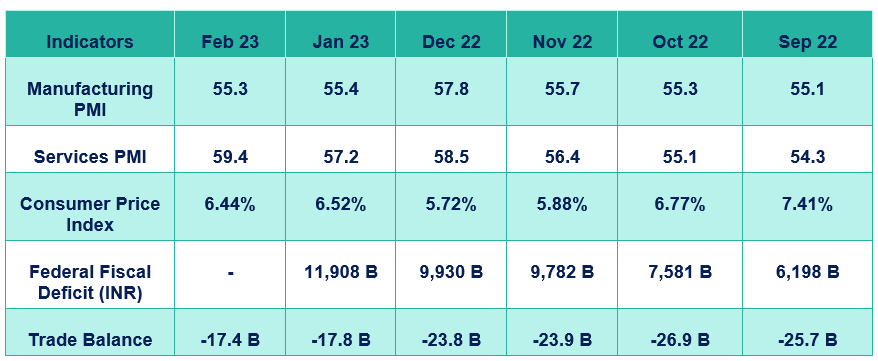

Domestic Macros

India’s Macroeconomic Outlook: The domestic PMI data is still in the expansionary territory with the services sector expanding further but the manufacturing sector slowing down in its growth trajectory. The domestic CPI has come lower than the previous month’s data point but is still higher than the comfortable level as we may expect another minor rate hike by the RBI. The federal fiscal deficit is on the rise as it saw a 20% jump since the previous month as the government continues to boost the economy through fiscal policy whilst the contractionary monetary policy aims to contain inflation. The trade balance is on the decline since October 2022 as lower import bill for the month of February could signal the slacking domestic demand for imports.

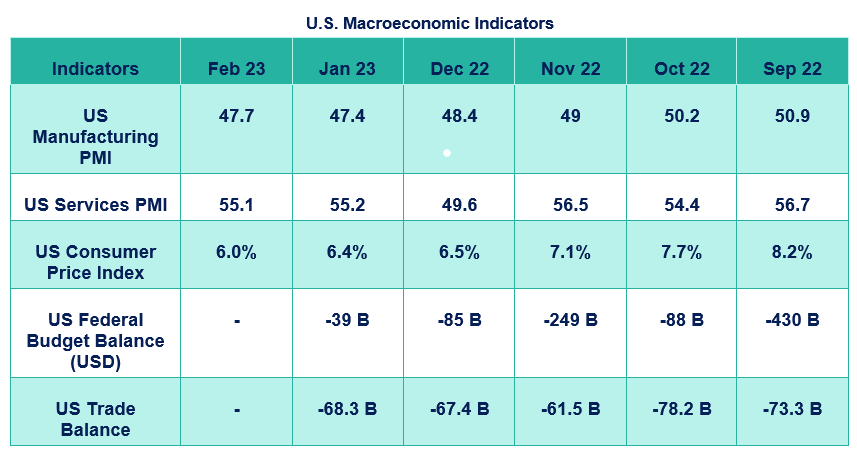

Global Macros

Global Macroeconomic Outlook: The US PMI data showcases its resilience amidst all the monetary tightening done by the FED to contain inflation. The manufacturing PMI data is marginally better than the previous month and the services PMI remains almost flat and in expansionary territory. This provides more legroom for Powell to increase the interest rates further and keep them elevated for a longer period of time to bring down the PPI inflation rate to the targeted 2%. The federal budget balance has reduced further in the month of January as the government further risks the chance of a recession in the biggest economy of the world. The US trade deficit increased marginally even though the dollar was marginally weaker.

