Investment Report - August 2023

25 August 2023 | By IFA Global | Category - Market

Domestic:

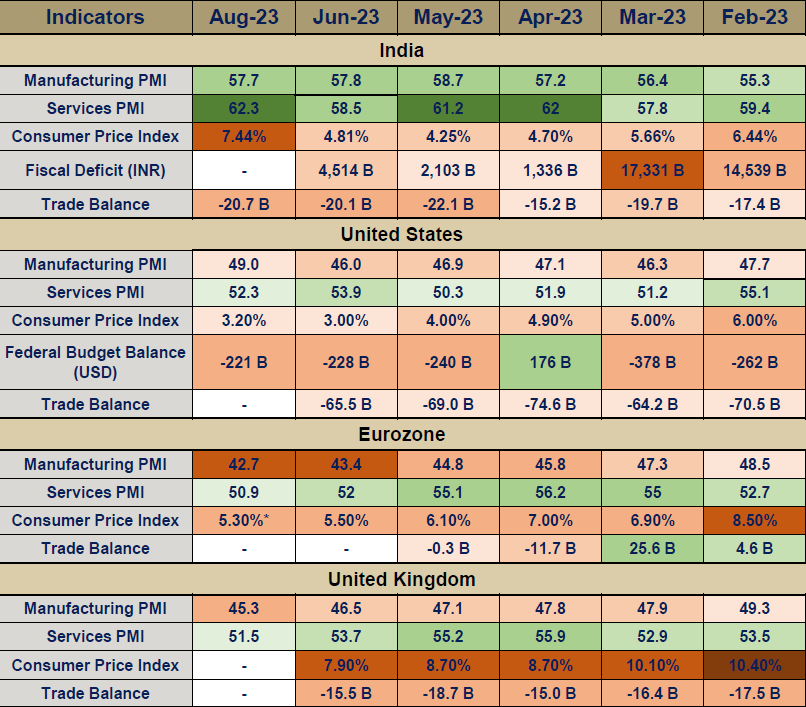

- The manufacturing and services sectors both remain resilient and well in the expansionary territory showcasing upstream domestic economic activity.

- Contrarily, the inflation has surged to a 15-month high and has breached RBI’s tolerance band of 2% - 6%. The primary reason for this is food prices shooting up.

- The center’s fiscal deficit widened despite an increase in the nontax revenues it received from the RBI. Major expenditure revolved around subsidy expenses on food and fertilizers.

- The domestic trade deficit is marginally higher but still stood lower than what the expectations of 21.0 B.

Global:

- The global trend of weak manufacturing sector in most major global economies continues amid tight monetary policies. The U.S. manufacturing PMI showed relative strength as compared to the Eurozone and the U.K. but all of them remain well in the contractionary territory.

- The services sector also felt the lagging impact of such high interest rates all over with the services PMI reducing across the three countries.

- Inflation data is somewhat mixed as the inflation cooling down in the U.K. and Eurozone but rising by 20 basis points in the U.S.

- The U.S. trade deficit improved slightly for June on the back of slight dollar weakness which must’ve helped the U.S. exporters.

Domestic equities:

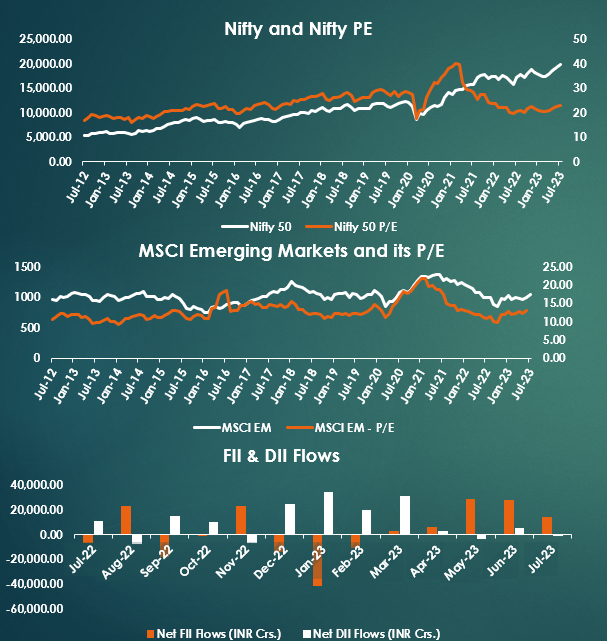

- Domestic equities continued to rally amid improved risk sentiments in July and the continued FII inflows. The DII’s however turned net sellers again after a month of buying.

- Broader India equities, however, underperformed the emerging markets as they rallied around 5.8% as compared to the 2.9% rally in Nifty.

- The domestic P/E also remains quite elevated as compared to the emerging markets (23.01 vs. 12.45) which brings up the question if we are in for a minor correction after such an extensive rally over the last 4 months.

- The domestic Midcap and Smallcap indices outperformed the broader index with positive risk sentiments looming around the month of July.

