Why Debt Mutual Funds are better than FDs?

3 January 2023 | By IFA Global - Category Wealth

About Client:

- A private limited company (ABC Limited) has an excess working capital of INR 10 crores.

- It primarily parks these funds in FDs.

Challenges and Observations:

- ABC Limited did not have a predefined investment policy to park its surplus funds.

- It invested all of its funds in an FD, which increased the concentration risk due to investment with a single issuer.

- ABC Limited often got lower returns on their investments due to early withdrawal penalty charges of an FD and this also reduced the liquidity of funds the company required.

Process:

- A multi-asset investment policy was designed by considering the company’s risk profile.

- IFA’s team advised ABC Limited to invest these surplus funds in debt mutual funds.

- Appropriate debt mutual funds were selected using various thresholds like credit rating, duration, AUM, and yield to maturity.

- IFA Global facilitated the entire investment process of ABC Limited in debt mutual funds.

Outcome:

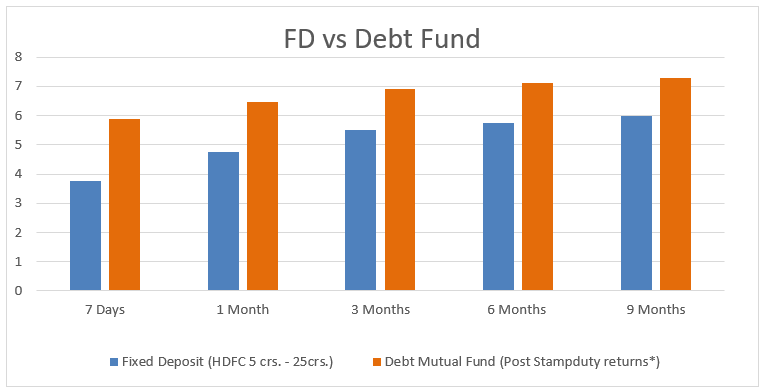

- As seen in the graph, by parking their surplus funds in debt mutual funds ABC Limited was able to generate 1% - 2% higher returns based on the time horizon of the investment.

- This means a higher return of up to 20 lakhs on a 10 crore investment.

- Investing in various debt mutual funds reduced the concentration risk of the investment.

- ABC Limited also generated a 1.5% higher post-tax return due to indexation benefits on the investments that were held for more than 3 years.