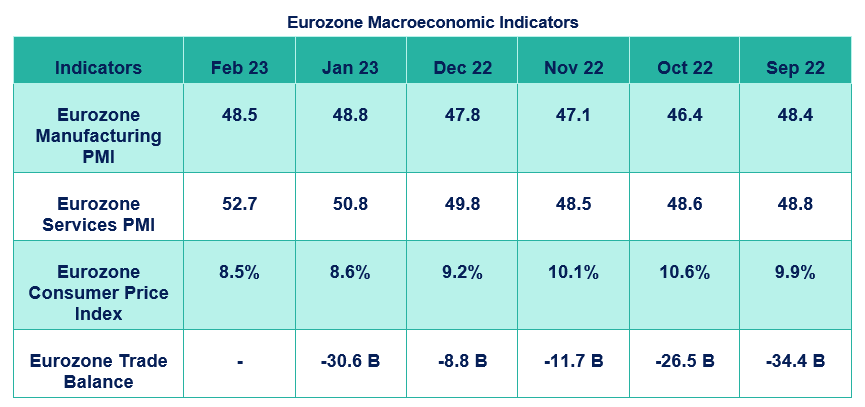

The manufacturing sector in the European economy remains a cause for concern as the manufacturing PMI remains in the contractionary territory and has actually come lower than the previous month. The services sector, on the other hand, continues to expand further. Due to ECB’s persistent hawkish stance and tightening monetary policy, the CPI in Eurozone has cooled down in the last 3 months. Its trade balance decreased by around 3.5 times amid a Euro appreciation of around 1.5% helping the importers procure goods from the international market at a lower rate.

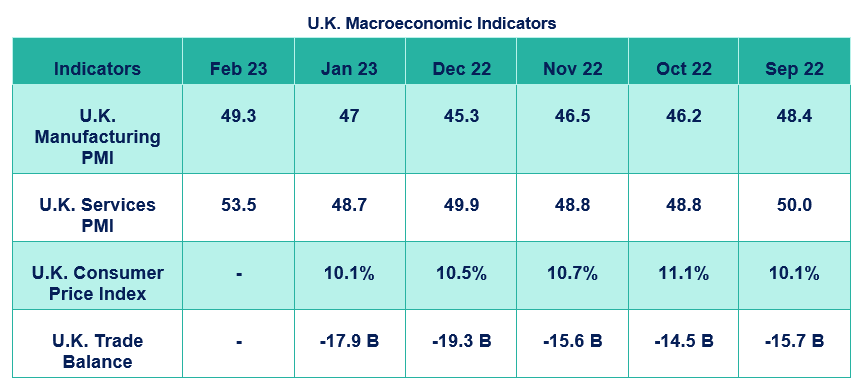

The UK economy is in a similar condition to the European economy as the manufacturing sector remains in the contractionary territory and the services sector showcases strength. Both sectors are better off when compared to the previous month’s PMI data. The inflation rate has cooled down for the past 3 months as the BoE has increased the interest rates by 175 basis points since September. The value of imports and exports both fell in the month of January but the magnitude of change in imports was much greater than exports which is why the trade deficit decreased by 7.2%.

Equity Outlook

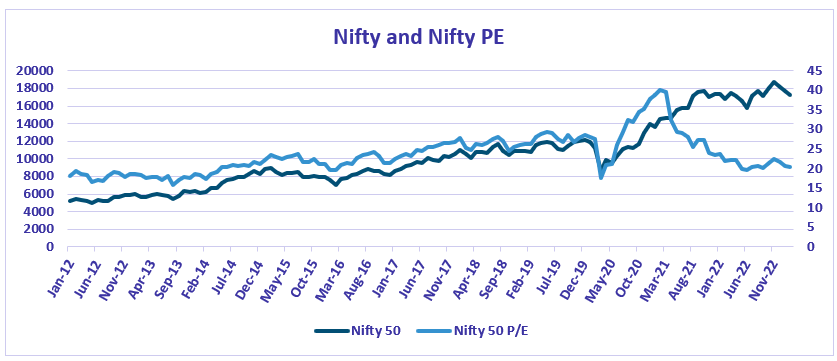

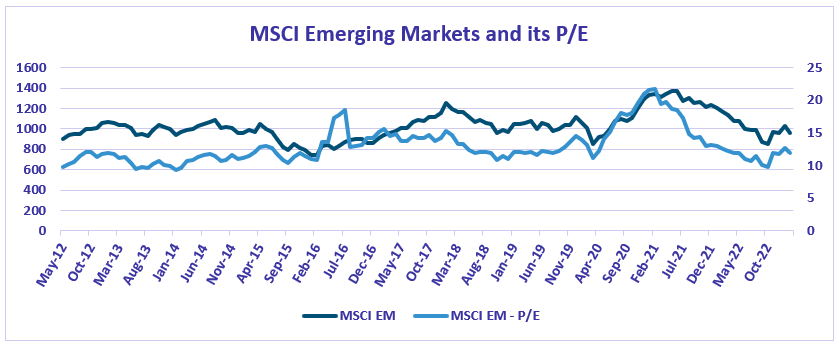

Equity Outlook: The difference between Nifty P/E and MSCI EM P/E has increased further to 8.46 which translates into a greater divergence and therefore suggests the domestic market is valued higher when compared to the other emerging markets.

