Investment Report - Apr 2023

17 April 2023 | By IFA Global | Category - Investment

Domestic Macros

India's Macroeconomic Outlook: The domestic PMI data remains in the expansionary territory with the manufacturing PMI strengthening after a marginal decline in the month of February. The services sector, on the other hand, remains strong but has slowed down its growth on a month-on-month basis. RBI’s MPC’s status quo decision regarding the interest rates seems justified now given the headline CPI numbers have come below expectations and are at a much more comfortable level when compared to the 7.79% high of May 2022. The fiscal deficit has increased further by 22.1% as government expenditure is rising amidst fears of global recession and the contingent effect on the Indian economy due to the financial industry chaos spillovers from the U.S. economy. The trade balance has broken the downtrend which started in the month of October 2022 and the deficit has increased by 13% as the magnitude of the increase in imports was much greater than that of exports. Indian rupee strengthening in March justifies this increase in the Import bill.

Global Macros

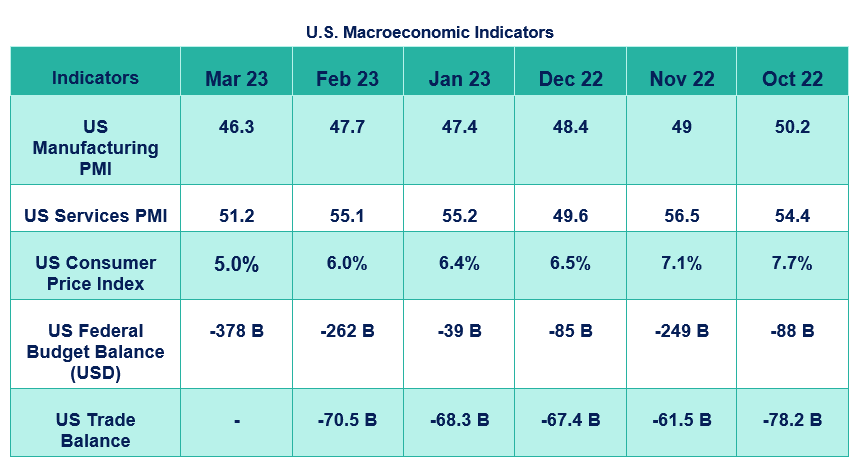

Global Macroeconomic Outlook: The US PMI data has started to show the adverse effects of rapid quantitative tightening on their economic activity as the contracting manufacturing sector shrunk further and the growth of the tertiary sector seems to be on a downward trajectory. The rapid increase in interest rates by the FED has served its purpose well so far with the headline CPI inflation cooling down more than expected suggesting the peak of the interest rate hike cycle is upon us. The federal budget balance has increased further with Medicare and Social Security contributing to the majority of outlays (spending) of $151 and $133 billion respectively. The U.S. trade balance continued its trend since November 2022 and widened its trade deficit by 2.7% as the goods deficit increased by a larger magnitude when compared to the services surplus.

Global weakness in the manufacturing sector seems to be the trend with the European manufacturing sector PMI standing at its weakest since November 2022. Whereas, the services industry is quite resilient and remains well above 50 in the expansionary territory. The inflation data is considered to continue the downward trend as the preliminary CPI estimates for March stands at 6.9%, showcasing ECB’s quantitative tightening in effect.

The UK economic activity seems to have backtracked as both the PMI data have shrunk as compared to the February data points with the Bank of England hiking the interest rates further by 25 basis points to 4.25%. Hotter-than-expected CPI data in February triggered the sentiments there as further quantitative tightening was signaled if there was any hint of persistent price pressure. The current CPI expectations stand at 9.9% and we shall get a clearer idea of the path U.K.’s economy will take on 19th April when their CPI data is due. Their trade deficit improved by 0.4 billion as GBP depreciation helped increase their exports and made imports slightly more expensive.