US Equities:

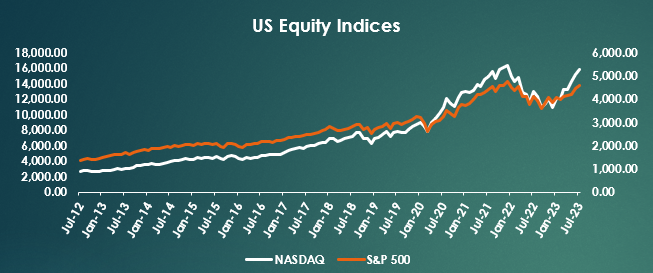

- A slight increase in the U.S. inflation had no impact on the equities as Nasdaq and S&P 500 both inched higher by over 3% each.

- The data-driven approach by the FED and positive labor market numbers improved risk sentiments as the chances of recession slimmed down even further and smart money started to flow into riskier asset classes.

- However, the recent market developments as per the FED meeting minutes triggered a slight sell-off in the risk assets as the tone remained quite hawkish despite the markets not expecting any further rate hikes by the FED.

- U.S. equities are a good tool for diversification but the risk-reward ratio does not seem the most favourable among the set of international equity basket.

Asian Equities:

- Inflows in equities have helped Asian equities as well with the Chinese equities rallying over 6% and Japanese equities ending with modest gains of 0.8%.

- The Chinese stimulus further improved the risk sentiments globally with easing recessionary fears in July but there seems to be increased fears over the growth concerns as it posted weak economic numbers.

- Japan, on the other hand, remains a much safer option with potential equity and currency returns as JPY continues to weaken against the USD.

Domestic Debt:

- The long-term domestic yields are marginally higher across the curve despite the RBI’s MPC maintaining the status quo in the last 3 of their meeting and keeping the rate intact at 6.50%.

- Despite the inflation rate edging higher in July and surpassing its upper tolerance level of 6%, the RBI does not show any signs of implementing additional rate hikes. As a result, the potential for an increase in domestic bond yields appears to be limited at this time.

- RBI will most probably be resistant to hike interest rates to contain food inflation as it might hamper our growth trajectory. Other measures like export bans and subsidies might be recommended to the government to ease out these soaring food prices.

- A potential shift in the U.S. interest rate decisions might prompt the RBI to alter its stance, particularly if the FOMC chooses to maintain an extremely hawkish approach and extend the cycle of rate hikes.

- Corporate bond yields have corrected with a slight decrease in yields as inflationary fears are on the rise again.

- This is the reason why the yield spreads are primarily lower as compared to the previous month. An increase in government bond yields has further narrowed down the spread so any additional exposure to corporate bonds could be put on hold for the short to medium term.

Global Debt:

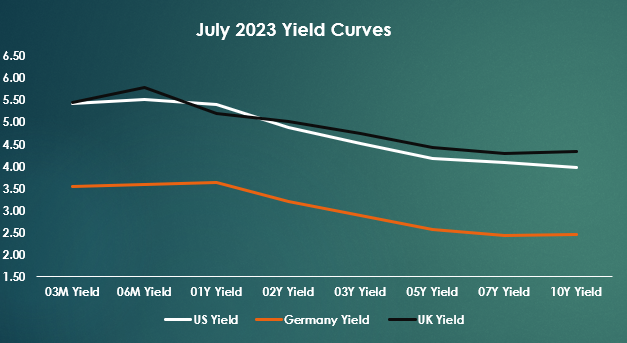

- The benchmark yields for the U.S. and Germany are marginally higher across the curve and are flatter than before with the long-term yields rising by a higher degree as compared to the short-term bond yield.

- U.K. government bond yields, on the other hand, are mostly lower with a contraction in the long-term bond yields.

After the recent rate hike by the FED, markets are not non expecting any further rate hikes despite the latest hawkish FED meeting minutes. The terminal rate is now expected to remain at 5.25% - 5.50% until the May 2024 FOMC. - Unless we see an exponential increase in inflation the FED are extremely unlikely to hike the rates further and would rather keep these elevated interest rates for a longer period rather than hiking the rates further.

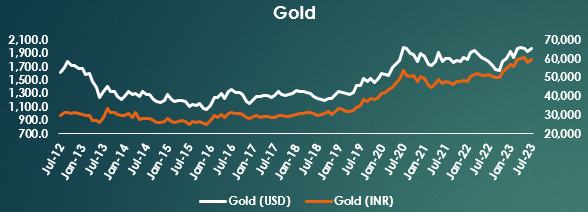

Metals:

- Both the precious metals ended the month on a positive note with inflows into commodities showcasing a divergence in global risk sentiments.

- Silver rallied over 8.5% and outperformed its fellow metal despite some safe-haven demand.

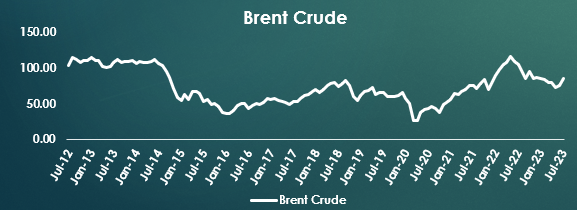

Brent:

- Crude prices shot up by a whopping 14% on the back of easing recessionary fears as China’s stimulus is expected to provide a smooth recessionary landing across major countries and not hamper the global supply chain.

- Higher crude could adversely impact the domestic economy despite India procuring cheaper crude from Russia as the price differential between regular crude and discounted one is declining.

REITs:

- REIT prices have significantly corrected, creating an appealing opportunity for investors to diversify into commercial real estate. A gentler recessionary scenario could further boost potential REIT returns.