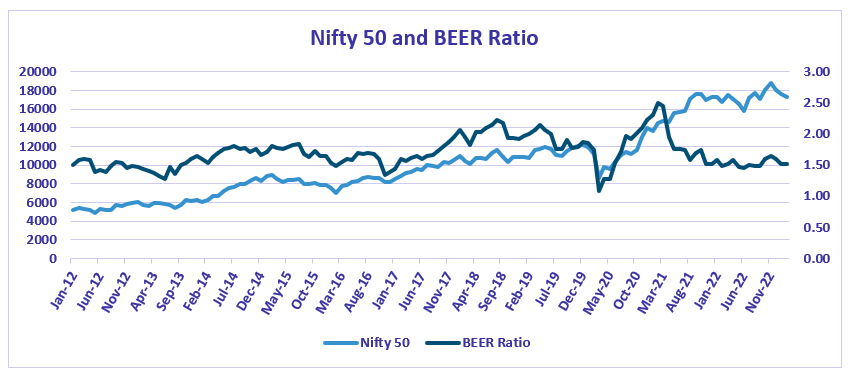

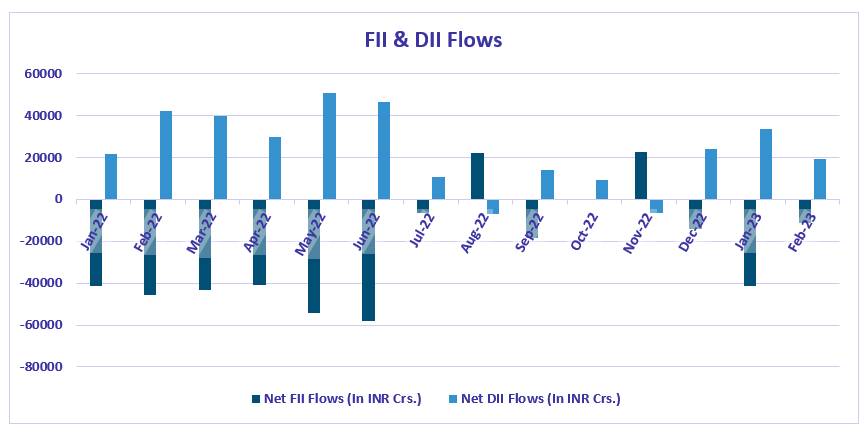

The BEER ratio has remained constant at 1.52 since January and advocates for a certain level of overvaluation in the equity markets as it has constantly been above the level of 1. This was one of the factors to justify the correction of around 350 points in Nifty in February. The markets did not see a further downside due to the FII’s slowing down the pace of their selling by a much greater degree than DII’s buying in the cash market.

An increased difference in Nifty and MSCI EM P/E alongside a BEER ratio greater than 1 suggests that equities are marginally outstretched and certainly on the higher end of the valuations which is why investors should be extra cautious when investing in this asset class. DII inflows declined in February, further cementing the chances of a correction in the equity markets in the near future.

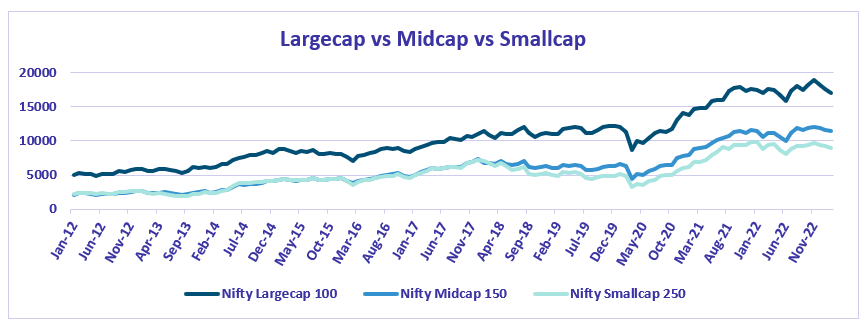

While considering the market capitalization, it can be induced that the Nifty mid-cap 150 was the best performer given the selloff in the equity market indices. The small-cap index bled the most by shedding 3.64% as compared to a 2.94% fall in the large-cap and 1.6% in the mid-cap.