Equity Outlook

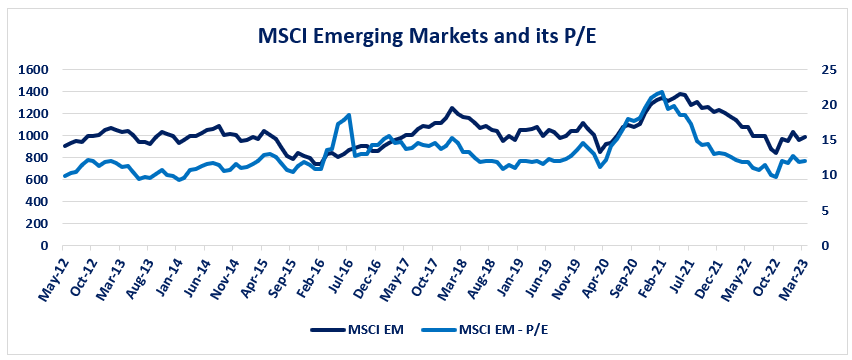

Equity Outlook: Our domestic equity markets ended the month of March with modest gains but the overall global emerging markets outperformed Indian markets. The global emerging market valuations were also in an uptrend which reduced the difference between Nifty P/E and the MSCI EM P/E by 1.12%. Yet, the Indian equity market remains to be valued marginally higher than the rest of the emerging markets.

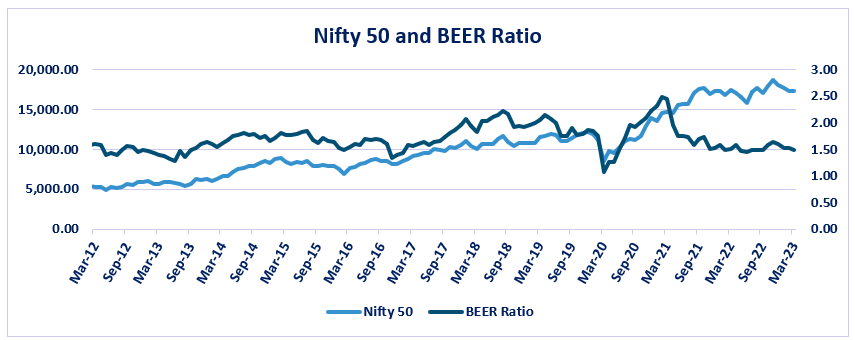

The BEER ratio is marginally lower at 1.50 from 1.52 the previous month but it is still indicating the overvaluation of equities with respect to the bond yields. This minimal improvement in the ratio is due to the magnitude of decrease in the 10-year bond yield being greater than the fall in earning yields.

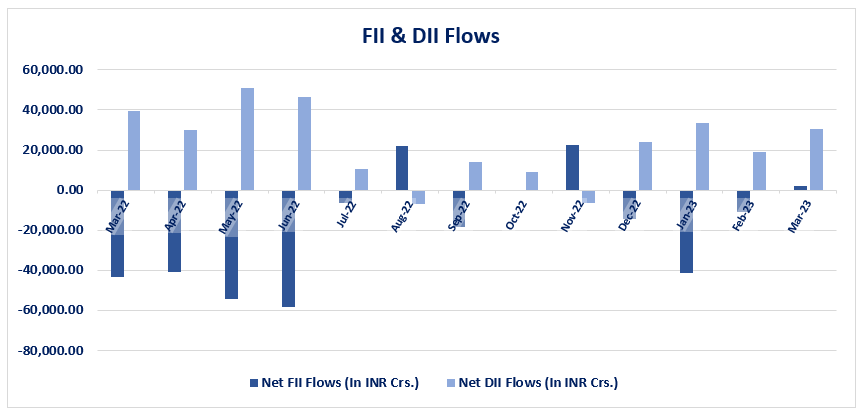

A decrease in the difference between the Nifty P/E and the MSCI EM P/E alongside the marginal improvement in the BEER ratio suggests that the Indian equity markets are not as overvalued as the previous month and there could be a higher probability of outperformance in the short-term to medium-term. Inflows in the cash market increases further as the SIP flows in March breached Rs. 14,000 crs. mark and for the overall gross SIP flows crossed over Rs. 1,50,000 crs., the highest ever. The DII’s pumped more on the back of strong retail participation and the FII’s became net buyers for the first time since November 2022. Even though the sentiments around the equity markets are improving, investors shall remain cautious with equity investments because they continue to be overvalued as per the global emerging markets’ P/E and BEER ratio analysis. Quarter 4 earnings would be crucial for the performance of domestic equities as two of the major IT companies have posted underwhelming results so far.