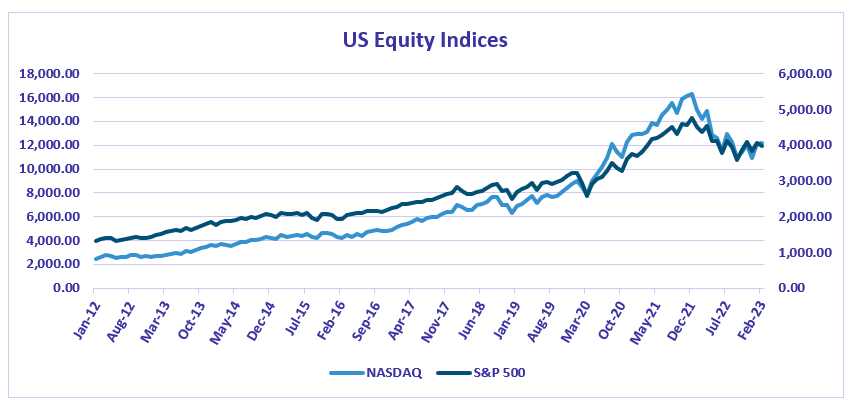

US Equity: Given how the US equity indices have fallen in recent times and entered into a bear market by falling over 20%, the direction going forward is uncertain as both the major market indices diverged in the month of February with S&P 500 shedding 2.61% and NASDAQ ending marginally higher by 0.42% The negative sentiments revolving around the US banking sector post SVB’s failure has raised concerns regarding the state of other financial institutions in the economy as this failure may lead to a domino effect and escalate this issue beyond FED’s grasp. This has, therefore, made the market participants more dovish regarding their monetary tightening expectations with 0% anticipating a 50-basis points rate hike in the March FOMC anymore and over 40% expecting a status quo.

Debt Outlook

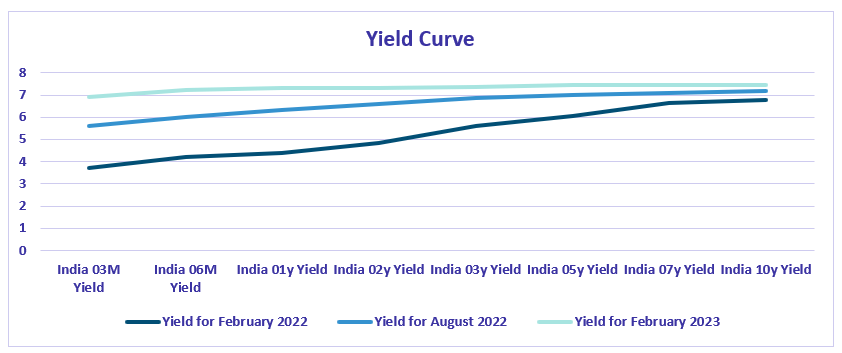

Debt Outlook: The yield curve flattened further in February due to the high levels of inflation and the Indian yields following the US bond yields with respect to the consistently Hawkish FED. A flat yield curve suggests that the market participants are expecting an easing monetary policy in the medium term as the RBI takes a dovish stance. The RBI seems to have already started to ease down its monetary pressure to contain inflation as the market liquidity has increased exponentially. Therefore, the market participants may increase their expectations of a less hawkish or a slightly dovish stance by the RBI MPC in April 2023.

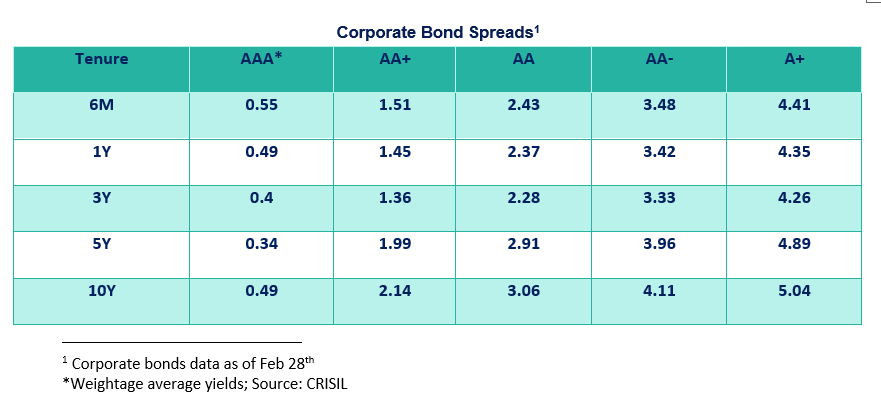

A higher and flatter yield curve alongside a BEER ratio of 1 provides a good opportunity to invest in 3-5 year duration bonds to benefit from the upcoming interest rate cuts in the medium term. Given the decrease in the yield spreads for AAA-rated corporate bonds it is wiser to invest in G-sec bonds. Investing in lower-rated corporate bonds will increase a certain level of equity risk and should be avoided given the ongoing recessionary fears.

Global Debt Outlook

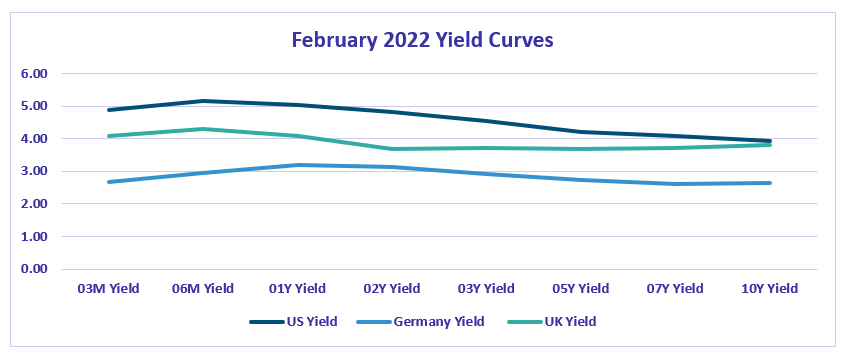

Global Debt Outlook: The US and Germany yield curves have inverted further with 06M and 01Y yields being the highest respectively along the curve. Traditionally, an inverted yield curve signals an upcoming major economic recession which is a major cause of concern for the global economy. The UK yield curve (2Y and 10Y) is not inverted currently but the 03M, 06M, and 01Y bond yields are all higher than 10Y, which suggests that the curve may get inverted soon. Even though the CPI for major economies has started to show signs of cooling down, it is higher than the comfort levels, and therefore, the central banks have maintained a hawkish stance.

Other Asset Classes

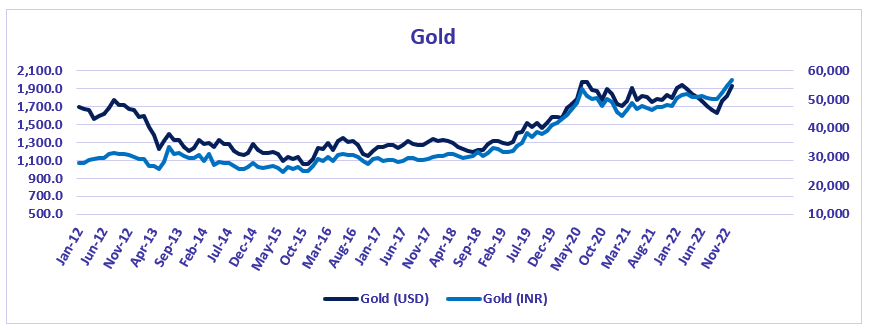

Other Asset Classes Outlook: Precious metals were lower in February as recessionary fears loomed over the global economy with high interest rates and persistent hawkish central bank stance in most major economies. Gold was down 5.3% whereas Silver was down 11.8%. Due to the rupee depreciation the downside in Gold and Silver futures in INR terms was capped as they fell 1.5% and 5.8% respectively.

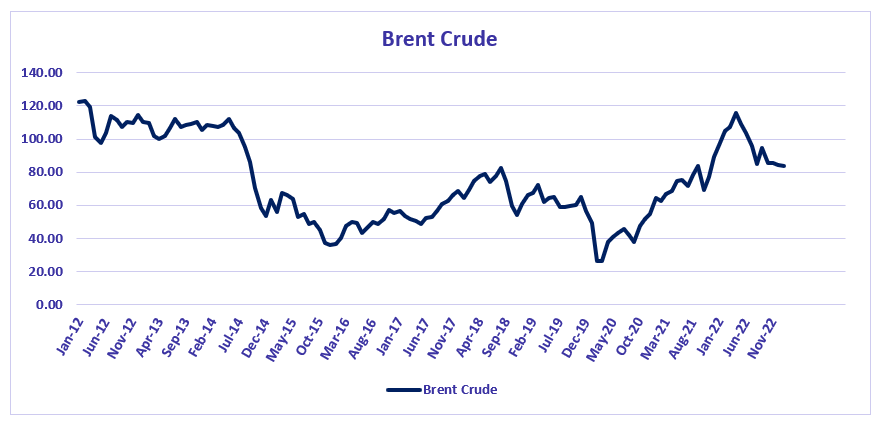

Brent has declined further on the basis of recessionary fears and strong oil supply globally. It was primarily range bound as it traded in a range of $87 to $77. The US crude inventories are on the rise which has reduced the price of WTI and increased the difference between Brent and WTI.