When we dig deeper into equities and analyze the indexes according to their market capitalization, we notice that the largecap index outperformed the midcap and smallcap index. The latter two indexes actually ended lower whereas the largecap gained a moderate 0.6% on a month-on-month basis. This is primarily due to the majority of FII inflows moving into largecap instead of the other two categories.

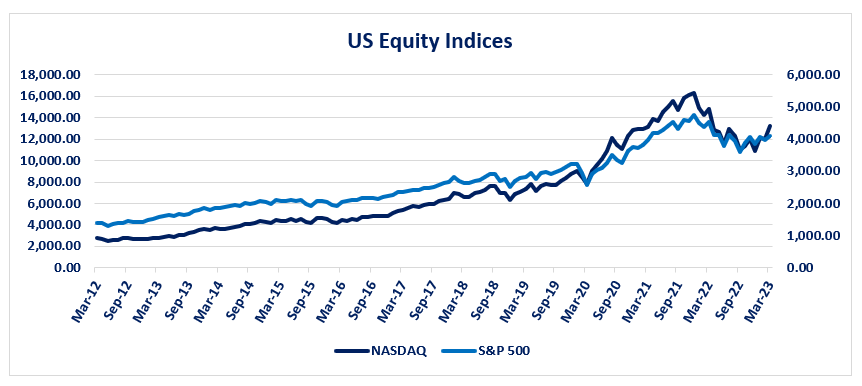

US Equity: Post the financial sector turmoil in the U.S. due to the Silicon Valley Bank, Signature Bank, and First Republic Bank’s collapse the international markets stabilized with the U.S. equity indices rallying on the basis of no bad news is good news sentiments. NASDAQ closed a whopping 9.46% higher, whereas, S&P 500 gained a modest 3.51%. The sentiments seem to have improved on the expectations of the FED cutting down the interest rates by the end of this year which would bring back risk-on sentiments and increase the demand for equities. Therefore, given the recent correction in the U.S. equity indices, these two indices could provide a good opportunity to diversify your portfolio and generate alpha, whilst reducing the overall risk on your portfolio.

Debt Outlook

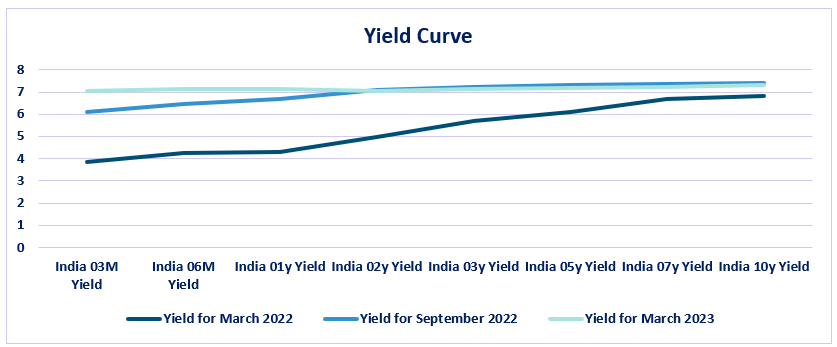

Debt Outlook: The domestic yield curve has moved higher and further flattened in March as inflation remained sticky and was also seen inverting (1Y and 10Y) for a short period of time. This further signifies how investors might be skeptical about the macroeconomic scenario. This also suggests the interest rate hiking cycle to be near its peak and it was further supported by RBI’s recent decision to maintain the repo rate at 6.5%. The market liquidity is also on the rise since February 2023 and has increased further in March.