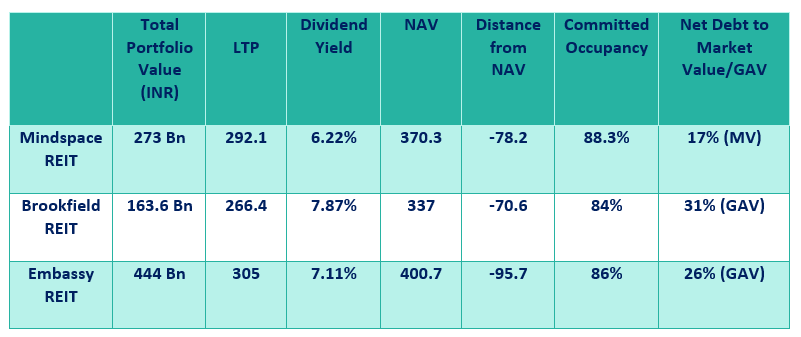

REITS: All the REITs listed on domestic stock exchanges are trading lower due to increased recessionary expectations and how it will affect the demand for corporate spaces and therefore the future cashflow of these institutions. This increase in the distance from their NAV, therefore, provides a good opportunity to invest a small proportion in these instruments and diversify your portfolio. The committed occupancy for Mindspace and Embassy has increased by a percentage point and more and their net debt to market value has decreased making these investments more lucrative at the current levels.

Currency: Rupee is primarily range bound between 82.99 and 81.62 amidst the turmoil caused in the US banking sector with Silicon Valley Bank and Signature Bank’s collapse due to the sudden increase in the interest rates. Due to this reason alongside minor weakness shown by the labor market in the US, there is a shift in hawkish expectations by the market participants as the anticipation of 50 basis points rate hike in the March FOMC are 0%.

We believe that the US treasuries will continue to be in demand in the medium term as they are considered to be the safe haven in any economic meltdown. Therefore, dollar could remain supported against majors and could strengthen against commodity currencies in particular. Asian currencies should remain under pressure but we expect the Rupee to continue to outperform.

IFA Market Mantra

Golden Month for Investors:

The month of March provides a golden opportunity to invest in debt mutual funds to enjoy extra indexation benefits and save your tax liability by up to Rs. 13.8 Lakhs (on an investment of Rs. 10 cr. and invested for a period of 3 years) when compared to the same investment done in the month of April.

The same investment done in the month of March will reduce your tax liability by a whopping Rs. 84.8 Lakhs as compared to a Fixed Deposit which does not provide any indexation benefit. This translates into a 9.2% higher cumulative return without taking any additional risk on your investment.

Market Outlook:

The latest market expectations have taken a U-turn from a hawkish FED’s outlook to a less hawkish to neutral stance altogether as the expectations of a 50 basis points rate hike in March FOMC are all the way down to 0% from 70% as on 7th March 2023. The expectations for a status quo have also increased from 0% to 41.7% in the same period. These less hawkish expectations and the economic turmoil caused because of SVB and Signature Bank’s failure to cope up with interest rate hikes should alarm the investors that further rate hikes are unlikely and quantitative easing could be anticipated sooner than we thought.

Therefore, this provides us with the appropriate opportunity to invest in multiple-duration long-term bonds to benefit from capital gains once these rate cuts begin. Given a further decrease in the corporate yield spread for AAA bonds, it is highly advisable to invest in long-term G-sec instead to avoid taking unnecessary equity risk in the current risk-off market.

Current high-interest rates and the expected recessionary fears amid this mayhem in the US banking sector equity as an asset class should the major focus of the portfolio. An increase in the P/E differential between Nifty and MSCI EM shows how the domestic markets might be outstretched towards the higher end of the valuation cycle and therefore a further correction could be anticipated. International equities, on the other hand, particularly US equities provide a good opportunity to invest currently and diversify your portfolio further as they have corrected massively and should provide a good return in the medium to long term. These exposures to international equities should however be managed cautiously as they are extremely sensitive to the current geopolitical scenario.

Investing a small chunk of the portfolio in Gold and REITs after the minor correction they have recently is also a good approach to diversify your portfolio further and mitigate the unsystematic risk in this period of high inflation and economic uncertainty. An appropriate diversification according to an individual’s risk appetite will help maximize their risk-adjusted return.

_________________________________________

*(2)Calculation based up on an annual Inflation rate of 5%