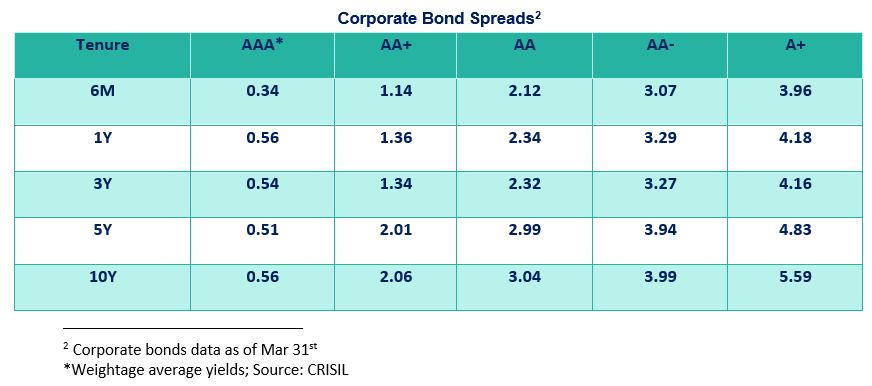

A BEER ratio above 1 alongside a higher and flatter yield curve provides a good opportunity to invest in 3-5 year duration bonds to benefit from the upcoming interest rate cuts in the medium term. The yield spreads have increased marginally for AAA-rated corporate bonds which makes them more attractive as an investment option. Lower-rated corporate bonds, on the other hand, remain highly risky given the dicey macroeconomic scenario and recessionary fears.

Global Debt Outlook

Global Debt Outlook: The yield curves across major economies have come down marginally and the inversion has also lowered on a month-on-month basis which has signaled the peak of the interest rate cycle nearing. It is also due to the financial sector chaos primarily in the U.S. and Europe which alarmed the central banks all over to ease down on the pace of rate hikes or face the certain failure of the private financial institutes. The inversion in the U.S. treasury yields (2Y and 10Y) has reduced by 33 basis points followed by Germany with 10 basis points. The UK yield curve (2Y and 10Y) is not inverted currently but the 03M, 06M, and 01Y bond yields are all higher than 10Y.

Other Asset Classes

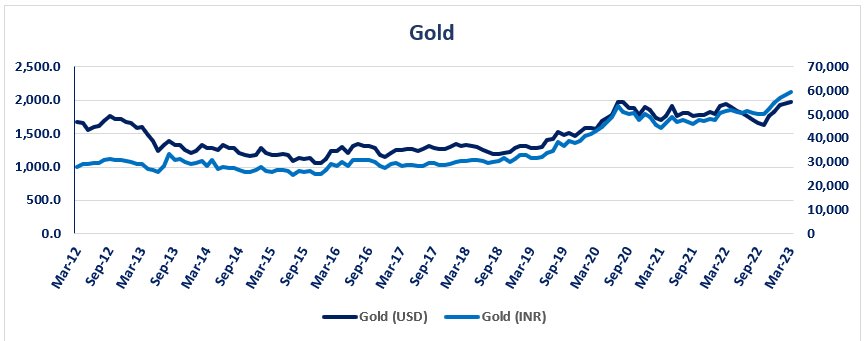

Other Asset Classes Outlook: Precious metals performed exceptionally well in March given the risk-off sentiments in the market amid the financial sector chaos globally. Silver outperformed gold and both metals provided a better return in USD terms rather than INR as the domestic currency appreciated by around half a percent.

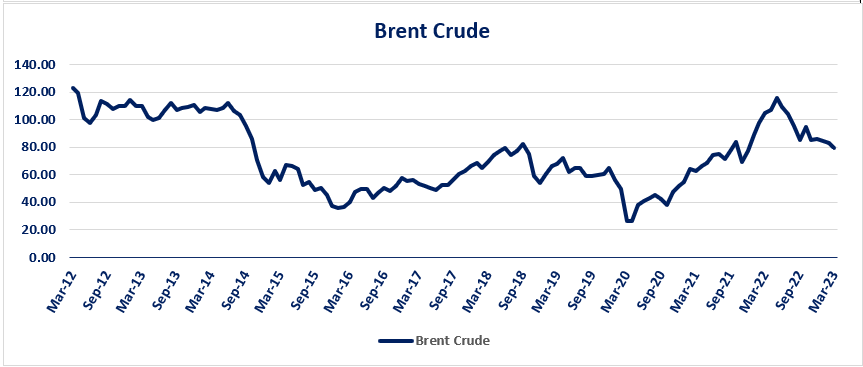

Brent, on the other hand, declined further and tested the low of $70 due to the continued recessionary fears and chaos in the banking sector. But later on, it went to close around $80 as the global risk sentiments improved.

REITS: All the REITs listed on domestic stock exchanges traded higher in March and are still trading lower to their NAV due to increased recessionary expectations and how it will affect the demand for corporate spaces. The prices are closer to their NAV compared to the previous month but they are still lower and this provides a good opportunity to invest a small proportion in these instruments and diversify your portfolio. The committed occupancy for Mindspace and Embassy has increased by a percentage point and more and their net debt to market value has decreased making these investments more lucrative at the current levels.

Currency: The rupee appreciated against the dollar amidst global dollar weakness primarily due to the economic chaos in the U.S. on the back of its financial institutions collapsing. This decreased the expectations of the FED remaining hawkish and the markets even factored in the status quo in its March FOMC. Many of the FOMC committee members also thought of maintaining a status quo amid this financial turmoil but they later came to the consensus that inflation remains elevated and a 25 basis points hike was necessary.

We believe that the rate hike cycle’s climax is upon us and we may see another minor hike in interest rates in the May FOMC, after which the major question will remain till when the FED decides to keep them elevated. The markets are already expecting rate cuts to begin from as early as July 2023 and interest rates to be around 1.25% lower by next year.

IFA Market Mantra

Are Debt Mutual Funds worth it anymore?

As we advocated in our last report for investors to park their funds in debt mutual funds instead of bank fixed deposits due to their indexation benefits, the government has decided to remove these benefits from 1st April 2023. This was primarily done to make investments in these funds less attractive and reduce tax arbitrage.

This decision shall now increase the flows in FDs for investors who have a long-time horizon and want stable returns with minimal risk. Individuals who fall under the higher tax brackets will also consider shifting to equity funds, with certain funds allocated towards non-convertible debentures and sovereign gold bonds. The debt mutual funds, on the other hand, remain attractive compared to typical band FDs as they provide higher liquidity and also yield marginally higher returns. Yet the most important decision remains to choose the most appropriate fund from the wide variety available to us.

Market Outlook:

The market risk sentiments have improved marginally as the extremely hawkish stance by central banks in most major economies seems to have eased out as they shift to status quo instead of further rate hikes. This has bolstered investors’ confidence as the equities are reacting positively. The recessionary fears are still looming in major economies around and due to this reason the rate cuts could be upon us sooner than we expected.

Therefore, this provides us with the appropriate opportunity to invest in multiple-duration long-term bonds to benefit from capital gains once these rate cuts begin. Given a marginal increase in the corporate yield spread for AAA bonds, they could provide a good opportunity for investors with a slightly high-risk appetite to yield higher returns on debt.

Equities as an asset class remain highly risky due to the ongoing high-interest rate markets and recessionary fears. International equities, on the other hand, particularly US equities provide a good opportunity to invest currently and diversify your portfolio further as they have corrected massively and should provide a good return in the medium to long term. The U.S. banking system crisis seems to be behind us for now but as the financial conditions tighten, the possibility of similar institutional failure cannot be ruled out. However, the markets are deriving a sense of comfort from the fact that central banks would extend the liquidity backstops should anything break loose. These exposures to international equities should however be managed cautiously as they are extremely sensitive to the current geopolitical scenario.

Investing a small chunk of the portfolio in Gold and REITs is also a good approach to diversify your portfolio further and mitigate the unsystematic risk in this period of high inflation and economic uncertainty. An appropriate diversification according to an individual’s risk appetite will help maximize their risk-adjusted return.